In an interview with CNBC Friday, MicroStrategy CEO Michael Saylor talked about the future of Bitcoin (BTC) and made some optimistic projections. Saylor expounded on the adoption rate of BTC, cryptocurrency regulation, market volatility, gold vs. BTC, and Bitcoin as the leading digital asset and safe-haven investment.

MicroStrategy currently holds 114,042 BTC (worth $6.72 billion at press time). When asked whether his company plans to continue acquiring BTC at the current price or await further corrections, Saylor noted that: “We are going to keep stacking forever.”

On the matter of BTC vs. gold, the interviewer asked the CEO if he thinks “Bitcoin has replaced, or will replace, or is in the process of replacing gold as the store of value for most investors.” Furthermore, he highlighted what he believed to be the advantages of BTC over gold, like the ease of transfer and low storage cost, Saylor explained that:

“It’s pretty clear that bitcoin is winning, gold is losing … and it’s going to continue … It’s pretty clear digital gold is going to replace gold this decade.”

On crypto regulation, including the controversial US infrastructure bill, Saylor noted that: “I’m not at all troubled with the regulations [that are] going on right now.” He added that: “The safe haven for institutions is to use bitcoin as a store of value,” emphasizing that “Bitcoin is the only ethical, technical, and legal safe haven in the entire crypto ecosystem.”

The pro-Bitcoin CEO also noted that the proposed crypto regulation currently discussed in the US will “have an impact on security tokens, DeFi exchanges, crypto exchanges, [and] all the other use cases of crypto that are not Bitcoin.”

Key Bitcoin Levels to Watch — November 21

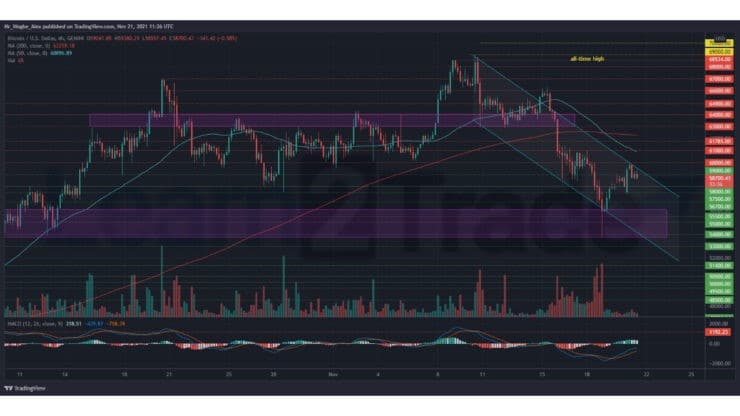

Following the recent plunge to the $53,760 low, which aligned with my previous $56,100 – $53,755 pivot zone, BTC recorded a mild bullish recovery near the $60,000 mark, although recorded a minor dip to the upper-$58,000 area earlier today.

This minor correction aligns with my eleven-day-long descending channel, indicating that this channel is crucial to the near-term price action of BTC. That said, as long as the benchmark cryptocurrency holds above the $58,000 support, we could expect to see a break above the $60,000 barrier soon.

However, failure to sustain itself above the cryptical $58,000 level could trigger another correction to the base of my channel at $54,000.

Meanwhile, my resistance levels are at $60,000, $61,000, and $61,785, and my key support levels are at $58,000, $57,500, and $56,700.

Total Market Capitalization: $2.64 trillion

Bitcoin Market Capitalization: $1.11 trillion

Bitcoin Dominance: 42.3%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.