This manipulation pattern has been discussed broadly in a previous article. It involves a tactic used by large BTC traders (Whales), which instills panic in the market and causes smaller traders with weaker hands to sell. The resulting rise in selling pressure pumps liquidity into the market and allows whales to stock-up on more BTC at a cheaper price with little slippage.

That said, if this current price action turns out to be one of these tactics, we should be prepared to see a significant spike to the $10,900 level soon.

Meanwhile, some BTC strategists are expecting to see a bias-confirming move, as the benchmark cryptocurrency’s volatility drops to its lowest point in three months.

The co-founder of Capriole Investment, Jan Uytenhout, itemized the outlook via a tweet earlier today. The fund manager drew connections between Bitcoin’s price and its historical volatility index. He added that Bitcoin experiences an aggressive price move regardless of its prevailing direction whenever its volatility falls below a certain level on a specific indicator.

In other news, developments from the long-standing political stalemate over the next round of fiscal stimulus in the US will continue to dictate the short-term price action in the market.

Key BTC Levels to Watch in the Near-Term

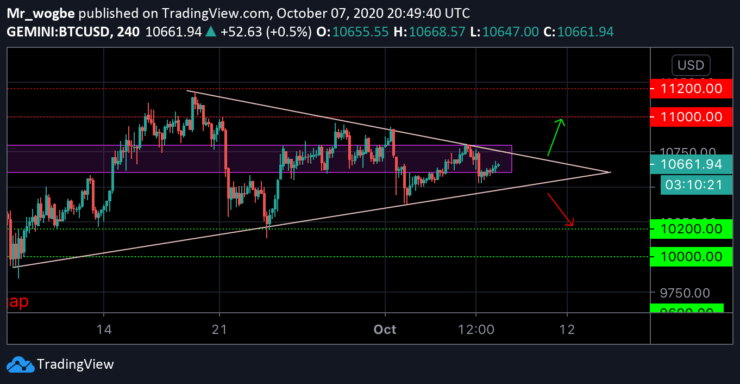

Bitcoin is currently sitting in the middle of its long-prevailing consolidation range between $11,200 and $10,200. At press time, BTC trades for $10,661 and appears to be headed towards the top of our wedge at $10,740 on our 4-hour chart.

If BTC emulates its previous performance around this line, we could see a sharp decline to the $10,560 level again. If the cryptocurrency continues in a back-and-forth manner in the coming days, it will eventually run out of room in this wedge, and a sharp spike (in either direction) could occur.

Total market capital: $336.9 billion

Bitcoin market capital: $197 billion

Bitcoin dominance: 58.6%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.