The race to launch the first Bitcoin (BTC) exchange-traded fund (ETF) in the US continues to intensify, as asset manager Kryptoin recently announced that it has re-filed for an ETF with the SEC.

With Kryptoin reentering the race, the number of impending BTC ETFs with the SEC is now seven. The list includes Fidelity, First Trust & Skybridge, Valkyrie, Wisdomtree, VanEck, NYDIG, and Kryptoin.

Kryptoin’s reentry prospectus is not much different from its first filing in 2019, except that it planned to list on NYSE Arca. However, the asset manager has decided to go with CBOE BZX as its listing exchange. The company revealed that its product would be called the “Kryptoin Bitcoin ETF Trust” and plans to launch as soon as possible.

The preliminary prospectus noted that the “objective is to provide exposure to bitcoin at a price that is reflective of the actual bitcoin market where investors can purchase and sell bitcoin, less the expenses of the Trust’s operations.”

The SEC filing noted that:

“In seeking to achieve its investment objective, the Trust will hold bitcoin, and in seeking to ensure that the price of the Trust’s shares is reflective of the actual bitcoin market, the Trust will value its shares daily as determined by the CF Bitcoin US Settlement Price.”

Key BTC Levels to Watch — April 11

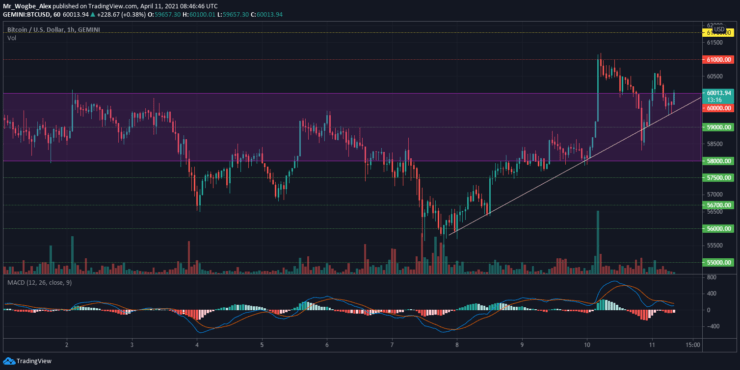

In an overnight spike over the weekend, Bitcoin finally posted a break above the $60k level and peaked at $61,180 yesterday. However, the benchmark cryptocurrency has fallen, once again, below the critical $60k level as bulls couldn’t sustain the rally.

That said, this dip will likely get perceived as a modest correction by bulls, who will get reinvigorated to take on the $61k resistance over the coming hours. Bitcoin bulls have the support of the ascending trendline, which has persisted since the primary cryptocurrency’s recent decline to the $55,500 support area.

Meanwhile, our resistance levels are at $60,500, $61,000, and $61,785, and our key support levels are at $57,000, $56,700, and $56,000.

Total Market Capitalization: $2.05 trillion

Bitcoin Market Capitalization: $1.11 trillion

Bitcoin Dominance: 54.4%

You can purchase crypto coins here: Buy Coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.