Still, it remains unclear what the cause of the sudden trend is. Could it be due to the acquisition of BTC by wealthy individuals as a hedge against the unknown?

It can be said that this is unlikely to be the case thanks to the extreme volatility of the cryptocurrency. An asset capable of crashing by more than $2,000 under 48 hours surely is not an excellent hedge against uncertainty.

Little wonder why equities investors laughed off the argument that Bitcoin was an anti-correlated asset to hedge a portfolio with.

Meanwhile, the narrative has shifted once again towards inflation and BTC’s usefulness as a hedge against a declining US dollar (DXY). Also, the benchmark cryptocurrency appears to have a close correlation with gold (XAU/USD), which is a strong safe-haven refuge for investors. Apart from being a good hedge against the dollar, gold gets its safe-haven appeal by giving investors private ownership over a physical commodity out of the reach of the government.

Bitcoin is even way better in this regard given its digital nature. This is why whales will continue to use it as a hedge against anything.

Key BTC Levels to Watch

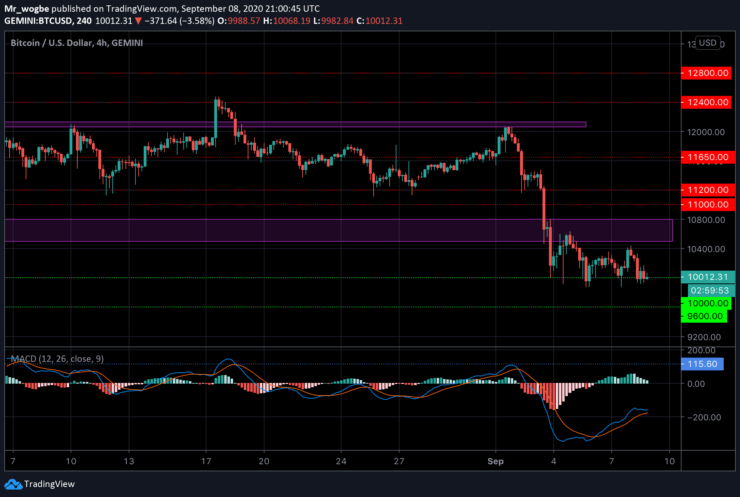

Bitcoin spent the majority of its day battling with the $10,000 strong support as traders stay on the sidelines amidst intense uncertainty. The cryptocurrency broke below the support—slightly—on several occasions during the day but was quickly met with decent bullish support. This consolidation phase has endured for about four days now between the $10,500 line and the $9,880 support.

That said, it appears that bulls are starting to tire as bears keep the $9,600 CME gap in focus.

Total market capital: $322 billion

Bitcoin market capital: $185 billion

Bitcoin dominance: 57.4%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.