Gold and Bitcoin get their fundamental cues for the same source; the global central bank policies in response to the Coronavirus pandemic. This includes near-zero interest rates, a growing fiscal deficit, and a weakening US dollar (DXY). These policies cause low-risk assets (apart from gold and Bitcoin) to return meager yields, forcing investors to seek riskier assets.

Also, the price action of both gold and Bitcoin remains erratic as investors continue to worry about the delayed second COVID-19 stimulus package, as well as the uncertainty hovering over the November US Presidential Elections.

BTC runs the chance of being increasingly bullish in the coming days and weeks if it maintains its correlation with gold, given that the precious metal is set for a bullish rally.

However, skeptics believe that gold and bitcoin could be wracked with a downward correction if Congress fails to pass the second stimulus package before the elections. In this scenario, investors will seek refuge in the safety of cash, which would cause the dollar to skyrocket.

Key BTC Levels to Watch

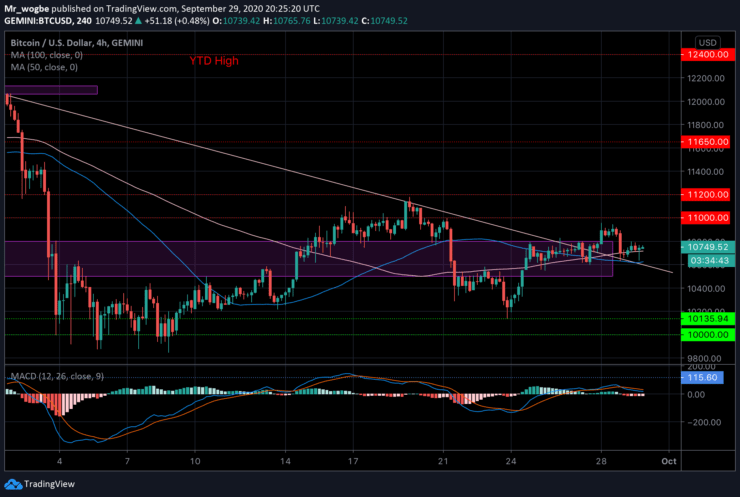

After a sharp drop yesterday, Bitcoin found strong support at the 50 SMA just as we projected in an earlier analysis. Presently, the cryptocurrency is balancing itself above the 100 SMA as it prepares to spike upwards again.

Meanwhile, the major resistance levels to watch are the $10,800 and $10,900 in the meantime. A break above $10,900 could open the doors to $11,200 once again.

Total market capital: $345 billion

Bitcoin market capital: $198 billion

Bitcoin dominance: 57.3%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.