Currently, investors are wracked with fears over the dwindling prospects of second domestic stimulus measures in the US, coupled with the weaning possibility of a sharp economic recovery.

Also, the upcoming US presidential elections are adding to the growing uncertainty surrounding the markets. These fears will likely remain unsolved in the near-term, making further choppiness in the equities market very possible.

That said, Bitcoin will likely get caught up in the mix, giving its correlation to the stock market.

Meanwhile, an On-Chain analyst has said that he expects the Bitcoin-Equities correlation to fade in the coming months. He explained that subsequent sharp declines in equities will eventually stop pulling Bitcoin lower as the crypto reaches its lowest technically possible levels.

Key BTC Levels to Watch

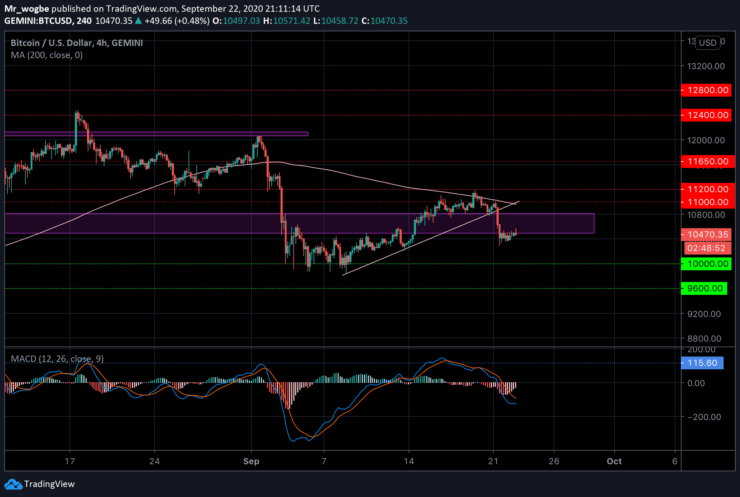

At press time, Bitcoin trades at $10,511, about 0.8% increase in the day. However, it remains trapped in its weekly consolidation range.

Last week, bulls attempted to pull the benchmark cryptocurrency out of its downward spiral and ended up taking the price to highs of $11,200. The rejection from that level was decisive and sharp, causing Bitcoin to fall to the level it currently trades at.

Meanwhile, the equities market was able to post a modest recovery today, which, as an extension, has given Bitcoin a reprieve for the near-term.

Still, the absence of any significant positive development around the US stimulus program or the pandemic-induced economic crisis may continue to burden the cryptocurrency market from rising in the near-term.

Total market capital: $333.6 billion

Bitcoin market capital: $194 billion

Bitcoin dominance: 58%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.