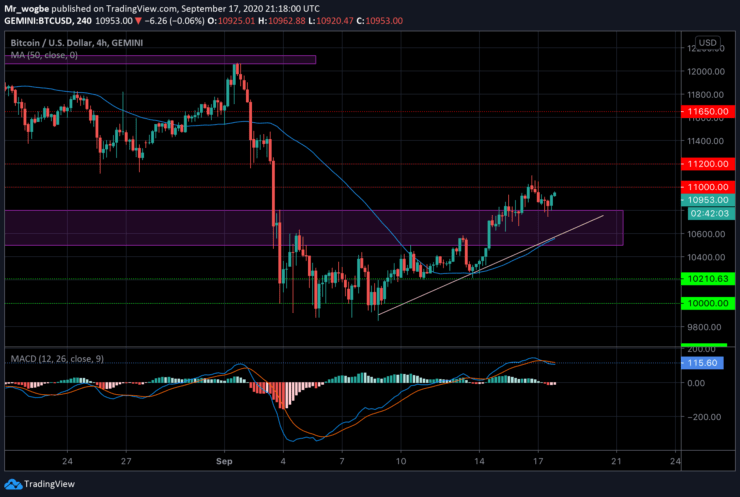

Over the last 24 hours, the cryptocurrency fell by more than 2%from $11,100 to $10,900, where it is currently lingering around. The $11,100 was a much-talked-about level by analysts and it is interesting to see how BTC was cleanly rejected from that line.

Meanwhile, the recent volatility spike in Bitcoin coincides with the upcoming expiration of about 77,000 BTC options contracts. According to reports, the BTC options open interest is currently hovering above 134,000 contracts.

Historically, September appears to be a very slow month for the cryptocurrency when it comes to volatility. That said, the high level of options open interest implies that a surge in volatility in October is very likely.

Whether that volatility would cause a significant drawdown or will help Bitcoin record higher YTD numbers remains largely uncertain. However, if Bitcoin goes according to past performance, we’re likely to see a new all-time high in about 15 months after its recent halving.

In the near-term, Bitcoin could remain trapped between $9,000 and $12,000, as the accumulation phase continues.

Meanwhile, the September options expiration, which occurs on the last Friday of every month, Bitcoin will confirm a directional bias.

Key BTC Levels to Watch

Bitcoin remains in a struggle to claim the $11,000-200 zone in the near-term. However, it appears to be running out of steam to help keep it above the $10,800 support line. If a fall should occur, it is unclear how far BTC is likely to fall, however, the $10,500 pivot area seems like a good place to start.

Meanwhile, Bitcoin has begun a descent from centering into overbought territory, indicating that this decline could be drawn-out.

On the flip side, BTC has to break above the $11,200 mark to confirm a bullish bias.

Total market capital: $353 billion

Bitcoin market capital: $202 billion

Bitcoin dominance: 57%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.