A large percentage of this influx of investment comes from the recent pickup in Ethereum (ETH), which is currently the best-performing cryptocurrency among the top 10 largest cryptos by market cap.

Based on a recent report from Skew, a crypto analytics firm, there have been significant gains in ETH futures trading volume compared to BTC, as ETH currently accounts for 46% of Huobi’s derivatives volume and BTC coming behind with 36%.

This positive momentum is largely driven by the DeFi market, which is still considered as a hot investment by the crypto community.

Meanwhile, some analysts believe that the benchmark cryptocurrency is set to see further highs in the near-term courtesy of the equities market. They believe that the recent stock market drop was stimulated by Bitcoin’s decline from its recent highs around $12,400.

That said, the equities markets have begun a recovery from its recent fall, suggesting that Bitcoin could get a modest boost in the short-term as well.

Key BTC Levels to Watch

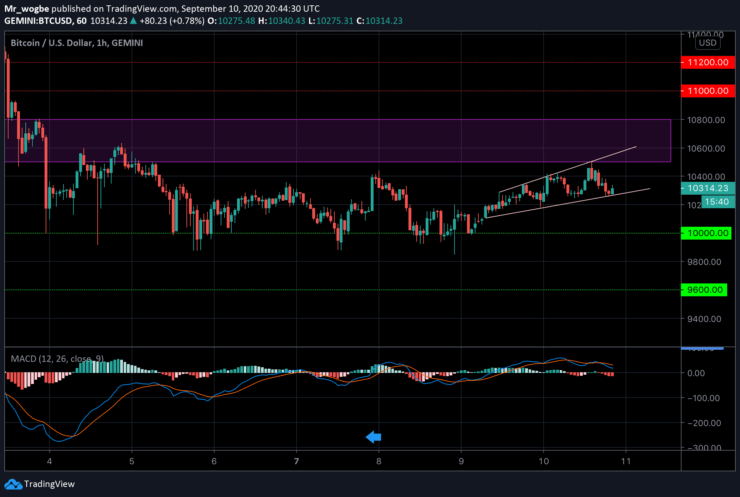

Bitcoin appears to be picking up new bullish momentum after its last drop to the $9,900 area. Over the past 48 hours, the crypto has been steadily recording higher lows, while recording slightly higher highs. This is an indication that a bull rally could be imminent.

BTC is likely going to make another attempt to break into the $10,500 pivot zone, where it can get a further boost to the $11,000 region.

On the flip side, any drop from this level will immediately be supported by the 21-day SMA around 10,220. Further declines from that level will be strongly supported by the lasting $10,000 psychological level.

Total market capital: $337 billion

Bitcoin market capital: $190 billion

Bitcoin dominance: 56.3%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.