Meanwhile, the major cause of the recent dip was the strong pick up in the US dollar (DXY), following the decision to forego a second stimulus relief bill before the presidential elections on November 3 by the Treasury Secretary, Stephen Mnuchin.

Over the months, Bitcoin has grown significantly, especially as central banks across the globe made moves—including ultra-low interest rates, infinite bond-buying, and massive stimulus aids—to prop-up their economies following the pandemic-induced economic crisis.

That said, investors expected that Bitcoin would get yet another boost upon the finalization of a second stimulus package. However, with the prolonged politically-inclined stimulus debates, investors started flicking back to the safety of the greenback. The outright cancellation of another stimulus round by the Treasury Secretary could cause some near-term problems for Bitcoin’s demand.

Also, the recent setback in the preparation of a COVID-19 vaccine has added to the booming risk-on mood across markets, which is influencing BTC negatively.

Key BTC Levels to Monitor in the Near-Term

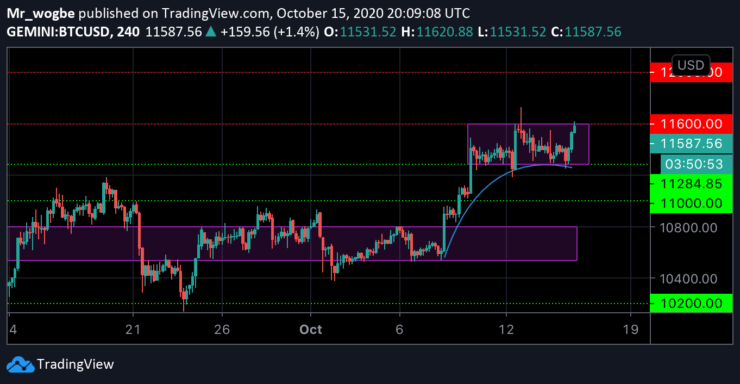

Bitcoin has been in a prolonged consolidation range between $11,600 and $11,284 for the fifth consecutive session now. Currently, the benchmark cryptocurrency is locked in a battle with the $11,600 resistance, following a sharp drop to the $11,280 level yesterday.

With its current momentum, BTC could likely break this resistance soon as investors keep their eyes on $12,000.

Total market capital: $364 billion

Bitcoin market capital: $214 billion

Bitcoin dominance: 58.7%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.