On-chain data provider Glassnode recently revealed that a large majority of Bitcoin (BTC) tokens on the market have been dormant for over 12 months. Bitcoin addresses described as dormant are those that have recorded no outgoing transactions within a given period and have maintained an above zero balance all through the said period.

Glassnode some hours ago: “The volume of Bitcoin supply that has remained unspent for at least one year has reached a new ATH of 12.589M BTC. This is equivalent to 65.77% of the circulating supply. Increasing dormant supply is a characteristic of #Bitcoin bear markets.”

In the report, the on-chain analytics provider noted that the 2022 bear cycle has been one of the most challenging for cryptocurrency investors, with heavyweights like Bitcoin and Ethereum slumping from their all-time highs by 75% and 85%, respectively.

Events like this have been commonplace in past near cycles, with investors seeing unrealized profits crashing as the market falls below its aggregate break-even margin levels.

Meanwhile, Bitcoin slumped by 38% in June, the cryptocurrency’s worst monthly performance since 2011. At the time, BTC trades below the $10 mark, making June’s crash the worst in “modern-day” BTC history.

Regardless, the flagship cryptocurrency has rebounded by over 30% since June, prompting analysts to speculate that the bear cycle, which has persisted for most of 2022, could be coming to an end.

Key Bitcoin Levels to Watch — September 6

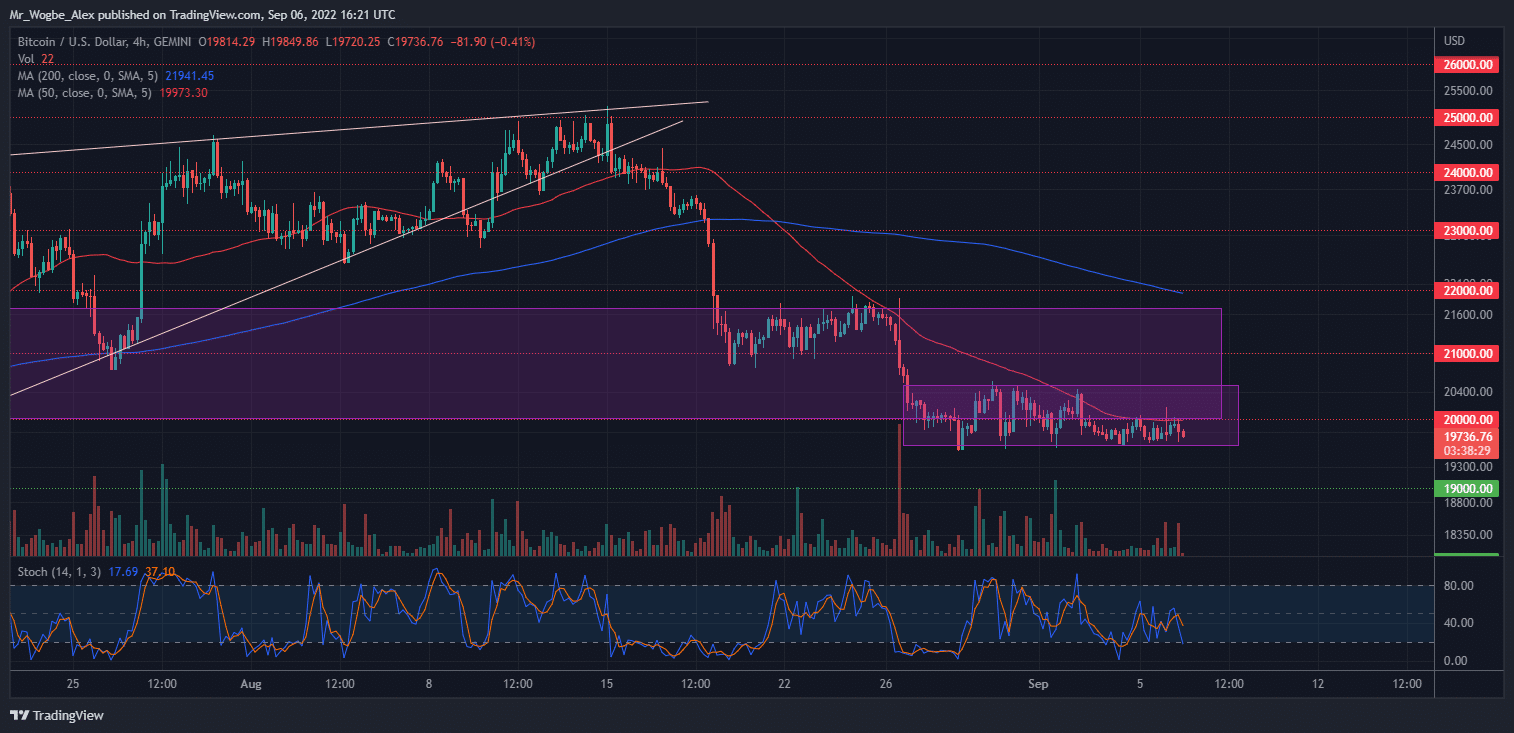

Bitcoin maintained a sideways pattern into the late North American session on Tuesday, even as many crypto assets recorded notable gains.

The cryptocurrency remained suppressed by the $20,000 resistance coupled with the 50-day SMA on the 4-hour chart. At the same time, the benchmark cryptocurrency held itself solidly above the $19,600 pivot base.

That said, the broader market seems to be excited ahead of the Ethereum Merge upgrade scheduled for September 14.

Meanwhile, my resistance levels are at $20,000, $20,500, and $21,000, and my key support levels are at $19,600, $19,000, and $18,000.

Total Market Capitalization: $997 billion

Bitcoin Market Capitalization: $380.9 billion

Bitcoin Dominance: 38.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.