Chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, recently noted that Bitcoin (BTC) and the crypto industry could record a significant boost from the regulatory move headed by his organization.

Behnam noted that a clearer regulatory pathway would open up the industry to institutional investments. The CFTC chair argued that the only way for hopes of institutional inflow into the space can be achieved is through a regulatory framework for the market. The CFTC boss noted: “Growth might occur if we have a well-regulated space.” He added, “Bitcoin’s price may double if a market is CFTC-regulated.”

Behnam has always been an advocate of regulatory clarity, an area many have pointed out is lacking in the crypto space. In the past few months, the CFTC, the US Securities and Exchange Commission (SEC), and other regulatory agencies have fought to be in charge of monitoring the cryptocurrency space.

However, none of the agencies have deemed it necessary to release formal guidelines for crypto companies, preferring instead to churn out regulatory precedent through enforcement actions.

Behnam explained: “Non-bank [crypto] institutions thrive on regulation, they thrive on regulatory certainty, they thrive on a level playing field.” He added, “And they may say otherwise, they might bicker about the type of regulation – but what they love most is regulation because they are the smartest, the fastest, and the most well-resourced. With those attributes, they can beat everyone else in the market.”

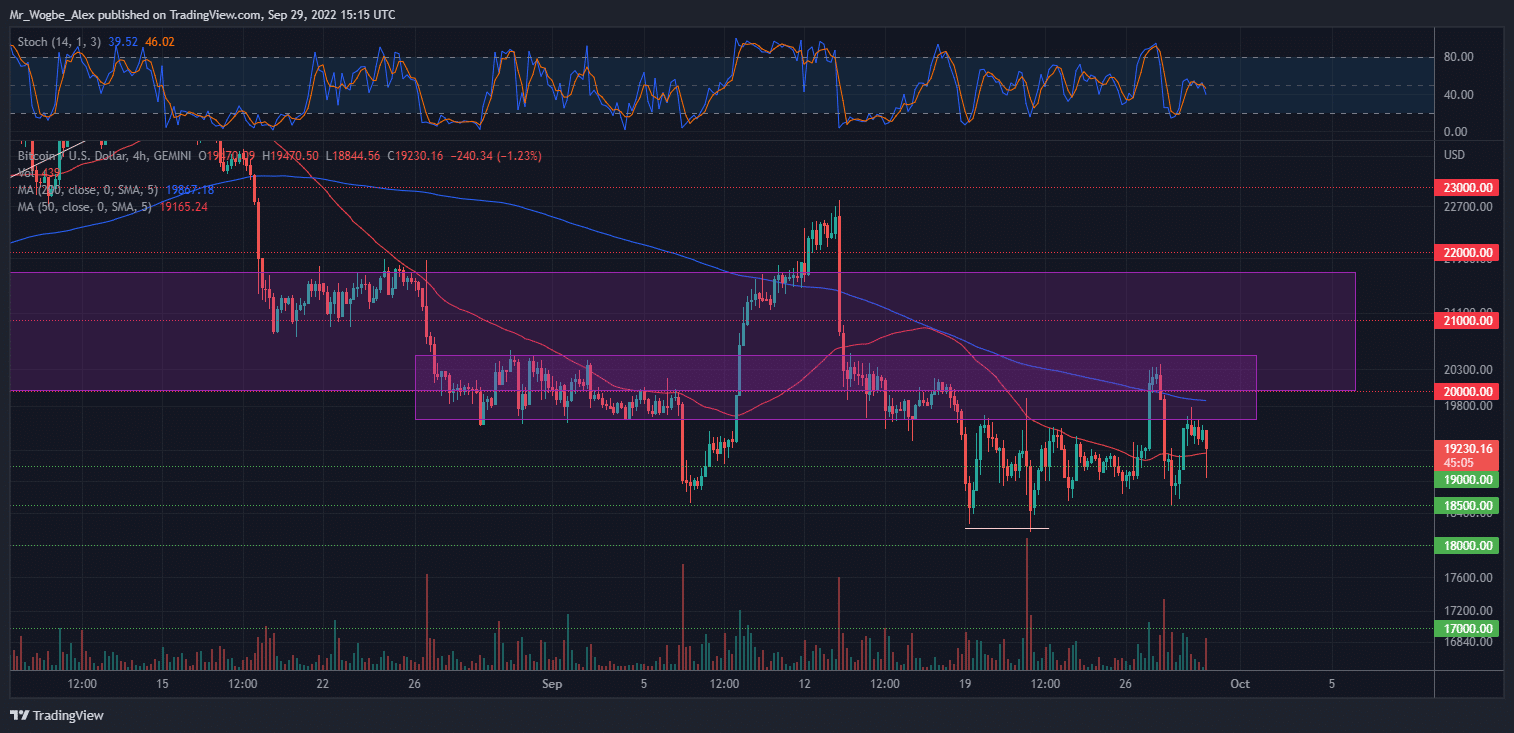

Key Bitcoin Levels to Watch — September 29

Bitcoin continued its choppy ride around the $19,000 mark on Thursday as traders lost interest in expecting a breakout.

Bears seem to lack the push to drag the benchmark cryptocurrency below the $18,500 mark, suggesting that this level might be the bottom for BTC. However, bulls cannot also get the cryptocurrency past the $19,600 hurdle leaving it in a floating state.

Regardless, a bullish breakout over the coming days and weeks is more likely than the opposite, considering the $18,500 support appears unlikely to give any time soon.

Meanwhile, my resistance levels are at $19,600, $20,000, and $20,500, and my key support levels are at $19,000, $18,500, and $18,000.

Total Market Capitalization: $934.2 billion

Bitcoin Market Capitalization: $368.5 billion

Bitcoin Dominance: 39.4%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.