Reports show that Bitcoin (BTC) has shared a remarkable correlation with the stock market for about over a month now. Bitcoin currently trades around the $46,000 area, down by about 8% over the last seven days.

This price decline comes amid several positive factors in the industry. Just last week, El Salvador officially kicked off its Bitcoin Law, which would see the benchmark cryptocurrency serve as a legal tender. Also, BTC network hash power has reclaimed significant heights since the expulsion of miners from China.

Additionally, huge amounts of institutional investors continue to pour into the BTC market.

However, the price of the primary cryptocurrency continues to plummet despite the numerous positive blockchain fundamentals. Analysts have suggested that this bearish bias emanates from the recent BTC correction with the stock market.

According to a charting exercise by Cryptopotato, clear correlations of gains and losses are observed in the superimposition of BTC and the S&P 500 Index. Granted, BTC displays a more dramatic volatility curve, but the correlation in price action is glaring. Additionally, when superimposed with the Dow Jones Industrial Average, NASDAQ Composite, and UK100 or FTSE 100 Index, the correlation becomes even more obvious.

That said, Bitcoin’s correlation to top stock indexes indicates that the crypto asset has matured significantly as an investment vehicle.

Key Bitcoin Levels to Watch — September 12

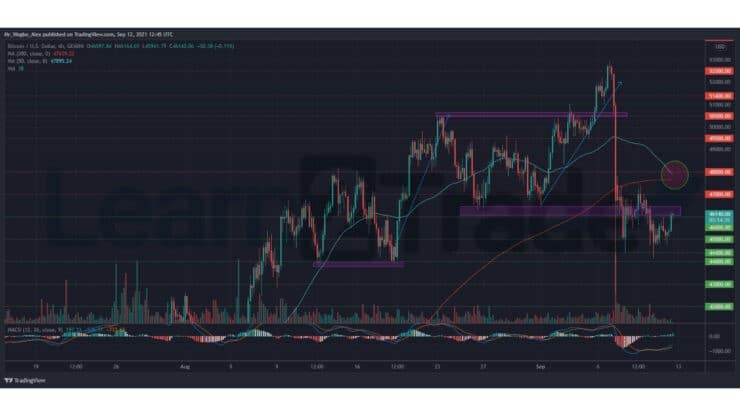

Bitcoin has recorded a slow-down from its recent crash last Tuesday around the $45,000 area. That said, the cryptocurrency has now entered the $46,500 – $46,000 pivot area as bulls record minor gains in the early hours of Sunday.

However, our 200 and 50 SMAs paint a troubling picture for bulls as a bearish death cross appears to be in the making. BTC needs to record a bullish jump to the $48,000 area over the coming days to disrupt the previously mentioned technical factor.

Meanwhile, our resistance levels are at $47,000, $48,000, and $49,000, and our key support levels are at $45,400, $45,000, and $44,400.

Total Market Capitalization: $2.13 trillion

Bitcoin Market Capitalization: $865 billion

Bitcoin Dominance: 40.7%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.