Bitcoin (BTC) miners have recorded a significant increase in their overall income over the last few weeks, as block rewards surge. According to recent data from analytics provider Glassnode, BTC mining revenues climbed above $40 million per day in October, a massive +275% increase from the pre-halving days.

BTC mining revenue witnessed a positive turn since the halving event in May 2020. This event remains one of the primary factors behind the Bitcoin 2020 – 2021 bull run. That said, BTC has grown by over 500% since May 2020.

Despite taking a massive hit from the China crypto mining ban, which saw the Bitcoin hash rate fall by over 50%, the mining rate has recorded a healthy recovery in August and September. Currently, the mining rate is close to its highest point in BTC history. Glassnode highlighted that:

“Remember, Bitcoin miners have CAPEX (hardware, facilities, logistics) and OPEX (power, personnel, maintenance, etc.) costs that are denominated in fiat currencies. Comparing the current aggregate mining income of $40M per day to revenues observed around the 2020 halving event, we can see that miner revenues are up 275% from the pre-halving period of $14M to $18M/day and +630% compared to the post-halving period of $6M to $8M/day.”

Key Bitcoin Levels to Watch — October 5

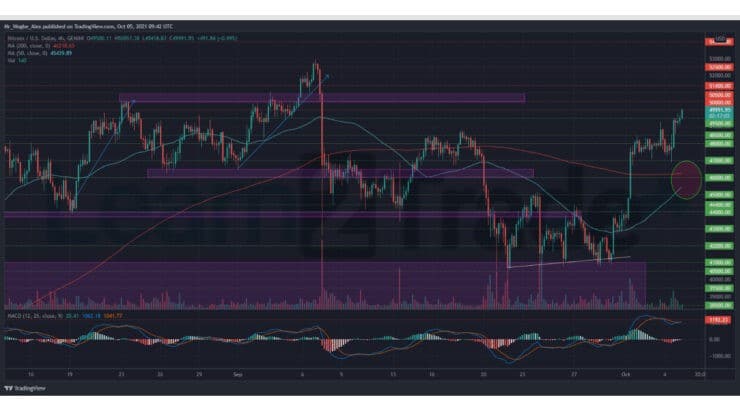

BTC has finally resurfaced above the highly-anticipated $50,000 mark and could make its way to the $51,000 – $52,000 region over the coming days. This projection becomes more plausible when we include the looming formation of a bullish golden cross on our 4-hour chart.

That said, we could record a bullish weakness near $51,000 as short-term traders take profits and BTC eases out of overbought conditions On larger timeframes. In the event of a correction from the current price, we expect the $48,000 support to repel subsequent declines and propel the price higher.

Meanwhile, our resistance levels are at $50,500, $51,400, and $52,500, and our key support levels are at $49,500, $48,500, and $48,000.

Total Market Capitalization: $2.20 trillion

Bitcoin Market Capitalization: $944.2 billion

Bitcoin Dominance: 43.1%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.