Bitcoin (BTC) has had a ridiculously bullish session this week as it made history with its first US SEC-approved futures Exchange-Traded Fund (EFT).

ProShares Bitcoin Strategy ETF (BITO) launched on Tuesday amid volcanic fanfare and record-breaking ETFs volume. Yesterday, BTC recorded a new all-time high at $67,000 due to the excitement from the news.

As if the ProShares ETF approval was not news enough, VanEck published its Bitcoin futures ETF post-effective filing on Wednesday, indicating that the SEC has also approved the listing on NYSE Arca. The VanEck BTC Strategy ETF will have the ticker “XBTF” and leverage cash-settled Bitcoin futures contracts. The official VanEck ETF summarizes that the fund “does not invest in bitcoin or other digital assets directly.”

Shortly after the publication of the post-effective filing, co-founder of The ETF Institute Nate Geraci tweeted that: “Vaneck [is] joining the bitcoin futures ETF party next week.”

Commenting on the new developments, senior ETF analyst at Bloomberg Eric Balchunas explained that BITO has already entered “the top 30% of ETFs by assets and a near-lock to exceed my $750m by end-of-week estimate.”

VanEck decided to apply for a Bitcoin Strategy ETF on August 10, after several failed attempts to receive approval of a BTC ETF from the SEC. Some analysts speculate that VanEck’s ETF move came following positive statements from SEC Chairman Gary Gensler in the same week.

Key Bitcoin Levels to Watch — October 21

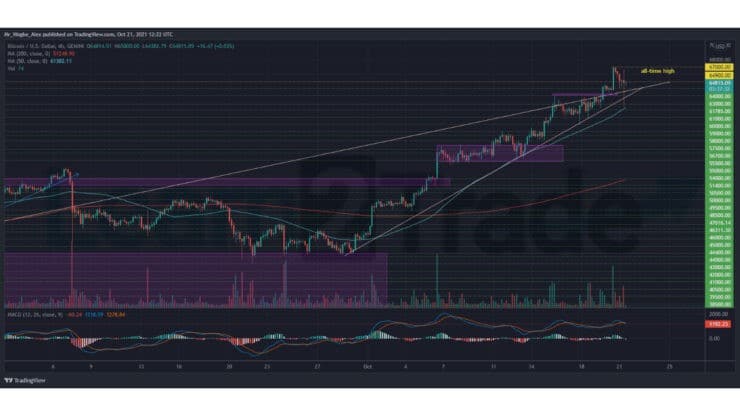

Although a few days (five) earlier than I predicted, the benchmark cryptocurrency has finally reemerged above the $65K ATH and painted a new one at $67K. Not surprisingly, BTC recorded a sharp correction a few hours ago to the $61.4K support as trading conditions entered overheated territories.

That said, BTC is not out of the woods yet, and we could see additional corrections in the coming days near the $60K psychological support. Nonetheless, a break above the $67K ATH (which is also a near-term possibility) should pause this imminent correction as BTC would resume on a price discovery trajectory.

Meanwhile, our resistance levels are at $66,000, $67,000, and $68,000, and our key support levels are at $64,000, $63,000, and $62,000.

Total Market Capitalization: $2.63 trillion

Bitcoin Market Capitalization: $1.22 trillion

Bitcoin Dominance: 46.4%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.