It appears that the US States Securities and Exchange Commission (SEC) could approve its first Bitcoin (BTC) Exchange-Traded Fund (ETF) soon, after years of turning down numerous ETF proposals.

The company that filed for its Bitcoin Strategy ETF, ProShares, could become the first company to receive the BTC ETF greenlight from the SEC next week. The company recently filed an amended prospectus, indicating that the ETF could launch as soon as tomorrow.

That said, the ETF in question is not a standard one but a futures-backed product. This means that the product tracks Bitcoin futures contracts and not Bitcoin itself.

Nonetheless, this development remains a significant achievement for Bitcoin and the cryptocurrency industry and one many analysts believe will have a lasting impact on the industry.

Exchange-Traded Funds typically provide a less-risky avenue to gain exposure to the assets in question in a regulated and secure setting. ETFs are the preferred investment routes for most institutional investors, especially with risky assets.

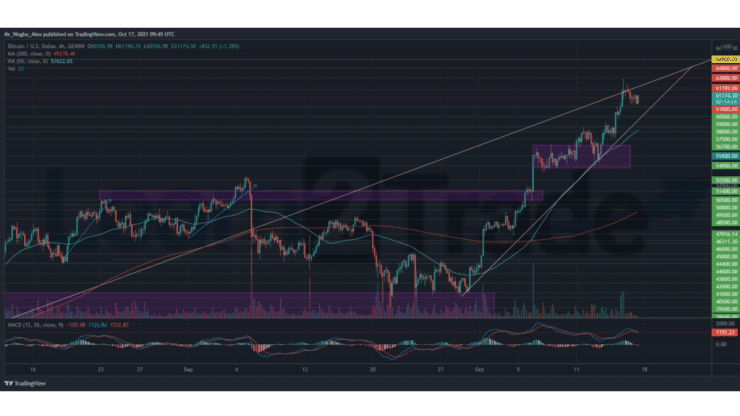

While the SEC has not published any official confirmation yet, rumors have put the crypto community in high spirits and bolstered the price of BTC. The benchmark cryptocurrency marked a steady ascent to the $63,000 line on Friday, 3% from its previous all-time highs of $65,000.

Key Bitcoin Levels to Watch — October 17

Following its parabolic run to the $63,000 mark on Friday, BTC has entered a minor correction towards the $60,000 psychological support. This correction comes amid a break above the critical 1192.23 area on our 4-hour MACD tool, indicating a foray into overheated conditions.

That said, as market conditions cool down, bulls need to defend the $60,000 psychological level over the coming hours and days to retain their dominant standing. A break below that support could foster a bearish continuation towards the $59,000 – $58,000 axis, stalling the primary cryptocurrency from reclaiming its previous ATH this month.

Meanwhile, our resistance levels are at $61,785, $63,000, and $64,000, and our key support levels are at $60,000, $59,000, and $58,000.

Total Market Capitalization: $2.49 trillion

Bitcoin Market Capitalization: $1.15 trillion

Bitcoin Dominance: 46.3%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.