According to on-chain data, retail traders have not returned on the Bitcoin (BTC) scene despite the recent +35% rally. Google Trends data shows that queries about BTC, which is typical in market conditions like presently, are nowhere close to conventional heights.

Reports show that the number of “Bitcoin” queries on Google is at relative lows in October. The current figures are nothing compared to the yearly highs reached in May, following BTC’s rally to the $65,000 all-time high. This disparity only increases when compared to the highs recorded in December 2017.

Also, the “buy Bitcoin” searches on Google have stalled in recent weeks, indicating that retail investors are not in the market presently.

This development reaffirms recent reports that the current bullish wave in BTC came from institutional investors and not retailers. This also paints an interesting picture of how BTC could perform once retail investors come back on board.

Meanwhile, the general BTC market sentiment has entered “Greed” levels amid the rally. The last time the primary cryptocurrency market sentiment entered “Greed” levels above 71 was in early September, when BTC traded above $50,000.

It is worth mentioning that the index going into any of the extremes, Greed or Fear, gets followed by an adjustment in the opposite direction. Nonetheless, the index still has some room left before Bitcoin enters “Extreme Greed.”

Key Bitcoin Levels to Watch — October 12

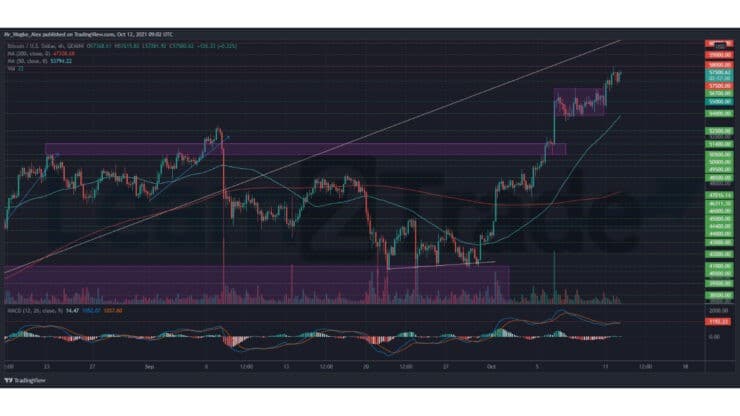

After a prolonged consolidation around the $56,000 – $54,000 last weekend, BTC has finally captured the $57,000 line, as bulls remain unrelenting. The benchmark cryptocurrency continues to etch closer to touching the bullish tripwire, which could cement its ascent to the $65,000 all-time high.

That said, our MACD indicator shows that BTC has recorded a minor correction, albeit insufficient in our view. This indication creates a tense situation around the primary cryptocurrency as a correction to the $55,000 – $54,000 could occur anytime.

Meanwhile, our resistance levels are at $58,000, $59,000, and $60,000, and our key support levels are at $56,700, $56,000, and $55,000.

Total Market Capitalization: $2.30 trillion

Bitcoin Market Capitalization: $1.07 trillion

Bitcoin Dominance: 46.8%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.