While Bitcoin (BTC) remains constricted within a sideways pattern, whales have only doubled down on supply accumulation.

On-chain analytics firm Santiment reported that BTC whale addresses have accumulated over 60,000 BTC over the past week. The firm noted that:

“If you’ve been waiting for #Bitcoin whales to show signs of accumulation, our data indicates it’s happening once again. In the past week, a total [of] 59k $BTC has been added to addresses that hold between 100 to 10k $BTC. This is 0.29% of the total supply.”

Meanwhile, prominent crypto analyst Will Clemente asserted via a recent Twitter post yesterday that he has observed clear signs of bullish divergence between Bitcoin supply moving to stronger hands and the BTC price.

While whales increase accumulation activities, other large institutional investors have also spent the past few months increasing their BTC exposure. In its recent filing with the US SEC, multinational financial institution Morgan Stanley revealed that some of its funds added BTC in the third quarter of this year.

Reports show that the Morgan Stanley Growth Portfolio Fund added 1.5 million shares of the Grayscale Bitcoin Trust (GBTC). Meanwhile, Morgan Stanley’s Insight Fund also added 600,000 GBTC shares in Q3.

All these, and more, suggest that Bitcoin’s price could record a facelift soon.

Key Bitcoin Levels to Watch — November 25

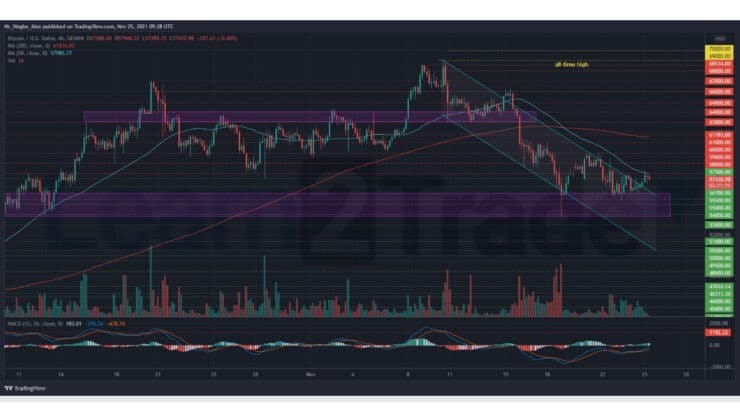

As projected in my last analysis, BTC has acquired some bullish undertone after breaking above my descending channel around $57,000. This break comes as bears repeatedly failed to sustain a break below the $56,000 pivot line.

That said, the benchmark cryptocurrency now battles with the $58,000 mark bolstered by the 4-hour 50 SMA line. A clean break above this level in the coming hours or days should place BTC back on track to taking the $60,000 psychological resistance and the $63,000 pivot zone.

Meanwhile, my resistance levels are at $58,000, $59,000, and $60,000, and my key support levels are at $56,700, $56,000, and $55,500.

Total Market Capitalization: $2.59 trillion

Bitcoin Market Capitalization: $1.08 trillion

Bitcoin Dominance: 41.9%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.