The charismatic founder of Bridgewater Associates, Ray Dalio, has warned that the success of Bitcoin (BTC) and other cryptocurrencies could become a big anchor at the Wall Street Journal “Future of Everything Festival” last week.

The Bridgewater founder noted that:

“Its own biggest risk is its success because as a store hold of wealth, no government wants to have an alternative currency.”

Dalio has been vocal with his concerns that Bitcoin could become a threat to regulators if it becomes successful enough to challenge their monetary sovereignty.

Dalio’s warnings come as regulators, like the governor of the Bank of England (BoE) and the president of the European Central Bank (ECB), remain hostile towards Bitcoin.

Last week, BoE Governor Andrew Bailey noted that Bitcoin possesses no intrinsic value, and investors that put their money into BTC should be ready to lose it all. Also, ECB Chief Christine Lagarde concurred with the governor, highlighting the use of Bitcoin as a money-laundering tool.

Meanwhile, the US also has its eyes on Bitcoin and crypto, as the new SEC chairman, Gary Gensler, emphasized the importance of a regulatory framework with healthy protection for investors.

Nonetheless, the co-chief investment officer at Bridgewater is optimistic about the future of cryptocurrencies, noting that it is “exciting and unknown.” Dalio added that:

“Crypto as a digital clearing mechanism and so on, very exciting, very bullish. Crypto as a store hold of wealth very interesting. Probably will be important for us.”

Key Bitcoin Levels to Watch — May 16

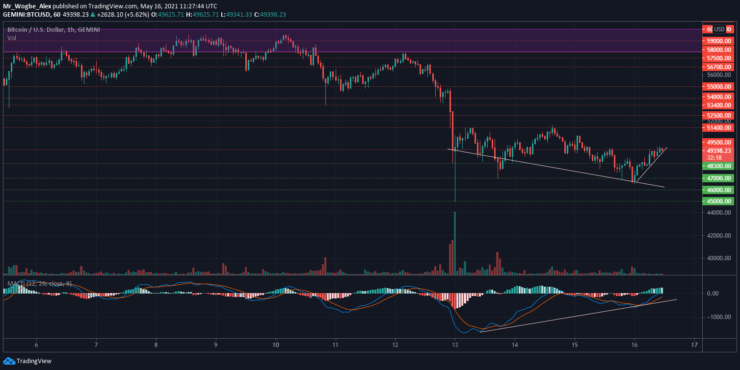

Bitcoin continues to trade under heavy bearish pressure as trading volume falters. Although the benchmark cryptocurrency appears to have gained a mild bullish momentum over the past few hours, it still faces a real threat of falling below the $48k support, once again.

That said, the bearish aura could get dissipated by a clean break above the $51,400 resistance. Until then, buyers need to trade with caution.

Meanwhile, our resistance levels are at $49,500, $51,400, and $52,500, and our key support levels are at $48,300, $47,000, and $46,000.

Total Market Capitalization: $2.28 trillion

Bitcoin Market Capitalization: $917 billion

Bitcoin Dominance: 39.9%

Market Rank: #1

You can purchase crypto coins here: Buy Coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.