Recent reports show that Bitcoin (BTC) whale accounts, large accounts holding at least 100 and 1,000 coins, have begun massively stacking up on BTC, once again.

Meanwhile, BTC accumulation wallets, active BTC accounts that have refused to sell their tokens, have hit a new record high.

The financial world has been rocked by a series of uncertainty-triggering events, which has impacted the crypto space significantly. Just as the financial world moved away from the impact of the COVID-19 pandemic and battled rising global inflation, the ongoing war between Russia and Ukraine has dealt a fresh uncertainty blow to the crypto industry.

Not surprisingly, the war, Europe’s first since world war 2, had a deterministic effect on Bitcoin and has caused severe price disruptions across the industry. Bitcoin’s ongoing price action is nothing short of a roller coaster.

The benchmark cryptocurrency enjoyed some windfall over the past few days following severe economic sanctions by the West against Russia due to its aggression against Ukraine, which has caused the Russian stock market and its currency, its economy, to plummet.

That said, Glassnode revealed that the number of BTC whale addresses holding between 100 to 1,000 coins skyrocketed around the same period of the aggressive sanctions.

Key Bitcoin Levels to Watch — March 3

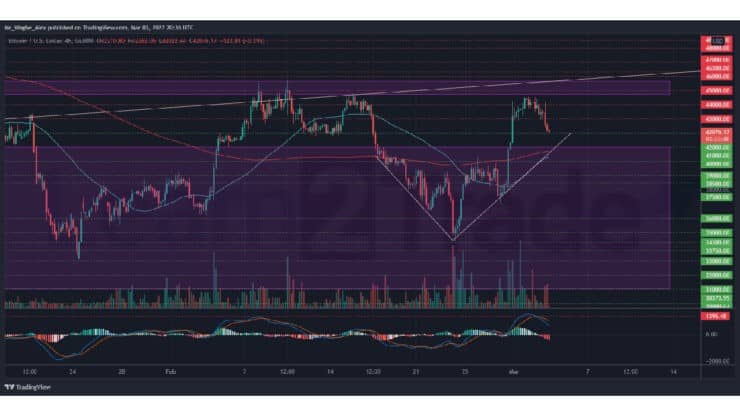

BTC has refreshed its bearish sentiment after suffering a decisive rejection from the $44,000 – 45,000 resistance area yesterday, as the Russia-Ukraine war worsened after peace talks failed to yield agreements between both parties.

Notably, the bearish correction comes after BTC entered overbought conditions per my 4-hour MACD indicator.

The benchmark cryptocurrency now struggles to hold itself above the $42,000 support line as bears appear determined to drag the price towards $41,000. That said, steadfast support around the $42,000 area should help the cryptocurrency thwart bearish efforts and push again towards $44,000 before next week.

Meanwhile, my resistance levels are at $43,000, $44,000, and $45,000, and my key support levels are at $42,000, $41,000, and $40,000.

Total Market Capitalization: $1.86 trillion

Bitcoin Market Capitalization: $801 billion

Bitcoin Dominance: 43%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.