Latest reports suggest that El Salvador Will suspect launching its Bitcoin (BTC) bond amid the prevailing unfavorable conditions in the broader market. The announcement came from El Salvador Finance Minister Alejandro Zelaya earlier today.

The Central American nation had hoped to release the Bitcoin-backed bond this month in conjunction with Bitfinex and Tether but has suspended the launch until September when conditions might have cooled.

The unfavorable conditions cited were the ongoing Ukraine crisis and the recent Bitcoin volatility. The benchmark cryptocurrency recently plunged by over 50% from its record high of $69,000 in December to the $33,150 low in late January.

That said, Zelaya noted in an interview with a local media house that he believes it would be more favorable if the BTC bond were issued in the first half of the year. He explained that “In May or June, the market variants are a little different.” The minister added: “At the latest in September. After September, if you go out to the international market, it is difficult [to raise capital].”

El Salvador President Nayib Bukele first announced the BTC bond plans in November 2021, where he also announced plans to build a “Bitcoin City” with the funds generated from the bond.

However, the international community has not taken El Salvador’s Bitcoin move with good faith, with credit rating agency Moody’s downgrading the nation’s credit. The International Monetary Fund (IMF) has also warned that it could become more difficult to borrow from the organization.

Key Bitcoin Levels to Watch — March 24

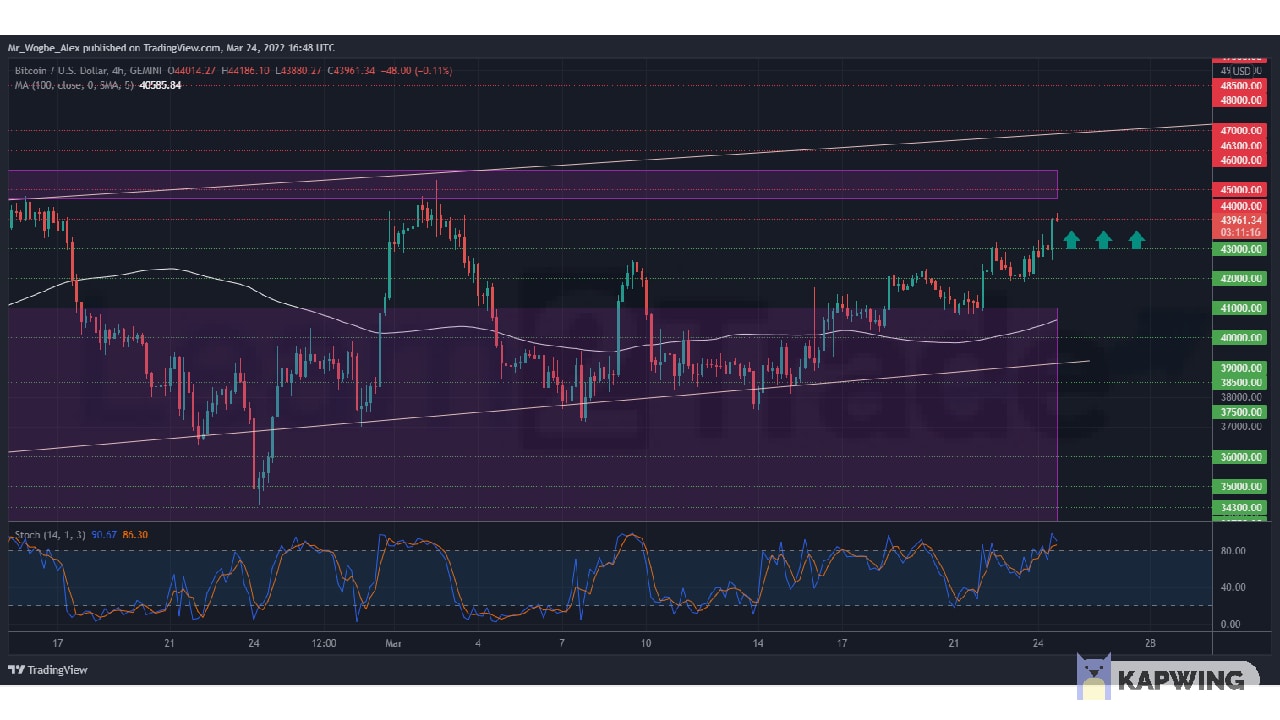

BTC obliterated the $43,000 line on Thursday, as it resumed its bullish charge. The benchmark cryptocurrency now sits atop the $44,000 psychological mark, making it the first time we would see BTC at this price point since March 3.

The cryptocurrency continues to thread a bullish path to close the March candle above the $45,000 line, which could initiate a bullish cycle in the medium term. However, BTC has broken above the overbought zone on the 4-hour stochastic, indicating that we could record a bullish slowdown and even a mild pullback over the coming days to ease the tension.

Meanwhile, my resistance levels are at $44,000, $45,000, and $46,000, and my key support levels are at $43,000, $42,000, and $41,000.

Total Market Capitalization: $1.99 trillion

Bitcoin Market Capitalization: $833.5 billion

Bitcoin Dominance: 41.7%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.