Creator of popular Bitcoin price analysis model stock-to-flow (S2F), Plan B, has just updated his notorious chart with a dot to represent the recent market performance. Plan B noted earlier today that “we knew bitcoin would not go up in a straight line” and added that the market action is “starting to look like 2013.”

Plan B is an alias for a popular crypto enthusiast on Twitter, who became a public sensation in March 2019, and has been documenting his famous stock-to-flow price model. Plan B’s price model, which is quite similar to technical analysis models like Golden Ratio Multiplier and Logarithmic Growth Curves, has just gotten updated to the stock-to-flow cross-asset (S2FX) model.

To operate, the model evaluates Bitcoin’s scarcity similarly to scarce assets like gold. Then, it leverages the total Bitcoin in circulation and evaluates it on a yearly issuance basis with reward halvings as well.

At press time, the Bitcoin network’s annual inflation rate is at 1.77% with a circulating supply of 18,723,781 BTC.

Meanwhile, despite its recent fall of over 53% from its recent all-time high of $64k to $30k over a month, Plan B asserts that the S2FX model is still intact. Also, the analyst noted that the current charts look a lot like that of 2013.

Key Bitcoin Levels to Watch — June 1

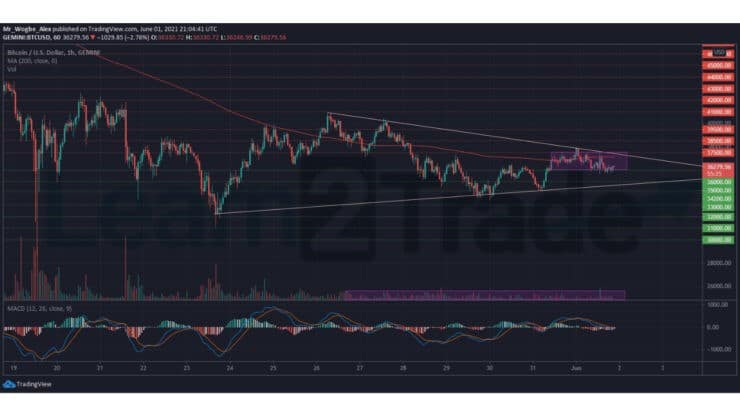

Following a healthy rebound from the $34k support, Bitcoin appears to have fallen into consolidation between $37,500 and $36,000. Meanwhile, the benchmark cryptocurrency is trading within a wedge pattern as trading volume wanes.

Considering that BTC has recently gotten rejected from the top end of our wedge, we could see a completion cycle towards the bottom of this region around $35k.

Nonetheless, our overall bias is currently bullish and sharp moves (upwards and downwards) would get followed by additional upward movements.

Meanwhile, our resistance levels are at $37,000, $37,500, and $39,500, and our key support levels are at $35,000, $34,200, and $33,000.

Total Market Capitalization: $1.62 trillion

Bitcoin Market Capitalization: $683 billion

Bitcoin Dominance: 42%

Market Rank: #1

You can purchase crypto coins here: Buy Coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.