A recent on-chain report from Glassnode shows that the existing balance of Bitcoin (BTC) on cryptocurrency exchanges is on a massive decline over the past few months. According to Glassnode, all the BTC on exchanges sits around 2.4 million, about 12.6% of the total circulating supply.

This report highlights the growing confidence in Bitcoin and is a healthy sign of the benchmark cryptocurrency’s long-term performance.

As the sell-off worsened, many investors offloaded their crypto investments and took cover with safe-haven assets. However, from a macro standpoint, some investors continue to hold their tokens but not in exchanges. Instead, many investors have their coins stored in offline wallets.

Glassnode previously noted:

“Bitcoin has seen a near complete expulsion of market tourists, leaving the resolve of HODLers as the last line standing”

The most recent wave of exchange outflows comes after Bitcoin recorded an impressive rally, jumping by 19.11% in July. At press time, the flagship cryptocurrency trades around $23,750.

That said, the coming weeks will be pivotal for Bitcoin as it will fight to continue the trend in August. The chief market technician at Piper Sandler Companies, Craig Johnson, recently asserted that BTC could end the lasting bear market if it secured a close above $26,000 or $28,000.

Key Bitcoin Levels to Watch — July 31

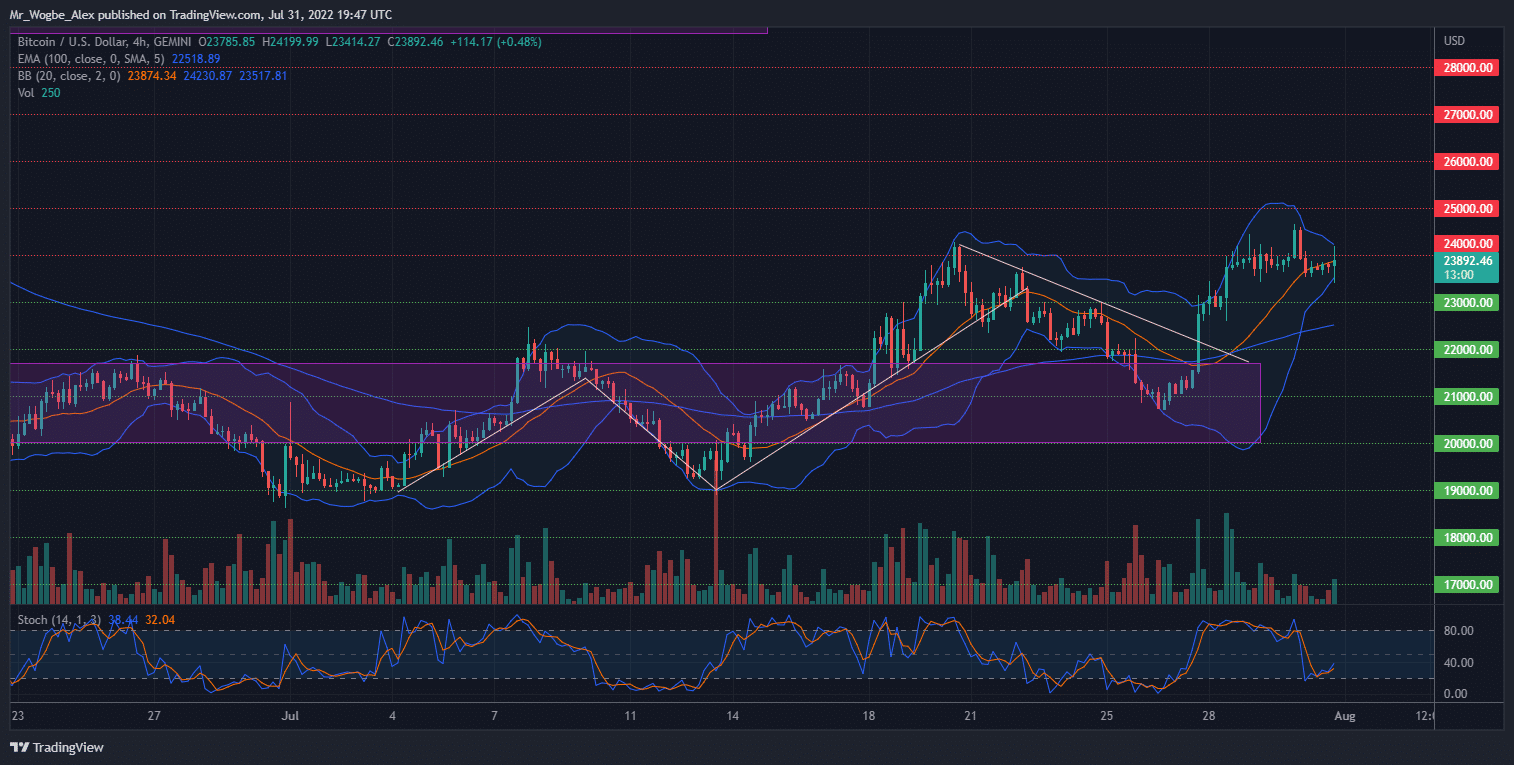

Bitcoin traded within a sideways range around the $24,000 mark over the weekend, as the crypto market maintained a quiet tone. Interestingly, the benchmark cryptocurrency took the chance to ease off any overheated trading conditions on the 4-hour chart, as it trades on a neutral level according to the stochastic oscillator.

With the Asian market opening in a few hours, we could see some sharp price movements, highlighting the possible tone of the market in the coming week. Regardless, the macroeconomic sentiment on the ground, the US being in a recession and all, favors the cryptocurrency, further increasing the possibility of a price hike to $25,000 – $26,000 this week.

Meanwhile, my resistance levels are at $24,000, $25,000, and $26,000, and my key support levels are at $23,000, $22,000, and $21,000.

Total Market Capitalization: $1.11 trillion

Bitcoin Market Capitalization: $456.8 billion

Bitcoin Dominance: 41.2%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.