As Bitcoin continues to struggle, a recent report shows that large institutions have sold over 236,000 Bitcoins or $4.95 billion using current exchange rates in the last two months. The benchmark cryptocurrency currently trades down by about 70% from its all-time high recorded in November.

Large crypto players like Luna Foundation Guard (LFG), Tesla, Celsius, and Three Arrows Capital (3AC), have all dumped notable sums over BTC in distress sales as the ongoing economic crisis takes its toll on risk markets.

In May, TerraUSD (now TerraClassicUSD) lost its dollar peg triggering a crisis for Terraform Labs and forcing the LFG to offload over 80,000 BTC in its reserves. This has been the largest BTC liquidation so far.

Meanwhile, miners also contributed to the increasing pressure on BTC as reports show that top miners sold 4,556 and 14,600 BTC in May and June, respectively.

At press time, the flagship cryptocurrency trades slightly below the $21,000 line and is down by 4.77%, according to data from CoinMarketCap.

Commenting on the mounting large-cap Bitcoin sales, Vetle Lunde, an analyst at Arcane Research, explained that forced/distressed selling has calmed, adding: “We will likely slump, pump, and dump in choppy conditions in the coming period, and macro and correlations will possibly resume being the key force of the market.” Lunde further explained: “However, the reduced presence of dollar-indebted institutions (i.e., Tesla and miners) might contribute to lifting some of the correlation forces.”

Key Bitcoin Levels to Watch — July 26

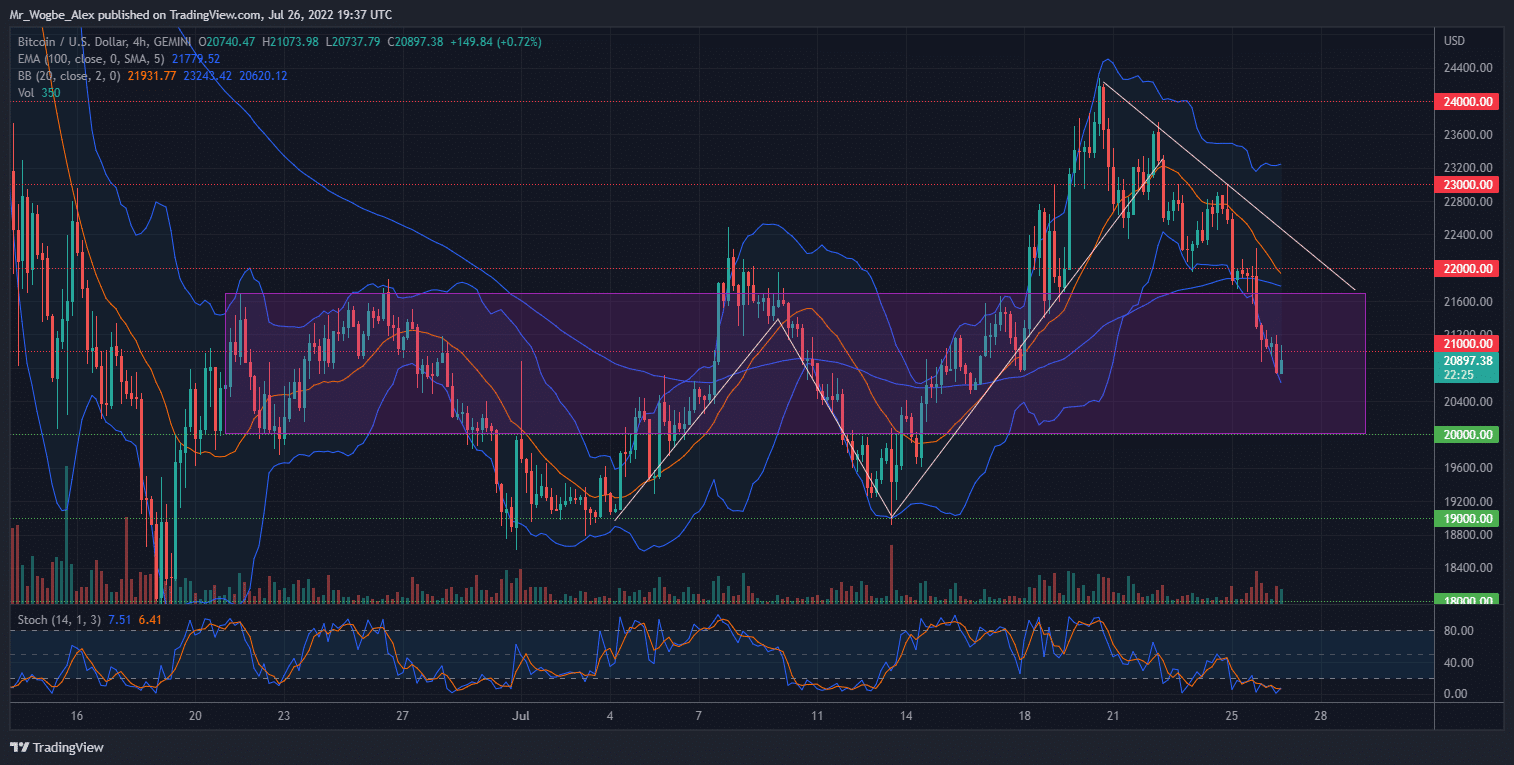

Since its rejection from the $24,000 top last Wednesday, Bitcoin has maintained a steady decline, culminating in a slump below the $21,000 mark today. Over the past six days, the cryptocurrency has recorded a clear downtrend pattern as the $20,000 support comes into focus.

However, the near-term stochastic indicator suggests that the price has entered overheated conditions and could post a modest correction in the coming days. Regardless, bears have their target locked on $20,000, making it unwise to expect any bullish move above the $22,000 point in the near term.

Meanwhile, my resistance levels are at $21,000, $22,000, and $23,000, and my key support levels are at $20,000, $19,000, and $18,000.

Total Market Capitalization: $952 billion

Bitcoin Market Capitalization: $399 billion

Bitcoin Dominance: 41.9%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.