NYDIG and enterprise payments company NCR Corporation has just signed a partnership that would see 650 US banks offer Bitcoin (BTC) and crypto purchases to millions of customers. The new partnership got announced by a Forbes article posting on Wednesday highlighting details of the deal.

After the rollout, financial institutions will have the capacity to invest and trade in cryptocurrency via a mobile app developed by NCR.

Notably, interested financial institutions do not have to bear the burden of holding the crypto asset for customers. Instead, they can outsource that responsibility to NYDIG’s custody services. That said, NYDIG will charge a holding fee while providing additional investment services.

While several traditional financial institutions denigrated Bitcoin and cryptocurrencies during the 2017 bull run, US banks are starting to come around and are eager to join the crypto train. Currently, several banks offer crypto-related products as no bank wants to get left out of the trend. That said, the new partnership between NYDIG and NCR could see banks and credit unions compete with crypto exchanges for customers and market share.

In an interview with Forbes, Douglas Brown, head of digital banking at NCR, noted that his company has high expectations for the cryptocurrency industry in the coming years. He explained that more customers are moving their funds to cryptocurrency exchanges to jump on the trend. He added that “these banks have been eager to join the crypto space and generate some extra income from the market.”

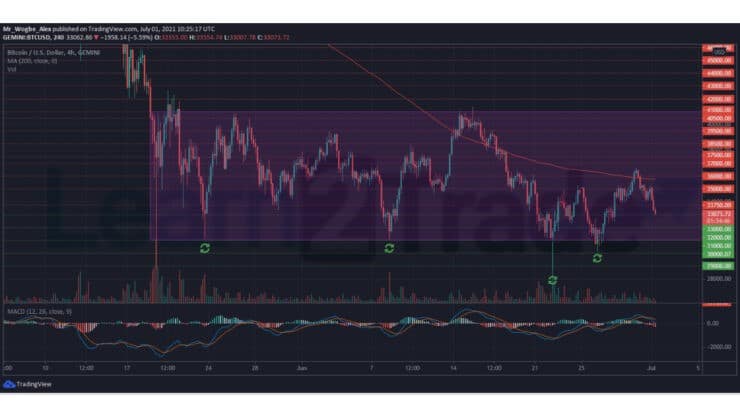

Key Bitcoin Levels to Watch — July 1

Bitcoin bulls appear to be losing control of the market as the benchmark cryptocurrency falls into a bearish spiral towards $33k. BTC got close to reclaiming the $37k level yesterday but met tough resistance at the $36,600 level.

That said, we expect the $33k level to cushion the current correction and set BTC back on its broader recovery path. Once again, the target level to break for bulls is the $35k psychological resistance. Failure to clear that level soon could foster consolidation and additional corrections.

Meanwhile, our resistance levels are at $35,000, $36,000, and $37,000, and our key support levels are at $33,000, $32,000, and $31,000.

Total Market Capitalization: $1.38 trillion

Bitcoin Market Capitalization: $623.2 billion

Bitcoin Dominance: 45.3%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.