Bitcoin (BTC) finally caved under the long-enduring bearish pressure as the benchmark cryptocurrency slumped to the $42,400 low in the early hours on Thursday. Currently, BTC trades down at $42,800 or -7.3%, according to CoinMarketCap.

Meanwhile, the broader crypto market shared a similar fate as it fell by a whopping 8.7% over the past 24 hours, or $200 billion. Interestingly, the global trading volume of BTC plummeted to $25.9 billion while that of Tether (USDT) rose to $53 billion in global swaps.

Many traders liquidated their crypto holdings and fled to stablecoins to hedge against the crypto crash, boosting inflows into assets like USDT, USDC, and others. The stablecoin industry captured $58.8 billion out of the total $98.5 billion in trades yesterday.

Also, the industry now dominates $166.4 billion of the $2.02 trillion crypto market valuation. However, stablecoins also suffered, albeit mildly, from the recent sell-off as many fell by one or two cents away from the $1 peg.

Meanwhile, Bitcoin’s dominance fell to 37.5% yesterday, its lowest point since July 2018. Also, data from the BTC Fear and Greed Index shows that the market is in “extreme fear” territory with a current score of 15.

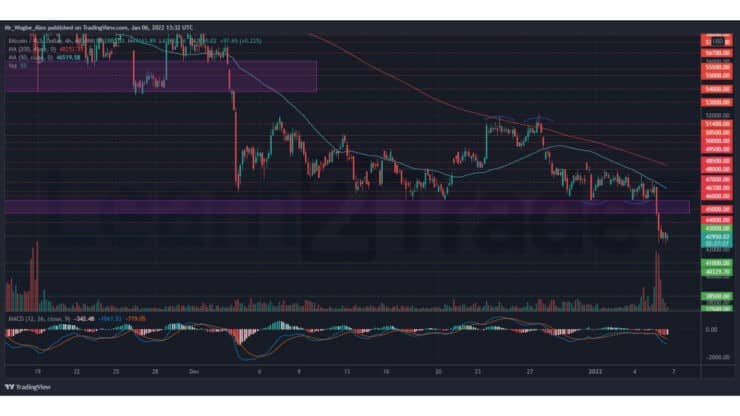

Key Bitcoin Levels to Watch — January 6

Following some hawkish revelations from the US Fed, BTC suffered a debilitating defeat by bears as it shed over 7% within the past 24 hours. The benchmark cryptocurrency now clings to the $43,000 support line, as a breakdown of that support could accelerate a crash to the $41,000 – $40,000 support area.

That said, bulls need to push prices back into the pivot area at $45,650 to 44,670 over the coming days to stall the current bearish bias, thereby preventing a complete crash to the $40,000 psychological support. It remains unclear how bulls intend to pull this off, considering the revitalized bearish pressure in the market.

Meanwhile, my resistance levels are at $44,000, $45,000, and $46,000, and my key support levels are at $43,000, $42,000, and $41,000.

Total Market Capitalization: $2.02 trillion

Bitcoin Market Capitalization: $809 trillion

Bitcoin Dominance: 40%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.