Bitcoin (BTC) suffered its worst single-day crash for the first time since mid-May last Saturday, as the price slumped to a multi-week low of $42,000. As expected, the +$16,000 crash within 24 hours sent many investors into a panic, which sent the Bitcoin Fear and Greed Index to “Extreme Fear” territories.

The Fear and Greed Index serves as an indicator of the prevailing investor sentiment at any given time on a crypto asset. It derives its reading by aggregating several on-chain metrics, including asset volatility, volume, social media trends, surveys, and many more. The Index’s reading ranges from 0 (Extreme Fear) – 100 (Extreme Greed).

At press time, the Bitcoin Fear and Greed Index indicates that investors are in a notable panic as the reading shows 25 (Extreme Fear).

The primary reason behind the recent crash is the discovery of the new COVID-19 variant, Omicron, which sent the entire financial market into a panicked frenzy.

Meanwhile, analytics provider CryptoQuant revealed that on-chain developments leading up to the crash indicated a possible crash. The platform revealed that the amount of BTC on crypto exchanges spiked significantly a few hours before the drop occurred.

That said, smart investors know that the best time to get on a market is when “there is blood on the streets.” It is common to buy when the financial markets are in “extreme fear” territory and vice versa.

Key Bitcoin Levels to Watch — December 7

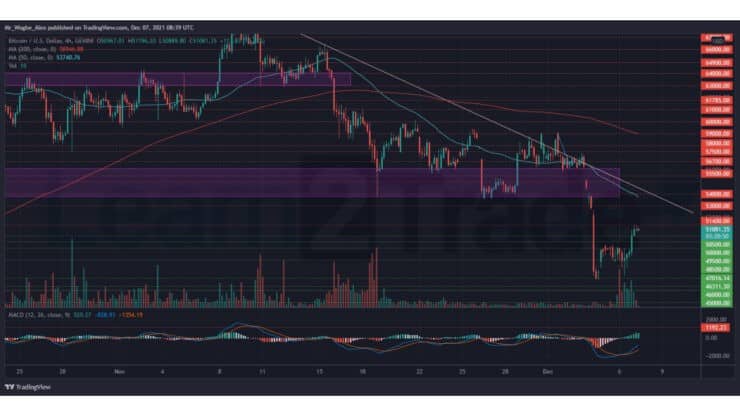

BTC regained some bullish traction on late Monday and has planted a healthy footing above the $51,000 mark. However, the benchmark cryptocurrency has failed to break above the $51,400 barrier in the pasts few hours and has suffered two rejections from that line.

This bullish move comes as the broader market regains some upward traction, indicating that we could see a bullish continuation to the $53,000 resistance over the coming hours. That said, BTC needs to hold above the $50,000 psychological mark to sustain this bullish projection, as a break below that mark could foil efforts by bulls and send the price to previous lows.

Meanwhile, my resistance levels are at $51,400, $53,000, and $54,000, and my key support levels are at $50,500, $50,000, and $49,500.

Total Market Capitalization: $2.40 trillion

Bitcoin Market Capitalization: $968.6 trillion

Bitcoin Dominance: 40.5%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.