On-chain analysis data shows that Bitcoin (BTC) might have reached its bottom. The data drew its reference from Reserve Risk, Balanced price, and the Cumulative Value-Days Destroyed (CVDD).

According to the data, the Reserve Risk is a seasonal Bitcoin on-chain indicator that juxtaposes long-term investor confidence against the existing price of an asset. That said, when investor confidence is high but the asset’s price is low, Reserve Risk shows a low value. Historically, such conditions have been the perfect time to secure the best risk-to-reward ratio (RRR) on an asset.

On July 6, the Reserve Risk indicator dropped to a historic low of 0.00099; the first time the indicator breached the 0.001 mark. That said, analysts suspect that the lower point on the bear cycle has been reached.

A Bitcoin bottom is usually confirmed once the indicator records a breakout on its descending trendline. That said, a breakout is confirmed after Reserve Risk moves above 0.002.

Meanwhile, Cumulative Value-Days Destroyed (CVDD) is the ratio of the cumulative USD value of Coin Days Destroyed and the market age (measured in days). Historically, this indicator has accurately spotted market bottoms and did so in the 2015, 2019, and 2020 cycles. Also, the price never touches CVDD, instead, it bounces before it reaches the bottom. This means a rebound in the CVDD is imminent, further proving the case for a bottom being reached already.

Key Bitcoin Levels to Watch — August 4

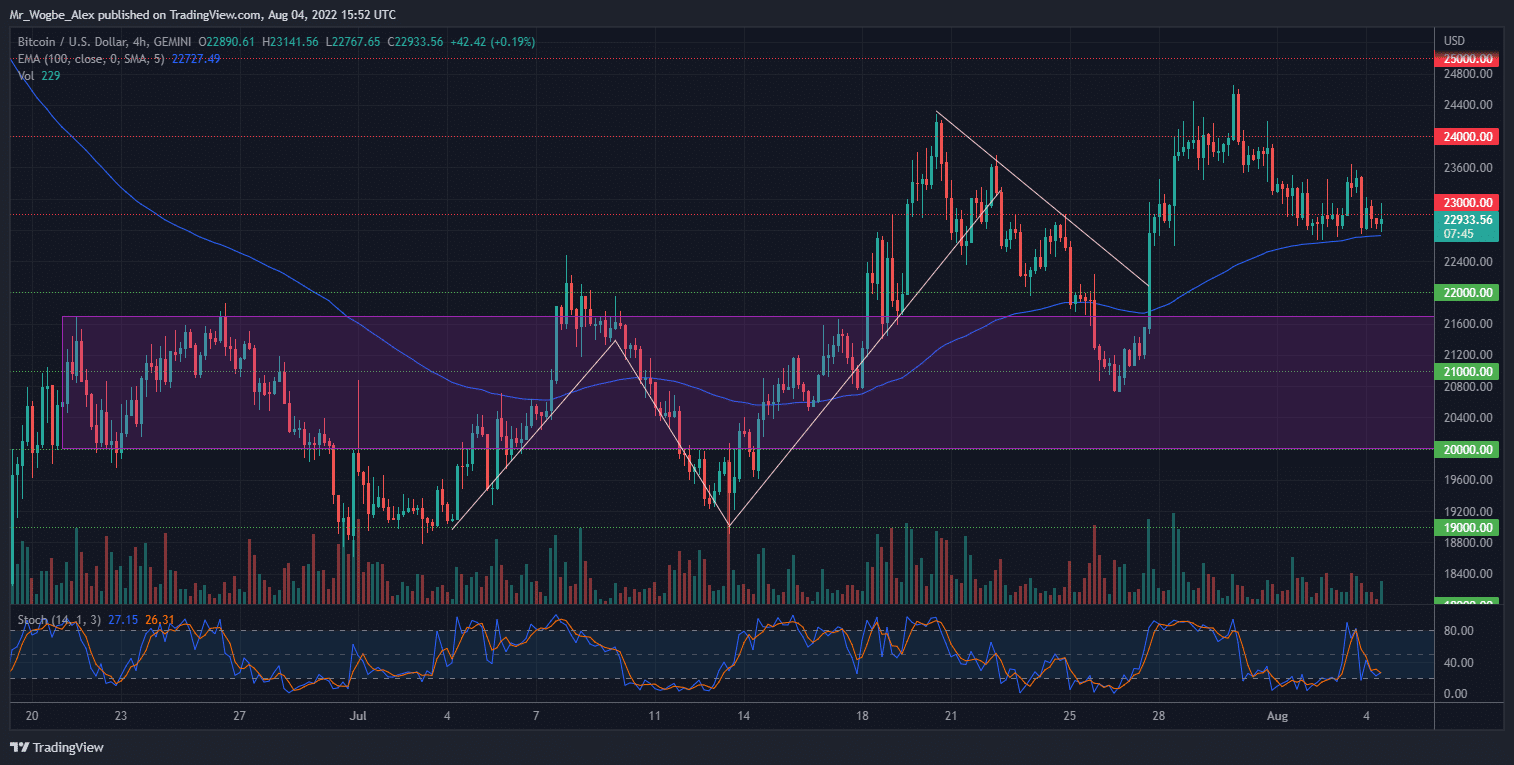

Bitcoin continues to hold onto the $23,000 figure thanks to the active support received from the 100 EMA line at $22,720. However, this prolonged consolidation around the $23,000 level could result in a full-blown bearish correction in the coming hours and days.

That said, BTC bulls need to push the price above the $23,600 mark to ease the bearish tension while they work on accumulating longs to push for $25,000. However, with the USD gaining some bullish strength after comments from several Fed officials, the benchmark cryptocurrency could suffer a downwards breach soon.

Meanwhile, my resistance levels are at $24,000, $25,000, and $26,000, and my key support levels are at $22,000, $21,000, and $20,000.

Total Market Capitalization: $1.07 trillion

Bitcoin Market Capitalization: $437.3 billion

Bitcoin Dominance: 41%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.