Earlier today, behemoth crypto exchange Binance (BNB) disabled cryptocurrency withdrawals on its platform, citing a massive backlog as the reason for the withdrawal suspension.

The exchange later announced that it had reinstated its withdrawal feature, only to suspend it again before finally turning it on. Binance announced via Twitter around noon (GMT) that:

“We have temporarily disabled all crypto withdrawals on Binance.com due to a large backlog.

Rest assured, our team is working on it with top priority. Thank you for your patience and apologies for any inconvenience caused.”

A while later, the giant exchange tweeted that crypto withdrawals had resumed but pulled the plug again in the ensuing minutes. At around 2 pm (GMT), the crypto exchange reannounced the resumption of withdrawals and apologized to users for the inconvenience.

Binance has made the news for several wrong reasons over the past few months, with today’s incident only adding to it.

In June, the crypto exchange halted withdrawals in sterling for UK customers following warnings from the Financial Conduct Authority on using the services of Binance Markets Limited, a Binance subsidiary.

Meanwhile, the platform was among the 59 exchanges to leave South Korea after the government introduced stricter rules for the crypto industry in September.

The cryptocurrency exchange also came under pressure for having ineffective customer background checks, which allegedly allowed bad actors to launder money through the platform. However, the top crypto exchange has reassured that its know-your-customer (KYC) checks effectively tackle financial crimes or graft.

Key Binance Coin Levels to Watch — November 1

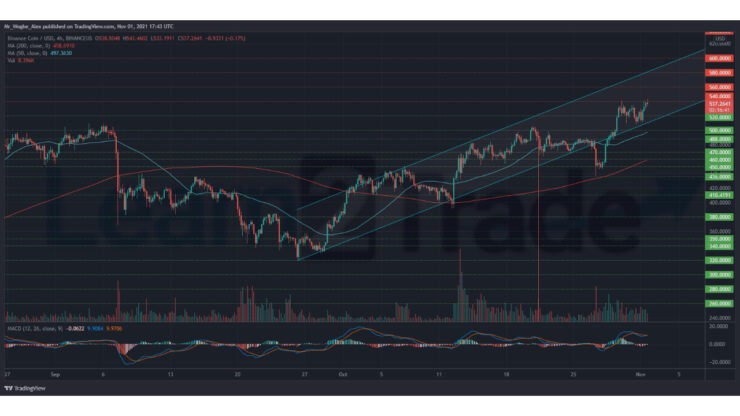

Amid a quiet trading session on Monday, BNB recorded a 5% intraday rally and touched its highest point since May 17 at $543. This jump comes amid a three-day consolidation between the $540 and $510 level last weekend.

That said, the third-largest cryptocurrency currently trades within an ascending channel, indicating that more upsides are likely in the near term. A retest and break above the $540 level (following the recent mild correction to $535) could consolidate the bullish bias and push the price towards $580 in the coming days.

On the other hand, we could see a fall back onto the $540 – $510 consolidation range if bulls fail to retake the $540 line.

Meanwhile, my resistance levels are $540, $560, and $580, and my support levels are $520, $500, and $488.

Total Market Capitalization: $2.62 trillion

Binance Coin Market Capitalization: $89.4 billion

Binance Coin Dominance: 3.42%

Market Rank: #3

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.