In a recent developments, Bitcoin miners are grappling with unprecedented challenges as profitability reaches all-time lows. Despite Bitcoin’s price rebounding to over $59,000, miners are feeling the squeeze due to reduced block rewards and increasing mining difficulty.

According to a recent report by Blocksbridge, a storage infrastructure company, miner hashprice, which measures mining profit margins, has fallen below $36 per petahash per second (PH/s). This marks the lowest level ever recorded. The situation is expected to worsen if the upcoming difficulty recalculation doesn’t adjust lower.

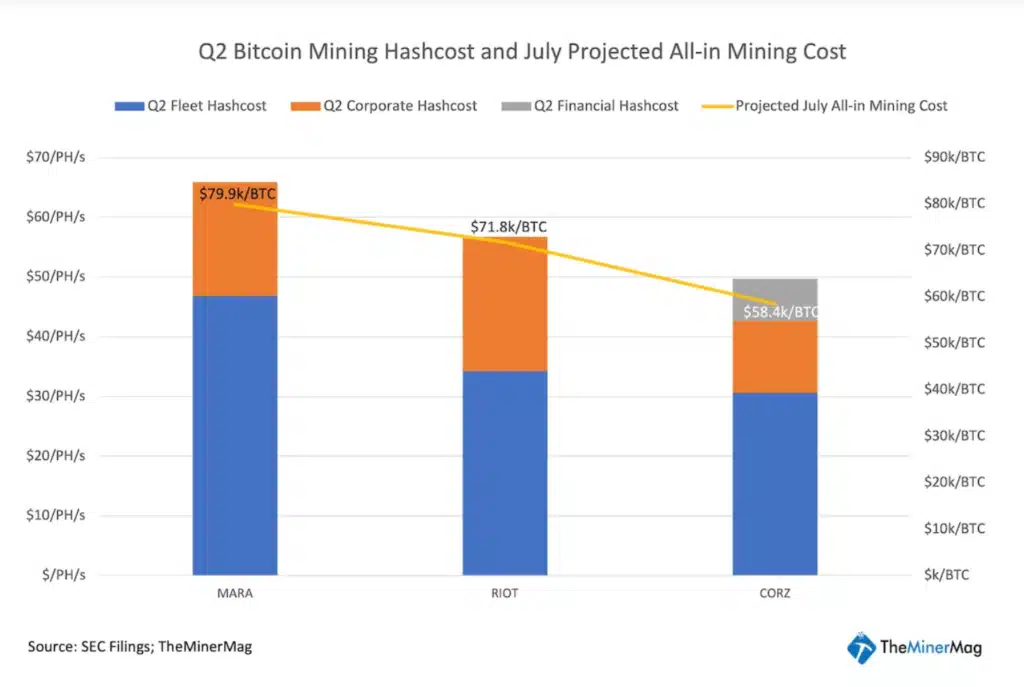

Large public mining companies are struggling to turn a profit at current hashprices. Marathon Digital Holdings (MARA), Core Scientific, and Riot Platforms each face projected monthly mining costs of $60,000 or more per Bitcoin. MARA currently has the highest all-in mining cost, based on second-quarter financial data.

Different strategies are being employed by mining companies to weather this storm. According to Cointelegraph, MARA and Riot Platforms are holding onto their mined Bitcoin, hoping for future price appreciation. In contrast, Core Scientific is selling 100% of its mined Bitcoin to cover operational costs. Each approach comes with its own set of risks and potential rewards.

Despite these challenges, some miners are showing resilience. CleanSpark, for instance, only sold 2.54 Bitcoin in July, holding onto most of the 494 Bitcoin it mined that month. MARA increased its Bitcoin holdings by 2,282 BTC, valued at approximately $124 million, as part of its long-term strategy.

Adding to the miners’ woes, Bitcoin’s mining difficulty recently hit a new all-time high of about 90.6 trillion on August 1. This increase makes it harder for miners to earn rewards, further squeezing their profit margins.

JPMorgan Says Institutional Investors Remain Steadfast with Bitcoin

However, it’s not all doom and gloom for the broader Bitcoin market. According to The Block, JPMorgan analysts report that institutional investors have shown limited to no de-risking in Bitcoin futures, despite recent market volatility. This institutional support has contributed to Bitcoin’s price rebound following a sharp correction on August 5.

Several factors are keeping institutional investors optimistic. These include Morgan Stanley allowing its wealth advisors to recommend spot Bitcoin ETFs to some clients, the likelihood that major liquidations from the Mt. Gox and Genesis bankruptcies are behind us, and potential cash payments from the FTX bankruptcy later this year.

As the Bitcoin mining landscape continues to evolve, miners will need to adapt their strategies to remain profitable in this challenging environment. The coming weeks will be crucial in determining the direction of both mining profitability and Bitcoin’s overall market performance.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.