While technical indicators largely maintain that bullish momentum in the Japan 225 remains active, it can also be observed that the market is currently in a consolidation phase. Fundamentally, this appears to be a lingering effect of the easing geopolitical tensions in the Middle East, as several stocks and futures are exhibiting dampened momentum.

Key Levels

Resistance: 40,000, 42,500, 45,000

Support: 39,000, 36,500, 34,000

NIKKEI Bulls Are Holding Their Ground

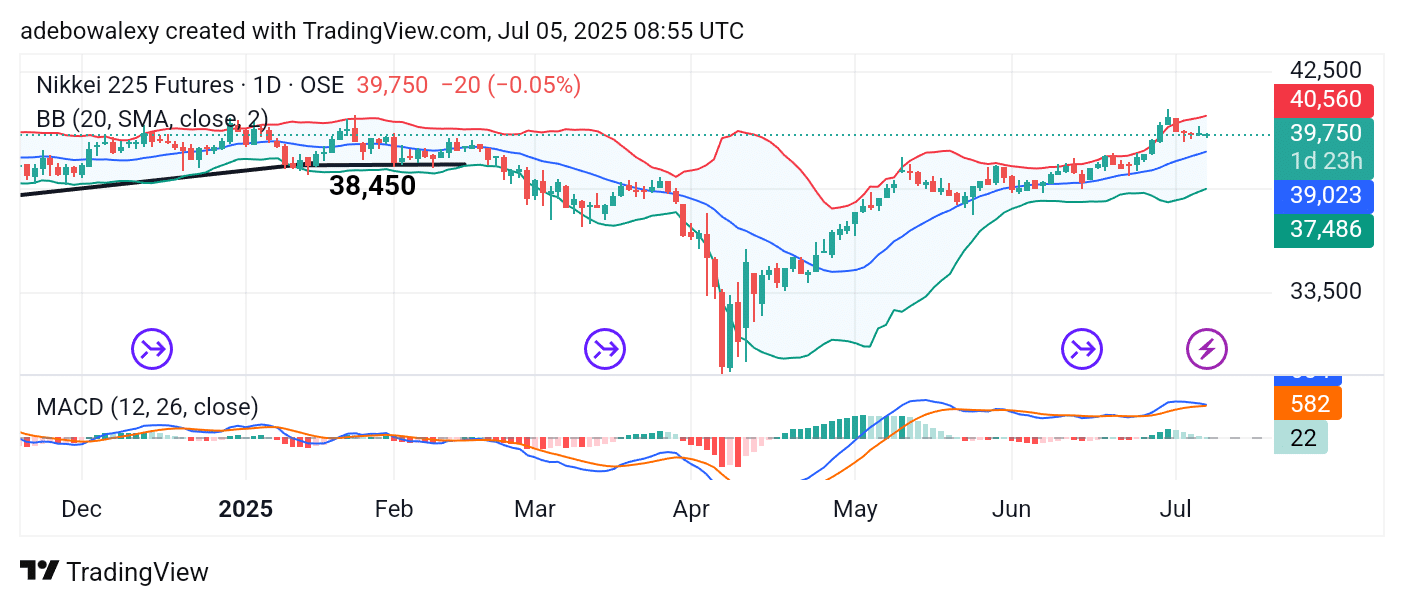

On the Japan 225 daily chart, price activity has shown signs of consolidation since the previous session. Nevertheless, bullish forces have remained in control, as suggested by the shape and color of recent price candles.

The Bollinger Bands (BB) indicator is slightly tilted upward, with price action hovering near the upper band—indicating that the bullish bias is still intact. However, due to reduced volatility, the Moving Average Convergence Divergence (MACD) lines are seen converging above the equilibrium level. While the market may seem subdued, the MACD’s position above the baseline still reflects an overall positive outlook.

Japan 225 Appears to Be Cooling Off

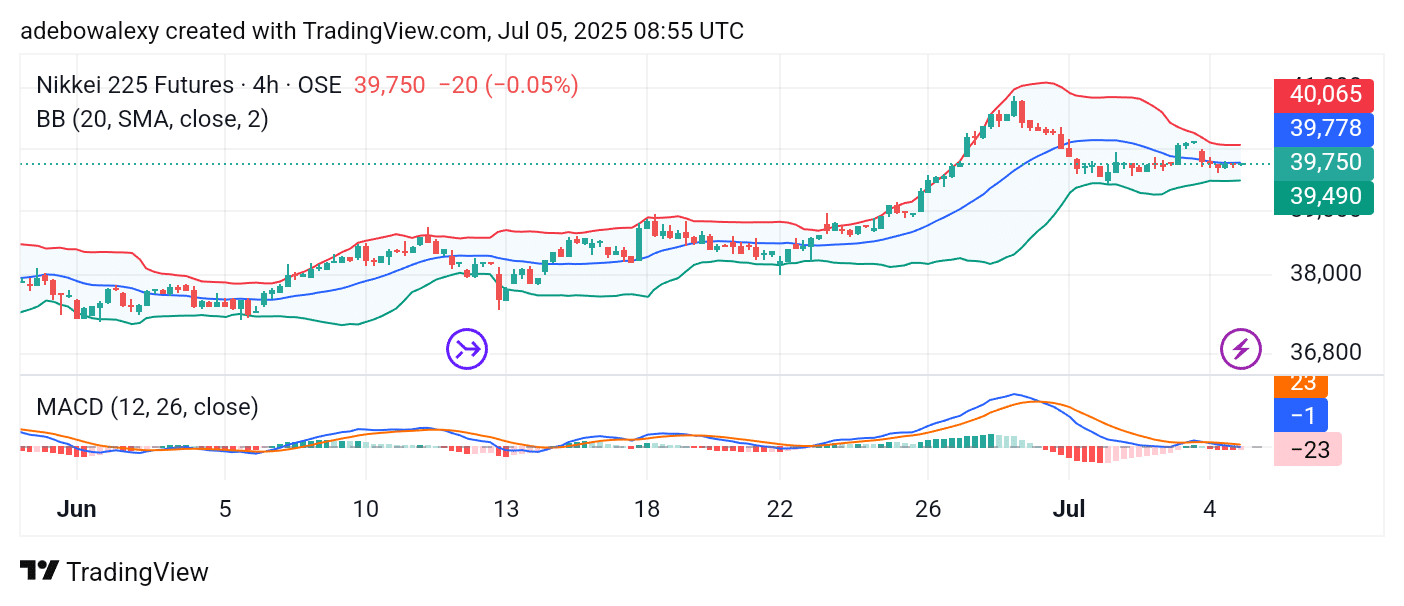

On the 4-hour chart, the Nikkei market shows price activity with a hovering characteristic, reflecting a lack of decisive direction. Price action remains slightly below the middle band of the BB indicator, while the upper and middle bands are now appearing narrower than before—signaling a squeeze and low volatility.

Additionally, the MACD lines are still slightly above the equilibrium level. Although this appears to be a temporary slowdown, technical indicators continue to suggest that bullish momentum could soon resume. If that happens, price activity may break above the 40,000 mark and potentially target the 42,500 resistance level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.