The Japan 225 market experienced a notable price dip, primarily triggered by Donald Trump’s trade tariff update. This development had a significant impact on most stocks, leading to a notable price decline. Although the upside retracement in this market appears to be fading, price action remains relatively above key technical landmarks. The Asian GDP data and central bank decisions could still play a crucial role in determining future price movements. Traders may want to monitor these factors closely.

Key Price Levels:

Resistance Levels: 39,000, 40,000, 41,000

Support Levels: 38,000, 37,000, 36,000

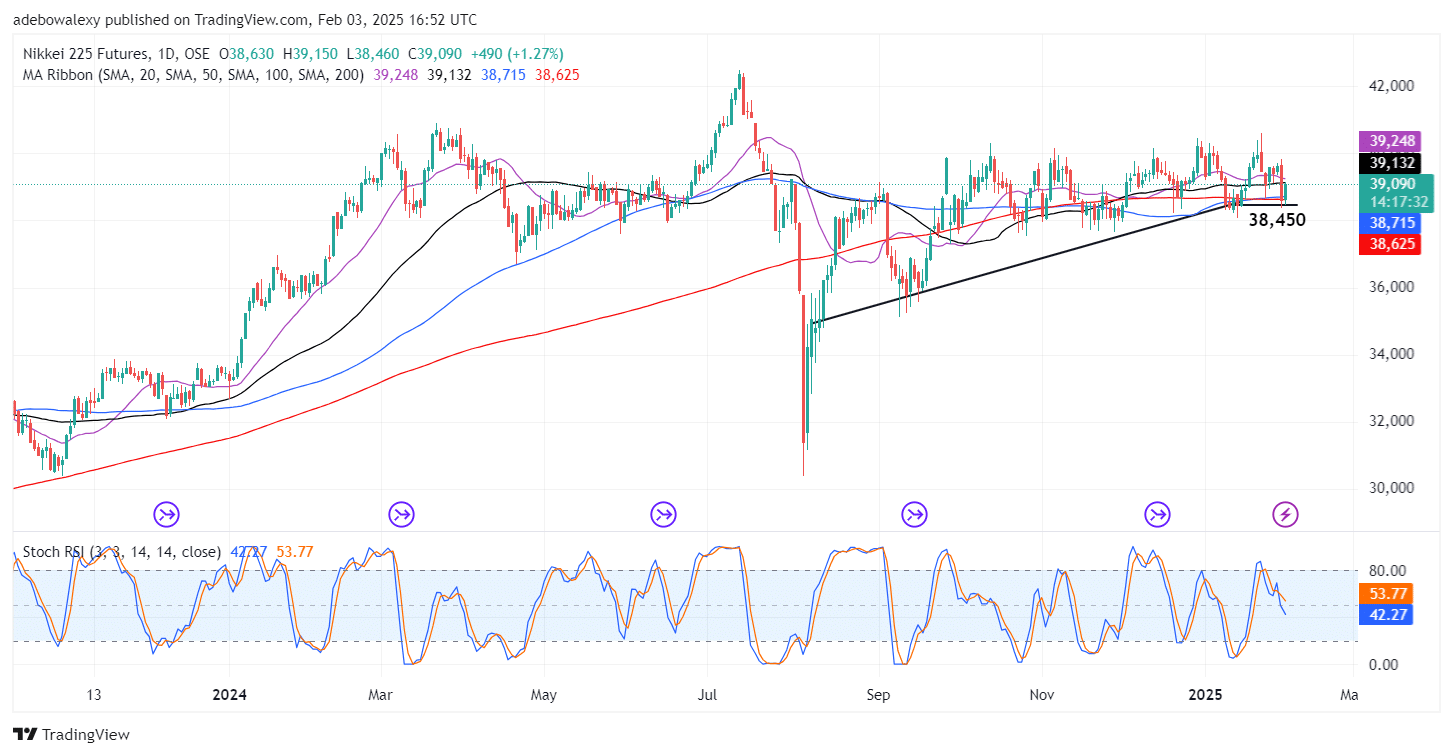

Nikkei 225 Bounces Off Support at the 38,450 Mark

The previous session in the Japan 225 market saw a sharp price decline. However, in the ongoing session, price action has rebounded moderately. Despite this recovery, the market appears to have shifted from a slightly upward trajectory to a sideways movement for now.

The latest price candle indicates that this futures contract is trading above the 100-day and 200-day Moving Average (MA) lines. However, the Stochastic Relative Strength Index (RSI) lines still exhibit a downward trajectory, with only a slight deflection in the lead line of the indicator.

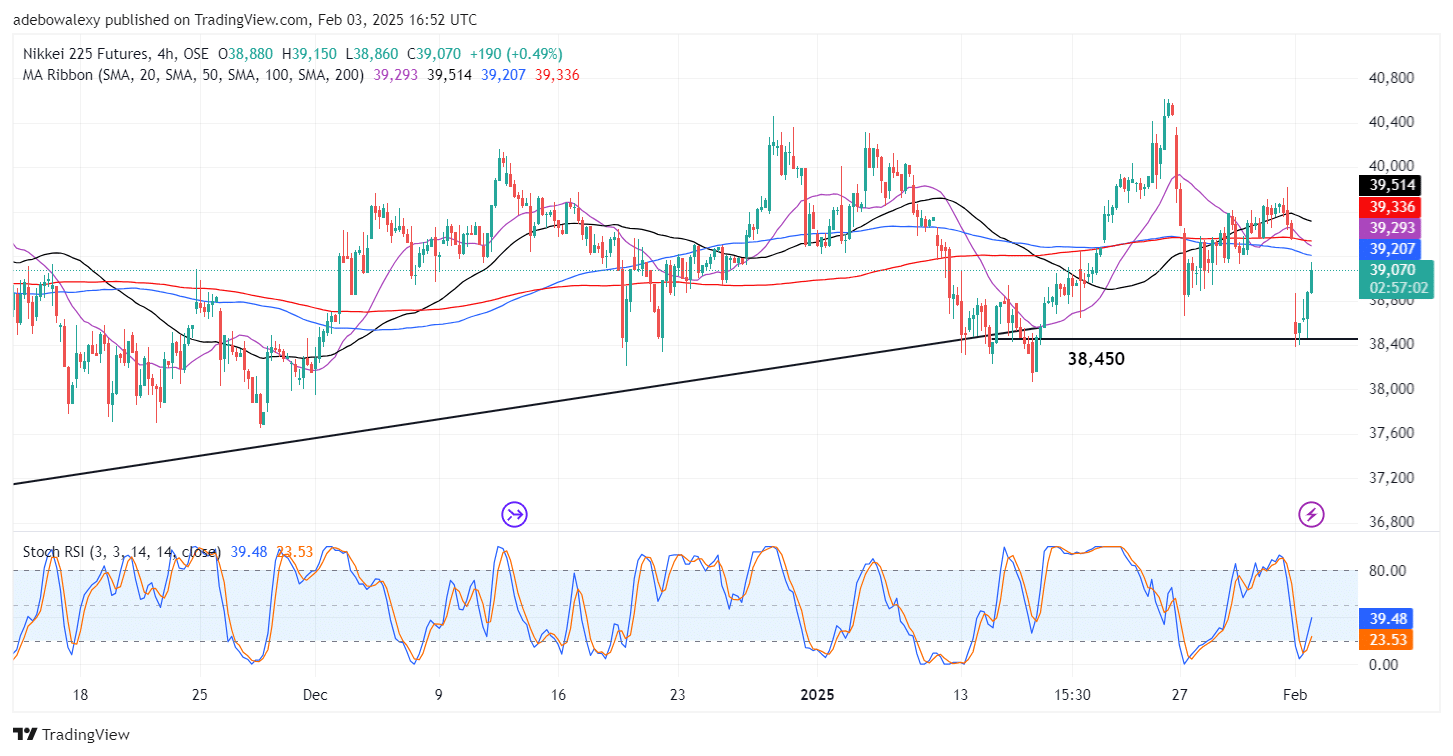

Japan 225 Recovers from Downward Retracement

On the 4-hour chart, the Nikkei 225 market experienced a sharp downward retracement, bottoming out at the 38,450 price level. However, price action has been retracing higher over the past three sessions.

Despite this upward movement, price action remains below all the MA lines on the chart. Meanwhile, the Stochastic RSI lines are rising toward the 50 mark, suggesting a potential continuation of the recovery. Given this trend, traders may consider targeting the 39,500 price level for short-term gains..

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.