The Japan 225 market has experienced a strong upward rebound over recent sessions. This movement has been influenced by various economic developments. However, of late, it appears that price action is transitioning from a strong bullish retracement to a more sideways trajectory. Let’s examine how this might unfold in the near term.

Key Price Levels

Resistance: 38,000, 39,000, 40,000

Support: 37,000, 36,000, 35,000

Nikkei 225 Hugs the 9-Day MA Line

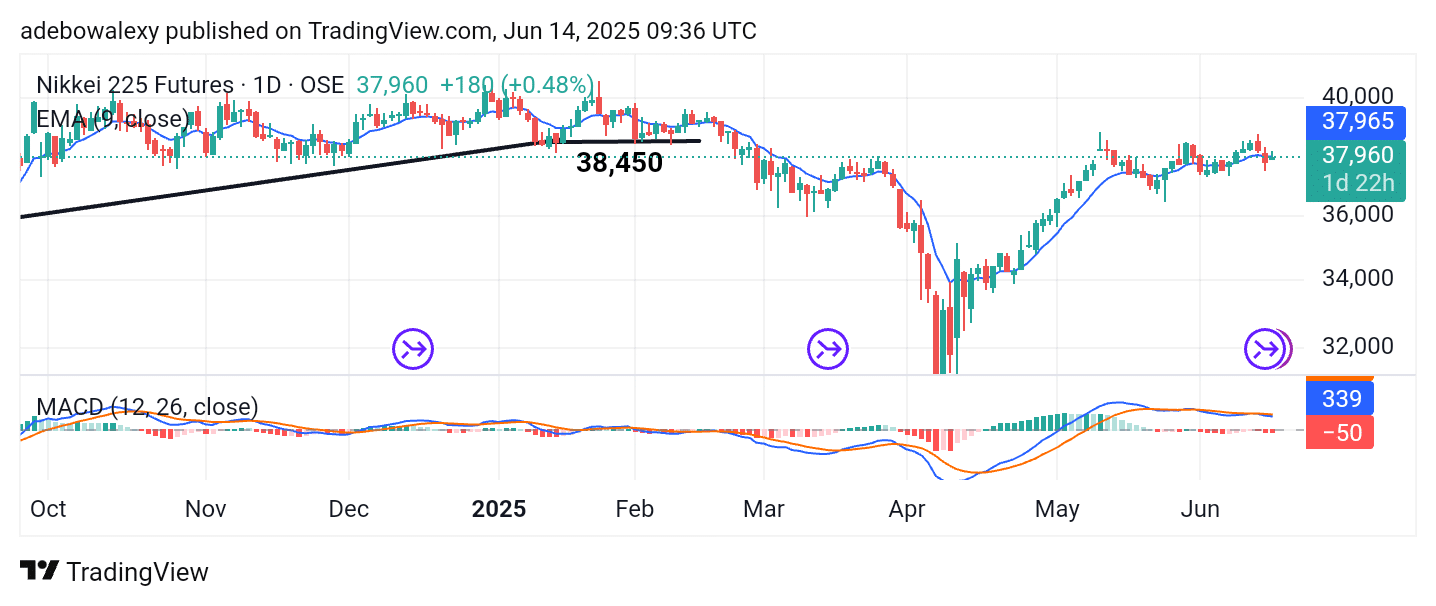

Price activity on the Japan 225 daily chart saw a modest pullback over the past two sessions, causing the market to drop below the 9-day Moving Average (MA) line. However, the ongoing session has brought a slight upward recovery, with price action now hovering close to the 9-day MA line.

Despite this, price action remains below the 9-day MA curve, although the current green candle indicates that upward forces are still active. The Moving Average Convergence Divergence (MACD) indicator line remains above the equilibrium level but is moving sideways.

The histogram bars of this indicator are short and lie below the equilibrium level. As a result, traders may prefer to stay on the sidelines for now and observe how the market evolves.

Japan 225 Appears Poised to Break Above the 38,000 Threshold

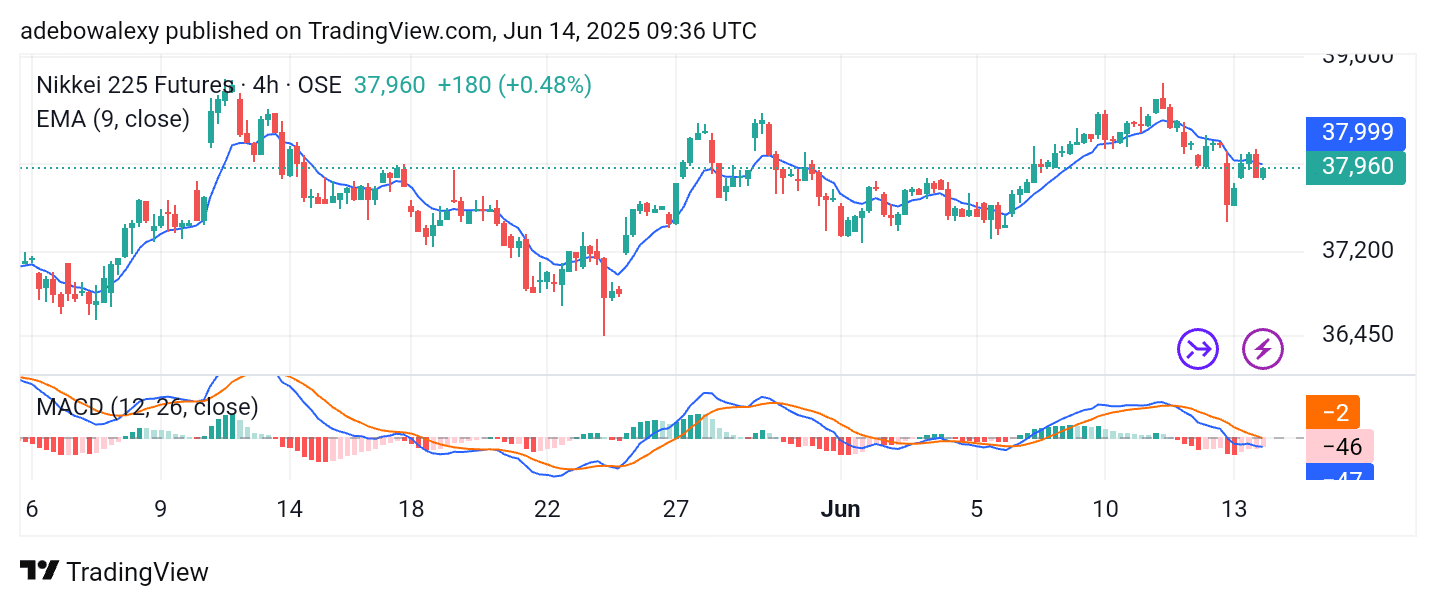

Even on the smaller 4-hour time frame, price action shows a bullish tendency. The latest candle is green, although it remains below the 9-day MA curve. The MACD line has dropped below the equilibrium level, and the histogram bars are pale red, indicating weak bearish momentum.

However, the MACD line appears to be moving toward a convergence, which, when combined with the bullish stance of the last price candle, suggests that the market may soon gather enough strength to break through the immediate resistance at the 38,000 level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.