The general stock market continued to edge higher over the week. Meanwhile, the greenback (U.S. dollar) has been slipping, even as trade talks continue to take center stage in the financial markets. The Japan 225, like other stocks, has been edging higher despite showing signs of reduced momentum. Let’s see how the market may evolve shortly.

Key Price Levels

Resistance Levels: 38,000, 39,000, 40,000

Support Levels: 37,000, 36,000, 35,000

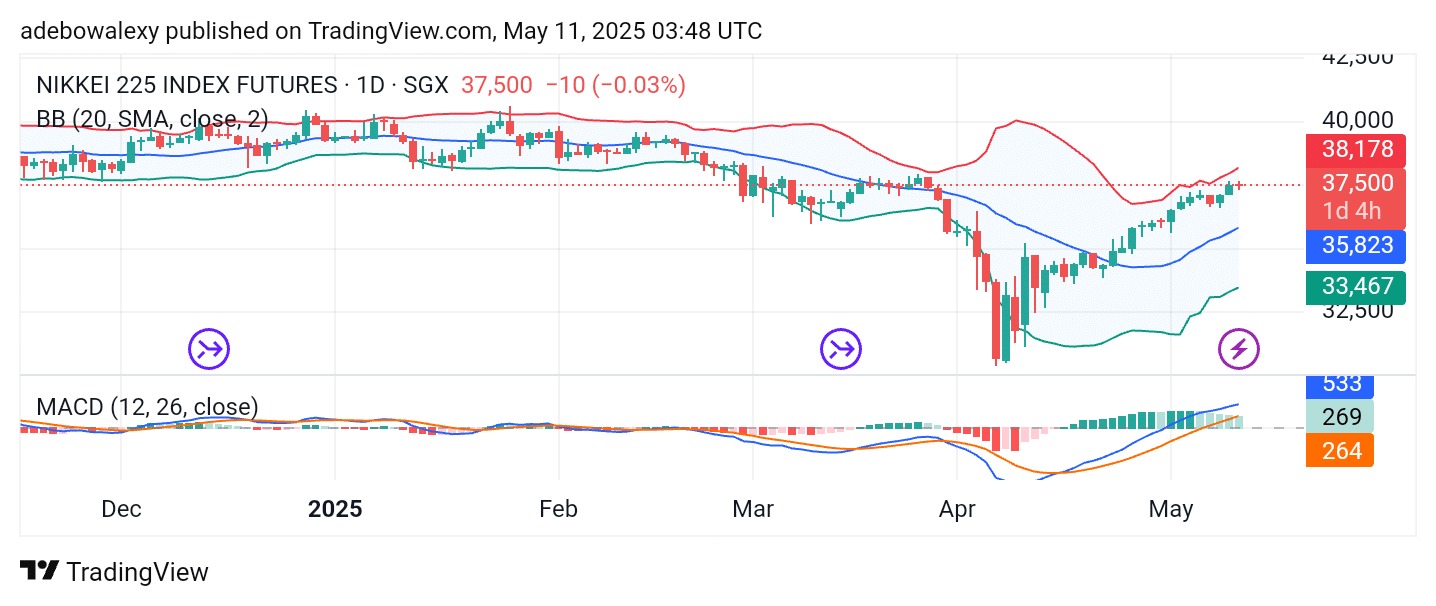

Nikkei 225 Proceeds Higher Above 37,000

The Japan 225 market continued to edge higher over the previous week after breaching the 37,000 price mark. However, price action experienced a strong contraction on Friday and consequently closed with minimal losses.

Meanwhile, the Bollinger Bands retain their upward trajectory, suggesting that overall momentum may persist. Price activity remains above the middle line of the Bollinger Bands, increasing the likelihood of continued upward movement.

Additionally, the Moving Average Convergence Divergence (MACD) indicator lines are steadily rising after crossing the equilibrium level. The MACD histogram bars appear pale green but continue to form above the equilibrium line, further supporting a bullish outlook.

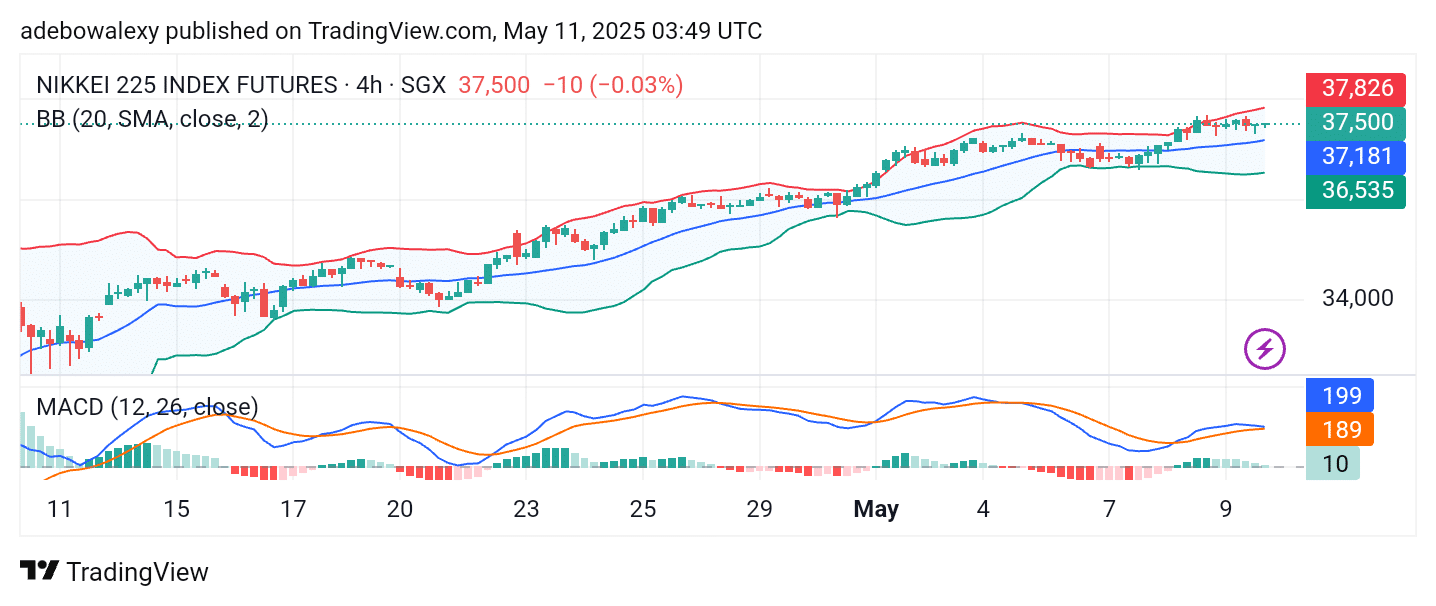

Japan 225 Bulls Are Holding On

Turning to the Nikkei 225 market on the 4-hour chart, price activity has continued to show minimal gains.

As a result, the market continues to consolidate above the middle line of the Bollinger Bands. The last two price candles on this chart appear green but are heavily compressed, indicating that headwinds are weighing on price movements.

The MACD lines remain above the equilibrium level but appear to be converging, hinting at a weakening uptrend. Therefore, unless contradicted by new fundamental developments, the market may retrace toward the 37,000 support level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.