Following last week’s performance, price action in the Japan 225 index has shown significant progress. However, there are indications of a potential upside breakout. This, however, will depend on how the stock market performs in the days ahead. Let’s examine this more closely below.

Key Levels

Resistance: 40,000, 42,500, 45,000

Support: 39,000, 36,500, 34,000

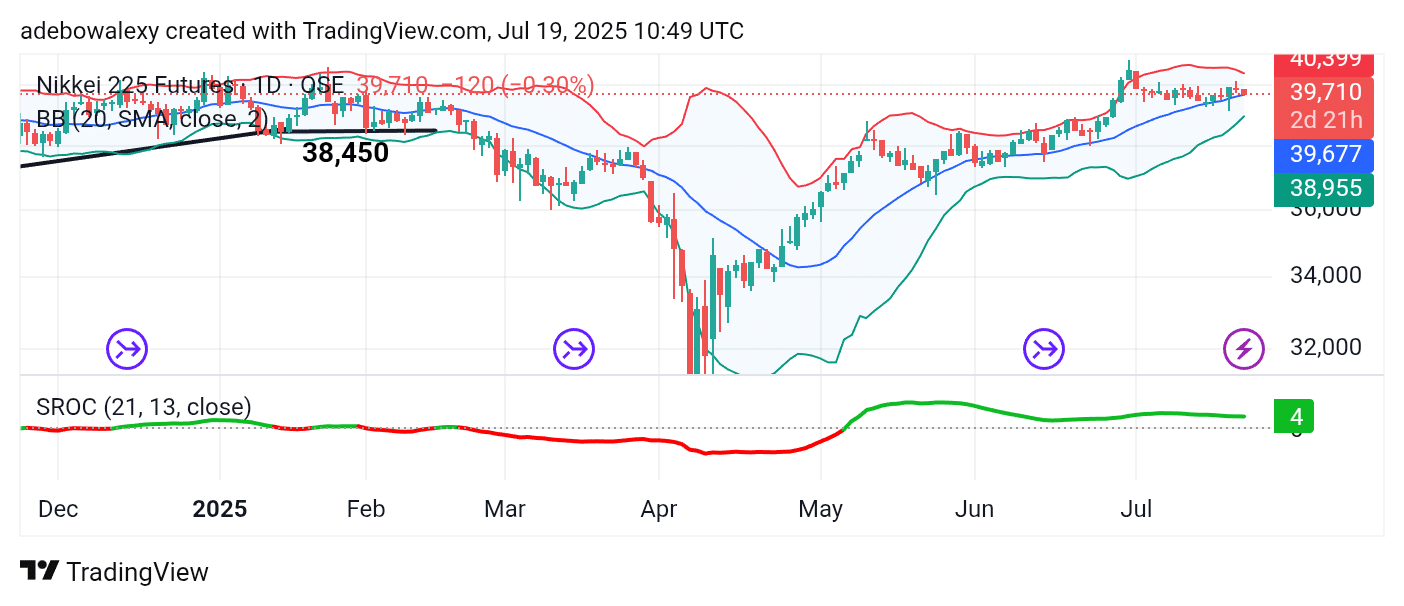

NIKKEI Perches on a Key Baseline

The Japan 225 has largely been consolidating for about two weeks. The Bollinger Bands (BB) indicator is seen contracting, signaling reduced volatility. The most recent price candle has landed on the middle band of the BB indicator.

This candle is bearish but has not broken through the previously tested support level. Meanwhile, the Smoothed Rate of Change (SROC) indicator line continues to move sideways above the equilibrium level. Therefore, the market appears to be well-positioned for a potential upward rebound.

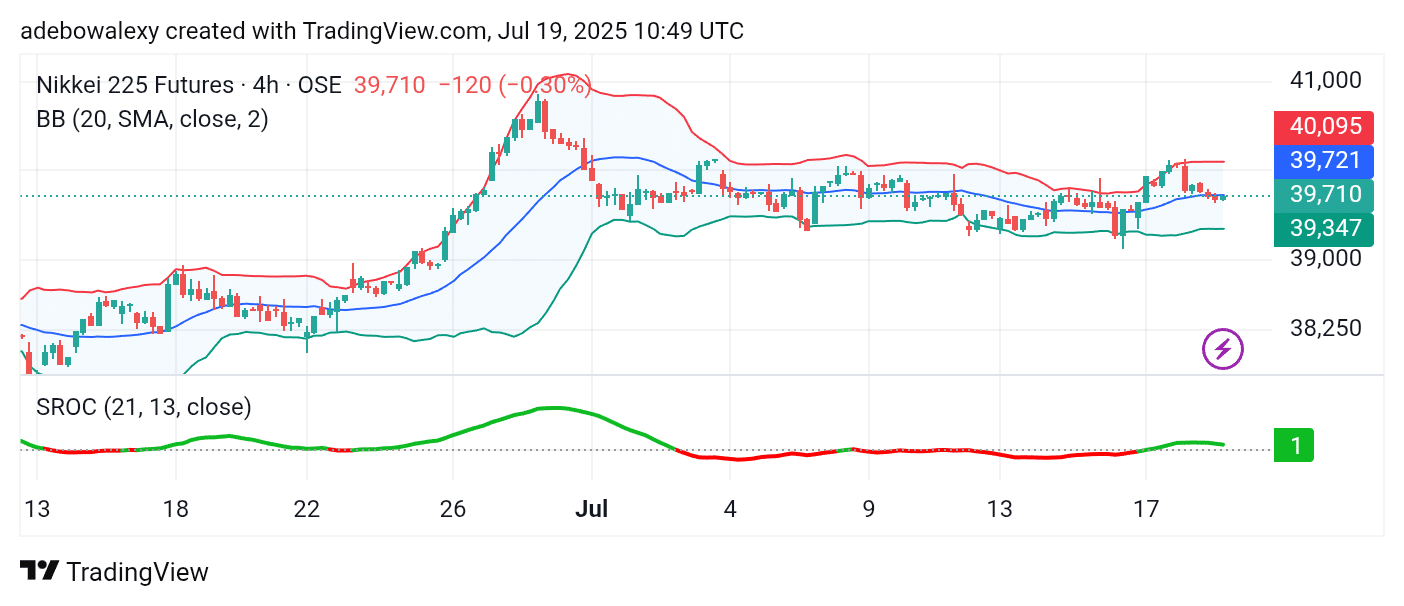

Japan 225 Stays Around Key Technical Levels

On the NIKKEI 4-hour chart, price action has slipped slightly below the middle band of the BB indicator. The latest candle is solid green with a small body, reflecting some buying pressure. Similar to the daily chart, the SROC indicator line here continues a sideways movement above the equilibrium line.

As a result, this suggests that price action may witness a notable upward rebound from current levels. However, this outlook is contingent on upcoming economic news from Japan and overall market sentiment. Consequently, traders may consider targeting a move back above the 40,000 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.