The Japan 225 market can be seen to have surged significantly on New Year’s Day. This move extended into the next trading day as well. This appears to have been aided by a tech stock rally. Also, metals are heating up as they continue on a bullish path.

Key Levels

Resistance: 51,000, 52,000, 53,000

Support: 49,000, 48,000, 46,000

Japan 225 Sees an Additional Modest Gain

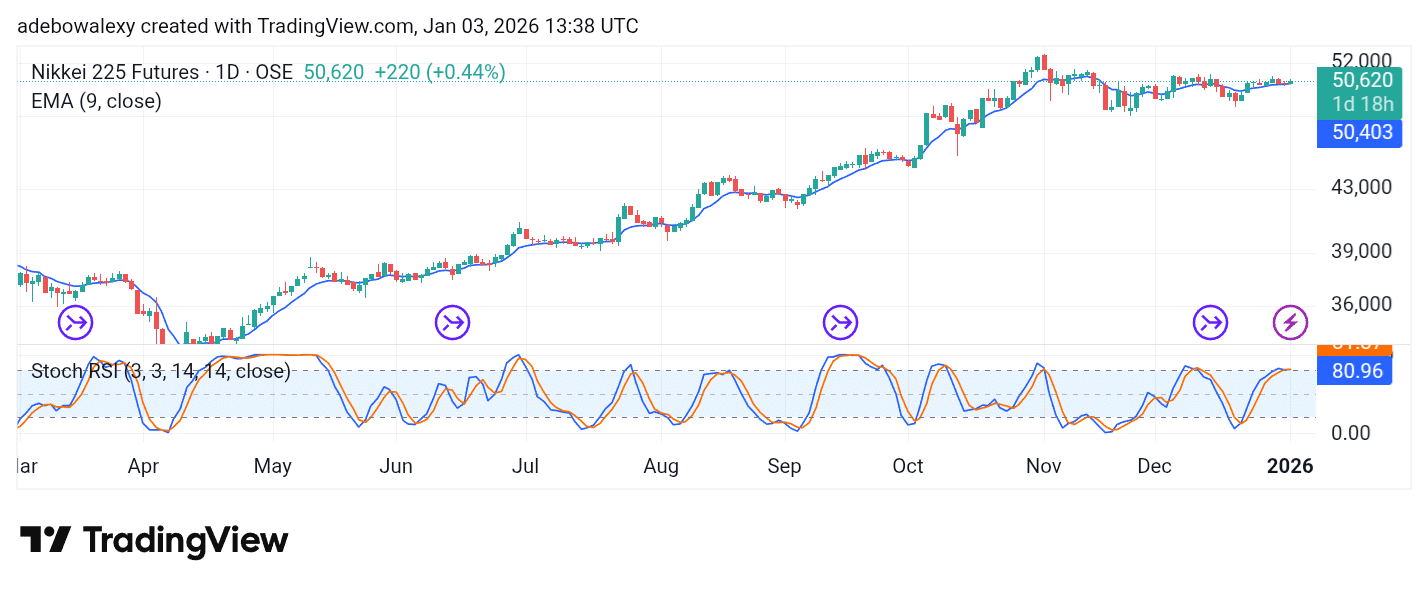

The NIKKEI 225 on the daily chart stayed on an upward course. The last price candle on the chart is green and stands above the 9-day Exponential Moving Average (EMA) line.

Though it appears quite small, the fact that it stands above the 9-day EMA holds some positivity. The Stochastic Relative Strength Index (SRSI) indicator lines have risen and show a slight sideways bend at the terminal part but remain above the 80 level of the indicator. This hints at the continued bullish momentum in the market.

NIKKEI Pulls Back Slightly

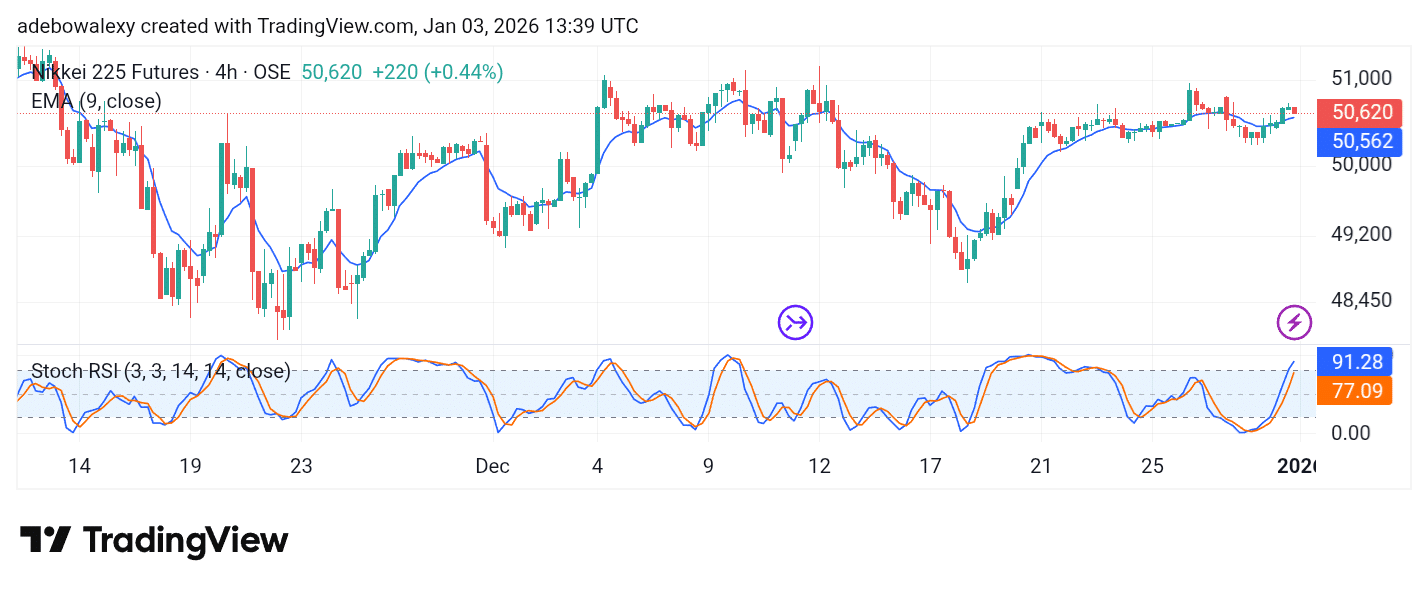

The Japan 225 market can be seen to have registered a bearish pullback in the ongoing session on the 4-hour price chart. The last price candle here is red and dips the market toward the 9-day EMA curve.

Meanwhile, the movement of the SRSI indicator lines appears quite exaggerated, considering how high they have risen relative to the level of price increase on the chart. However, price action in this market may still rebound upward off the support at the 9-day EMA. As such, traders can still eye short-term gains toward the 51,000 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.