Uncertainty surrounding the upcoming Fed rate cut has continued to affect the outlook of most stocks. One such market is the Japan 225. At this point, the index appears suppressed, and traders may become more cautious—something that does not favor bullish sentiment.

Key Levels

Resistance: 49,000, 51,000, 53,000

Support: 48,000, 46,000, 44,000

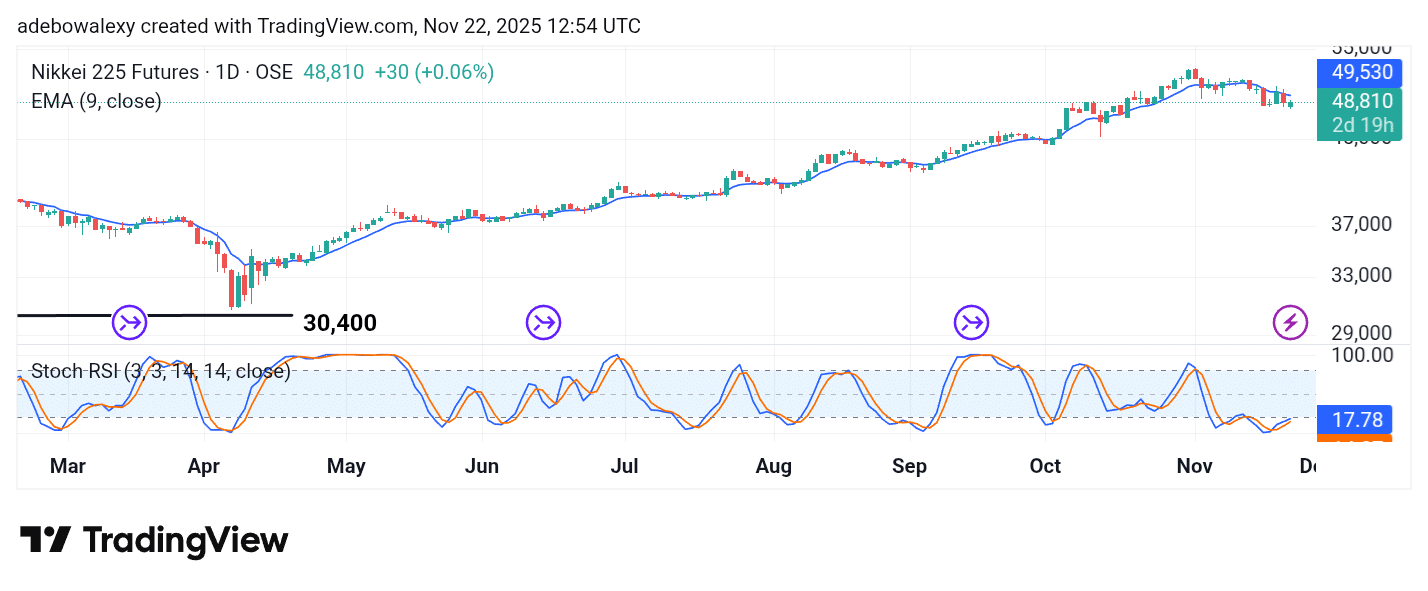

NIKKEI Dips Below 50,000

Since price action in the Japan 225 market bounced off a resistance level over two weeks ago, it has continued sliding to lower price levels. As a result, this futures index now trades below the 9-day Exponential Moving Average (EMA). Friday’s session closed in the green but still settled noticeably below the 9-day EMA.

The lines of the Stochastic Relative Strength Index (SRSI) are in the oversold region but are slightly angled upward. However, this offers only minimal bullish implications at this stage.

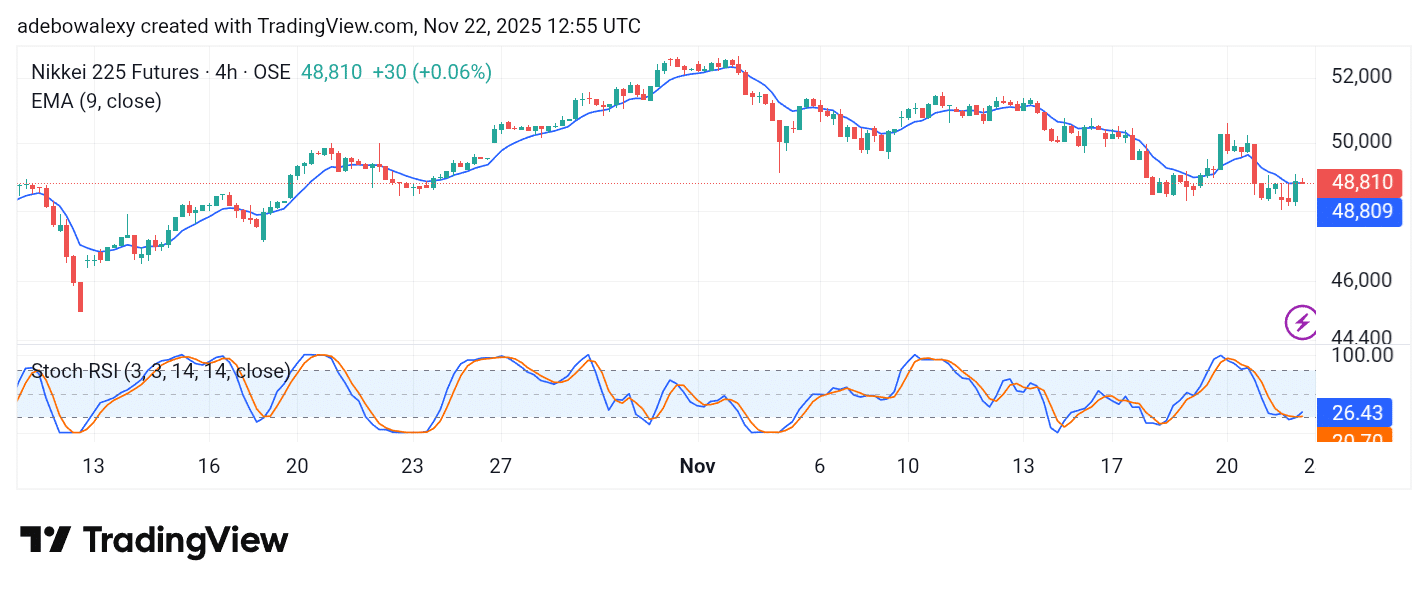

Japan 225 Flirts With the 9-day EMA Curve

The most recent session on the 4-hour NIKKEI chart was bearish but showed only modest price changes. As a result, the market still stands above the 9-day EMA—though only by a whisker.

The SRSI indicator lines have crossed just above the 20 level, suggesting the potential for a short-term upward retracement toward the 49,000 price mark. However, it remains advisable for traders to pay closer attention to broader fundamentals that could influence longer-term price direction.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.