Investor confidence in Bitcoin mining stocks is accelerating, with institutions sharply increasing their positions in the first half of 2025. The latest 13F filings reveal that IREN, CIFR, CORZ, APLD, and MARA captured the bulk of new holders and capital inflows, positioning them at the centre of Wall Street’s evolving crypto-mining playbook.

Bitcoin Mining Stocks and Investor Sentiment

Bitcoin Mining Stocks and Investor Sentiment

This update comes from Bitcoinminingstock.io, the go-to platform for research and education on Bitcoin mining equities. Originally published on September 11, 2025, it was authored by Cindy Feng.

While our team continues to develop new features, we wanted to pause and spotlight one critical theme: institutional activity. Since late 2024, we have closely tracked this development, and the latest filings confirm one thing—institutions are not merely holding their ground; they are betting bigger.

Earlier in the year, our 2024 Bitcoin Mining Review, co-authored with Nico from Digital Mining Solutions, highlighted CORZ, WULF, IREN, and HUT as top institutional bets. So far, those names have outperformed the sector broadly. The fresh filings now show where sentiment has strengthened, where it has shifted, and where it is fading.

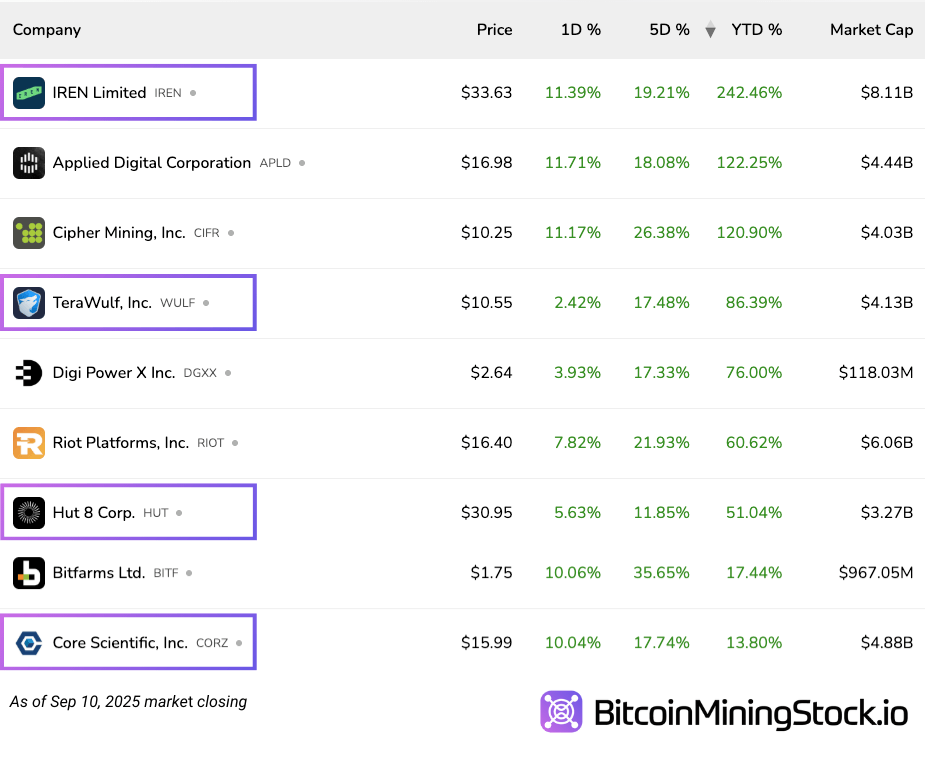

Investor Rotation and Market Momentum

Investor Rotation and Market Momentum

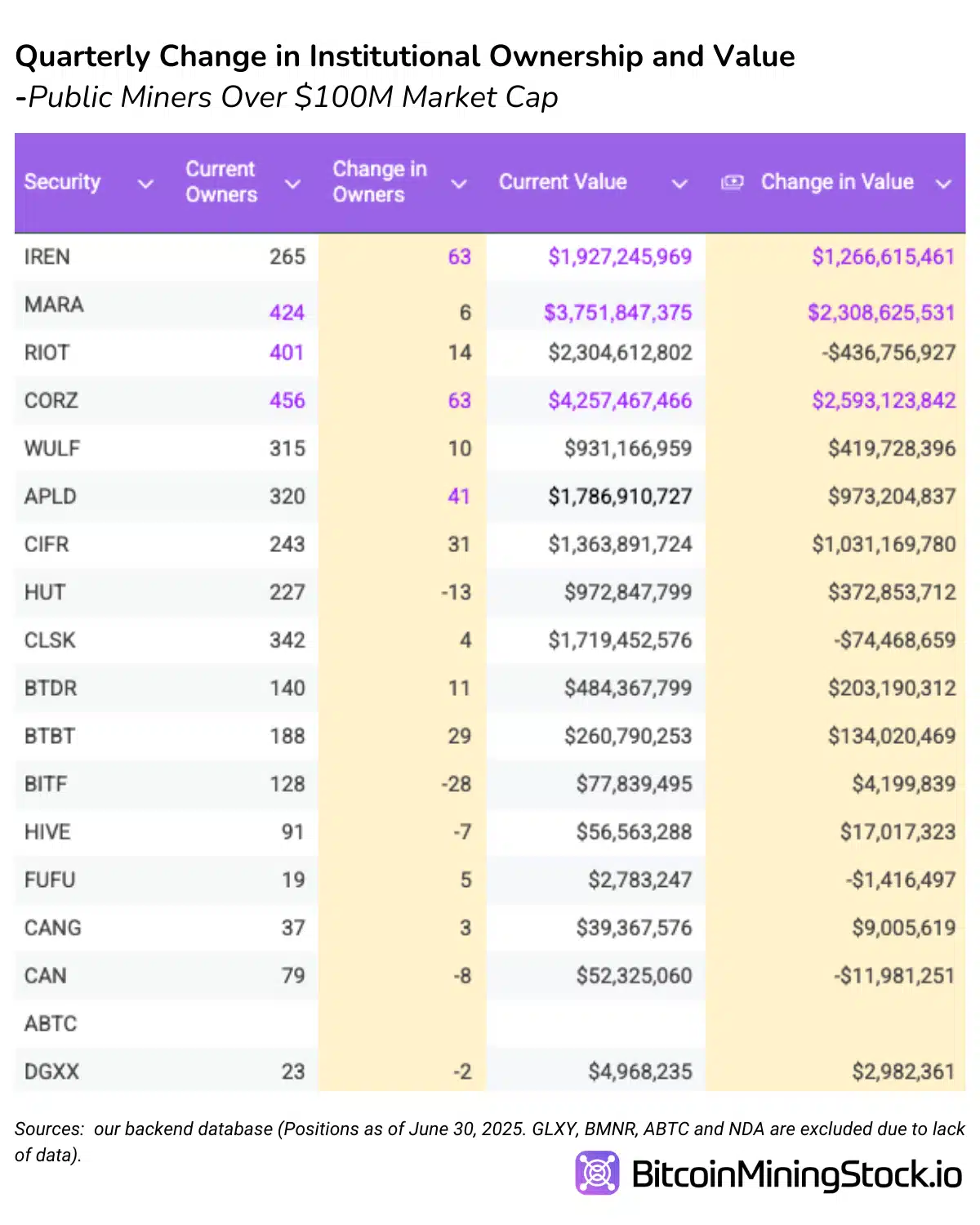

Across miners with market caps above $100 million, most reported gains in both institutional ownership and capital allocation. This underscores strong conviction in the sector through H1 2025.

Yet, capital has clustered. IREN, CORZ, and APLD surged ahead, each adding more than 40 new institutional holders. Their common advantage is direct exposure to AI and high-performance computing (HPC).

- CORZ and APLD signed multibillion-dollar colocation deals with CoreWeave.

- IREN has steadily advanced GPU deployment and AI-ready infrastructure, even without a headline HPC deal.

These developments prove that the AI/HPC narrative remains the sector’s strongest institutional magnet.

Dollar inflows echoed this. CORZ, MARA, and IREN led in increased investment value, followed by CIFR and APLD. MARA stands apart as the only top gainer without AI/HPC exposure, yet institutions continue to favor it thanks to its unmatched hash rate and Bitcoin treasury—making it the go-to vehicle for pure Bitcoin beta at scale.

Investor Caution: Not Everyone Benefits

Investor Caution: Not Everyone Benefits

Not every miner gained from the rotation. BITF, HUT, and CAN lost institutional holders, while RIOT, CLSK, and CAN saw reductions in capital.

Weak performance played a role: CAN is down more than -65% YTD. CLSK and BITF showed small single-digit gains but still lagged peers of similar scale.

HUT tells a different story. It lost 13 institutional owners but still posted strong YTD returns, suggesting rotation rather than lost confidence. HUT has also rebranded itself as an energy infrastructure platform, spinning off its compute business as American Bitcoin.

Meanwhile, RIOT, CLSK, and BITF continue to float HPC ambitions but lack energized capacity or signed contracts—limiting institutional conviction.

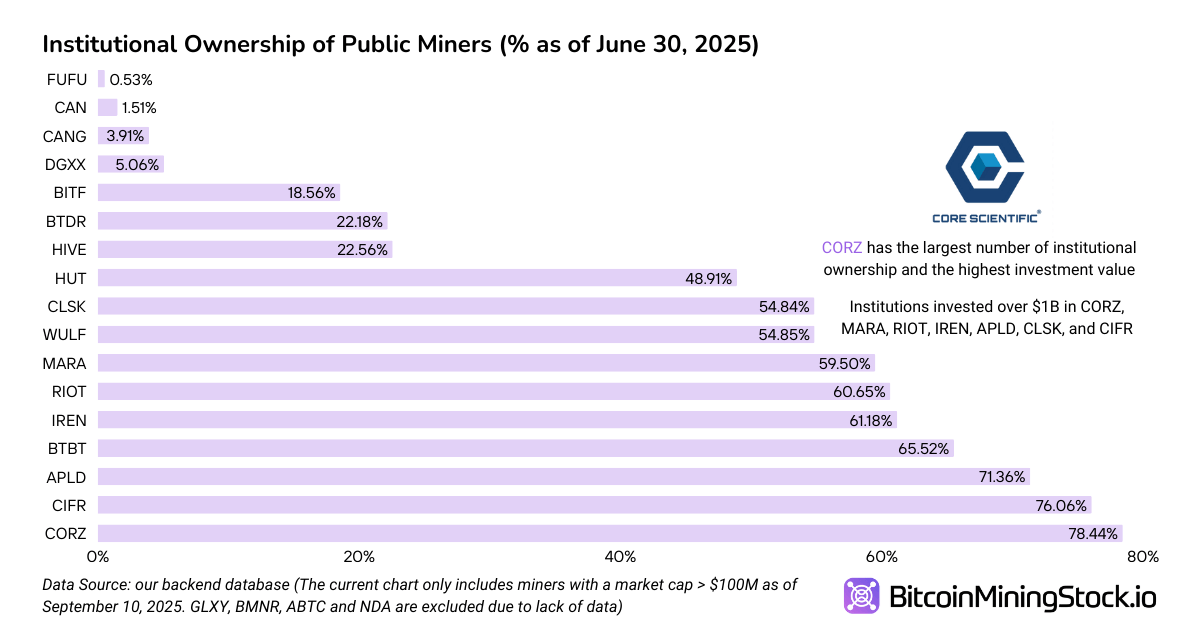

Ownership Patterns and Investor Positioning

Looking at ownership percentages adds nuance:

- CORZ (78.44%), CIFR (76.06%), and APLD (71.36%) dominate in institutional penetration.

- BTBT, despite being smaller, impresses at 65.52%.

- BTDR, with a market cap above $1B, lags at 22.18%.

These patterns highlight that narrative and visibility rival size in shaping institutional interest. Notably, CIFR, BTBT, and IREN reported the sharpest Q2 increases, fueled by bold AI/HPC positioning.

What Changed, What Stayed the Same

What Changed, What Stayed the Same

The data validates our earlier thesis: institutions are expanding exposure but concentrating capital among the largest players and those visibly tied to AI/HPC. IREN, CORZ, CIFR, and APLD lead in both ownership growth and capital allocations.

MARA remains the anomaly. Without HPC exposure, it still commands inflows thanks to sheer Bitcoin scale. Smaller caps and non-U.S. miners, by contrast, continue to struggle for institutional trust.

The Road Ahead for Investor Conviction

The coming quarters will be decisive. HPC-focused miners must now deliver—energizing capacity, scaling revenues, and executing contracts. Latecomers must sharpen their narratives and prove them with numbers.

Highly owned miners may face inflow ceilings, while under-owned operators with credible infrastructure have room to rerate on the right catalyst. Institutions have declared their convictions, but conviction alone will not sustain valuations—execution will.

Methodology and Limitations

This analysis draws from aggregated 13F filings as of June 30, 2025, covering U.S. institutional long equity positions only. Derivatives, swaps, and most non-U.S. filers are excluded. Since 13Fs are backwards-looking, current positioning may differ.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

Bitcoin Mining Stocks and Investor Sentiment

Bitcoin Mining Stocks and Investor Sentiment Investor Rotation and Market Momentum

Investor Rotation and Market Momentum Investor Caution: Not Everyone Benefits

Investor Caution: Not Everyone Benefits What Changed, What Stayed the Same

What Changed, What Stayed the Same