Stablecoins have had a strong few months. These digital assets aim to maintain a stable value, usually pegged to a currency like the US dollar. In the past 90 days, stablecoins have seen an impressive $16 billion in inflows, showing high demand.

The largest stablecoin, Tether (USDT), accounts for most of this growth. Its market cap surged by over $11 billion since March to reach $112.5 billion. This represents a huge 69% chunk of the total stablecoin inflows. However, Tether’s growth slowed to just 1.3% in the past month.

Other major stablecoins like USDC and DAI also saw gains over 90 days but dipped slightly in the last 30. A standout performer is USDe, which skyrocketed 334% in 90 days and 46% in the past month alone. This propelled USDe to become the 4th largest stablecoin.

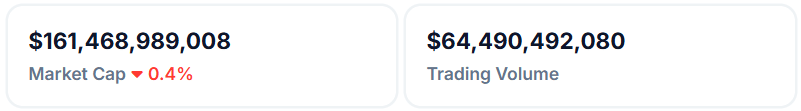

Stablecoin growth has been remarkably steady, with the total market cap rising for 8 straight months to a 2-year high of $161.4 billion in June.

However, stablecoin usage on crypto exchanges hit a monthly low in late May. This tends to happen in the month after each Bitcoin halving (a major event that happens every 4 years). Based on past data, lower exchange flows may continue for another month.

Inflows Into Stablecoins Come Amid MiCA Concerns

The strong demand for stablecoins comes as new European regulations are set to shake up the market. The EU’s landmark MiCA laws will soon restrict stablecoins that don’t meet certain standards.

Major exchanges like Binance and Kraken are reviewing which stablecoins comply. This could be a boon for Euro-backed stablecoins like EURS and EUROC.

While Euro stablecoins have much lower volume than their USD peers, they are growing fast and hit record weekly volumes.

Impending regulation is putting a spotlight on these assets. At the same time, there are questions about the future of large USD stablecoins like Tether in Europe.

The stablecoin landscape is evolving quickly as adoption soars and new laws take effect. The next few months could bring major shifts in this key part of the crypto market. Investors are watching closely to see which stablecoins thrive in this new era.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.