Chainalysis, a leading blockchain analysis company, has unveiled its latest annual report, shedding light on the intricate world of crypto money laundering. The report, released today, divulges insights into how criminals leverage cryptocurrency to mask their illicit gains.

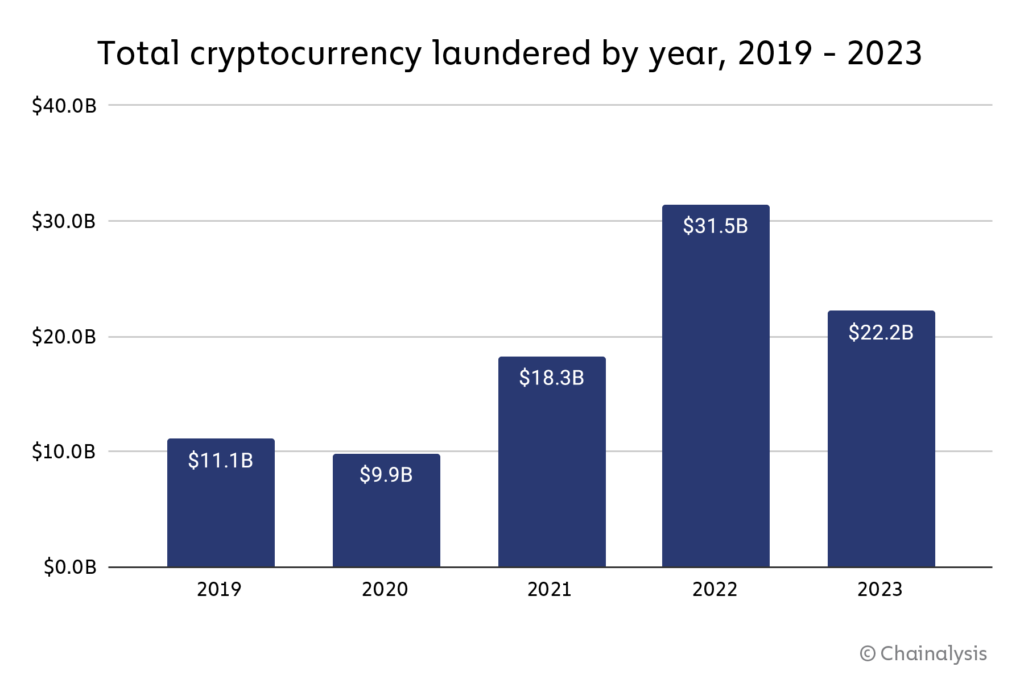

In a significant revelation, the report discloses a notable 30% decrease in crypto money laundering activities throughout 2023, plummeting from $31.5 billion to $22.2 billion.

This downturn is attributed partly to reduced trading volumes and partly to enhanced detection and prevention measures implemented within the industry.

Despite this positive trend, the report issues a stern caution regarding the emergence of sophisticated threat actors, exemplified by the North Korea-linked Lazarus Group, which is pioneering novel methods to circumvent tracking and sanctions.

The report delineates two primary categories of services and entities implicated in crypto money laundering:

Intermediary services and wallets: This encompasses personal wallets, mixers, instant exchangers, DeFi protocols, and other platforms facilitating the movement and camouflage of funds.

Fiat off-ramping services: This encapsulates entities converting cryptocurrency into fiat currency, predominantly centralized exchanges

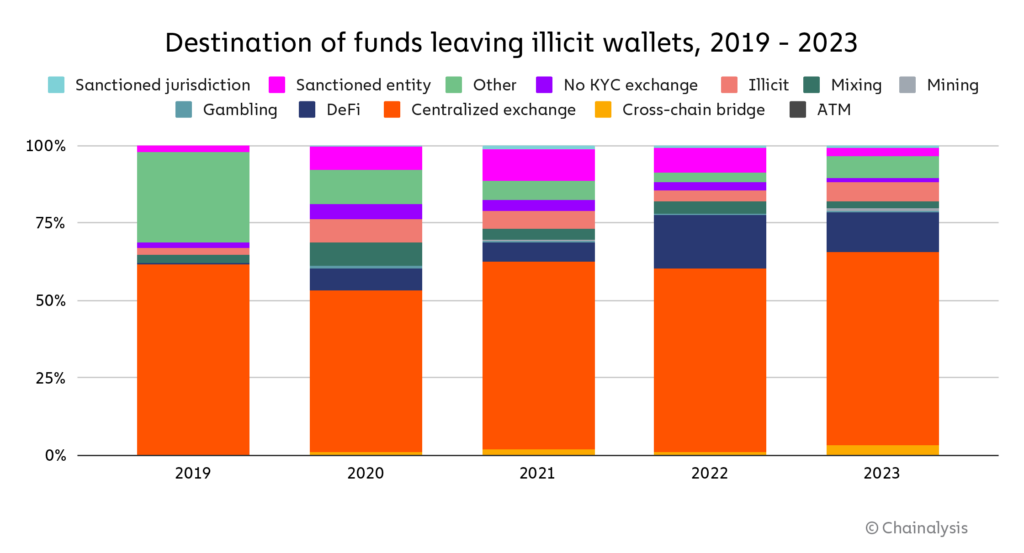

Highlighted in the report is the burgeoning employment of intermediary services and wallets, notably blockchain bridges and gambling platforms, juxtaposed with a decline in the utilization of fiat off-ramping services.

This strategic shift indicates an endeavor by criminals to sidestep regulatory scrutiny as authorities wield greater oversight over fiat off-ramping channels.

Illicit Funds Funneled Through DeFi Surges: Chainalysis

A striking observation within the Chainalysis report is the escalating proportion of illicit funds funneled into DeFi protocols, soaring from 0.3% in 2022 to 1.5% in 2023.

This upsurge correlates with the exponential growth of total value locked in DeFi, surpassing $100 billion in 2023. However, the report underscores that despite its allure, DeFi remains transparent and traceable, impeding its efficacy as a laundering avenue.

Furthermore, the report underscores the case of the Lazarus Group, a notorious hacking syndicate implicated in various cyberattacks and cryptocurrency thefts.

Leveraging a plethora of protocols, including mixers and cross-chain bridges, the group endeavors to obfuscate the origins and destinations of their ill-gotten gains. Notably, the report highlights the surge in popularity of YoMix, a mixer adopted by the Lazarus Group following the closure of Sinbad in November 2023.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.