Dogecoin, a result of an internet meme that went viral in 2013, has evolved from a lighthearted joke into one of the top 10 cryptocurrencies by market cap. DOGE, developed by software engineers Jackson Palmer and Billy Markus, started as a parody of the growing cryptocurrency craze. What set it apart from other coins was its friendly, fun image, symbolized by the Shiba Inu dog from the “Doge” meme.

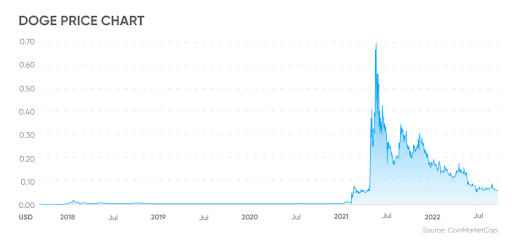

After its initial boom, Dogecoin experienced a decline till the end of 2020, but in 2021 the story changed as there was a sudden rise, fueled by endorsements from Elon Musk and an explosion of interest in digital assets from investors.

Today, while its meme-driven origins remain, Dogecoin is striving to prove itself as a serious contender in the cryptocurrency space. In this article, we’ll dive into key factors such as market cap, user activity, the team behind Dogecoin, tokenomics, and competition to explore just how high DOGE can go in the bull market.

Market Cap, Daily Active Users, Fees, and Revenue

Dogecoin’s growth can be attributed to its steady base of over 43,000 daily active users, which, while fluctuating over the past year, has maintained consistent engagement. Despite the relatively high emission rate of 10,000 DOGE per block, its transaction fees help generate revenue, though concerns remain about the sustainability of miner incentives.

Over the past year, Dogecoin’s market cap surged by 80%, from $10 billion to $18 billion, showcasing its dominant position among memecoins. With a market cap nearly double that of Shiba Inu, Dogecoin continues to outperform its competitors, driven by strong community support and sustained market interest.

The Team and Management

Jackson Palmer and Billy Markus, two software developers with little blockchain knowledge, form the core of Dogecoin’s startup team. The team has grown over the years, in spite of their initial lack of experience, and now includes experienced programmers who have advanced and upheld the project for a decade.

However there has been controversy surrounding Dogecoin, especially with regard to Elon Musk, who investors have accused of utilizing DOGE for insider trading. Despite these challenges, the team’s ability for navigating the rapidly changing cryptocurrency landscape has contributed to Dogecoin’s status as a major player in the industry.

Tokenomics

Dogecoin’s tokenomics present both opportunities and challenges for long-term investors. As a payment and tipping currency, DOGE is widely used and remains the project’s core product. Its uncapped token supply, with over 145 billion DOGE already in circulation, means that new tokens are continuously minted, diluting existing holdings over time.

While this inflationary model can reduce the value of each token, it also encourages spending rather than hoarding, which aligns with its original purpose.

Despite being a decentralized project, Dogecoin has a dedicated core team and a development plan called the Trailmap, which provides structure for future growth. DOGE is also easily accessible, being listed on major exchanges like Binance, Coinbase, and Kraken, but the uncapped supply may be less attractive for long-term investors seeking scarcity-driven value appreciation.

User Adoption and Partnership

Dogecoin’s user adoption is largely driven by its fun, engaging nature and strong community presence, making it an accessible option for internet users, social media communities, and crypto enthusiasts. With daily trading volumes averaging $1.4 billion in 2024, Dogecoin has exceeded expectations of being just a memecoin, demonstrating its potential to grow with the overall crypto trend.

Its low transaction fees and faster processing times compared to Bitcoin make it a practical choice for microtransactions and tipping, although merchant adoption remains limited.The project’s partnerships with major companies like Tesla, SpaceX, and the Dallas Mavericks, along with its massive social media following, further fuel Dogecoin’s visibility and appeal.

However, regulatory risks and technical complexities remain hurdles, but the strong community buzz and the potential for continued market growth suggest that Dogecoin could see further user adoption in the long term.

DOGE Competition with Memecoins

Dogecoin has a strong chance of surviving amidst the growing number of memecoins due to its early mover advantage and well-established network. As the first memecoin, Dogecoin has built a large, loyal community and a solid reputation that newer competitors struggle to match.

Running on its proof-of-work blockchain, DOGE offers a stable and recognized platform for users, setting it apart from many memecoins that operate on less robust infrastructures.

Additionally, Dogecoin’s connections to key figures in the crypto world, including past advisors like Vitalik Buterin, have helped solidify its credibility. While the memecoin market continues to expand, Dogecoin’s proven resilience, extensive network, and ongoing development give it a competitive edge to maintain its dominance and adapt to future trends.

Conclusion/Prediction: Long-Term Bull Case vs. Bear Case for DOGE

In the bull case, Dogecoin’s playful origin, strong community following, and high-profile endorsements, especially from figures like Elon Musk, continue to drive its mainstream appeal. As the original memecoin, Dogecoin benefits from its first-mover advantage, leading to widespread recognition and loyalty from its user base.

The simplicity of its use as a currency, its low transaction fees, and its accessibility on major exchanges make it attractive for microtransactions and tipping. Dogecoin’s established network, including past advisors like Vitalik Buterin, strengthens its credibility and gives it the potential to maintain dominance over competitors like Shiba Inu.

However, the bear case highlights significant concerns for long-term investors. Dogecoin’s high emission rate of 10,000 DOGE per block, combined with its unlimited supply, raises inflation risks, potentially diminishing its value over time. The fact that the development fund is held entirely in DOGE adds financial risk, as it ties the project’s resources to the coin’s volatile market performance.

The lack of smart contract functionality limits Dogecoin’s ability to expand into DeFi or other advanced use cases, confining it to its role as a simple currency. Additionally, its price is heavily driven by social media buzz and celebrity endorsements, creating extreme volatility based on sentiment rather than intrinsic value. This makes it less attractive to serious investors who prioritize stability and long-term growth.

For 2024, while Dogecoin may continue to see price spikes from endorsements and social media activity, its high inflation and dependency on public sentiment may deter more cautious, long-term investors. Intelligent investors might view Dogecoin as a high-risk, speculative asset rather than a solid investment vehicle. The project could sustain momentum this year due to general crypto market trends and cultural relevance. Still, its long-term outlook remains uncertain without more substantial technological development or real-world use cases.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.