The Bitcoin reaction to geopolitical events has become a fascinating study in market psychology and economic theory. Recent military actions between Israel and Iran caused Bitcoin to drop $1,000 within an hour. At the same time, other cryptocurrencies, including Ethereum, Solana, and Cardano, fared worse.

This immediate market response reveals crucial insights about how digital assets behave during times of international tension.

The cryptocurrency market’s violent reaction stems from a simple but powerful equation. Fear creates the initial spark, excessive leverage provides the fuel, and forced liquidations cause the explosive price movements we witnessed.

When geopolitical tensions rise, traders with borrowed positions get caught in a cascade of selling pressure that amplifies the initial decline.

Historical Patterns Show Bitcoin Resilience During Crises

Looking at past conflicts provides valuable context for understanding Bitcoin’s current behavior. In October 2023, Israeli airstrikes triggered approximately a 5% Bitcoin decline, which was followed by an impressive 80% rally over the subsequent months.

Similarly, during October 2024’s Operation True Promise II, Bitcoin experienced another 5% drop before breaking through to new all-time highs.

This pattern suggests that initial panic selling often creates buying opportunities for those willing to look beyond the immediate headlines.

As much of the western world is concerned with WW3, Bitcoin just hit $106k.

A true hedge against global insanity

— Toby Cunningham (@sircryptotips) June 16, 2025

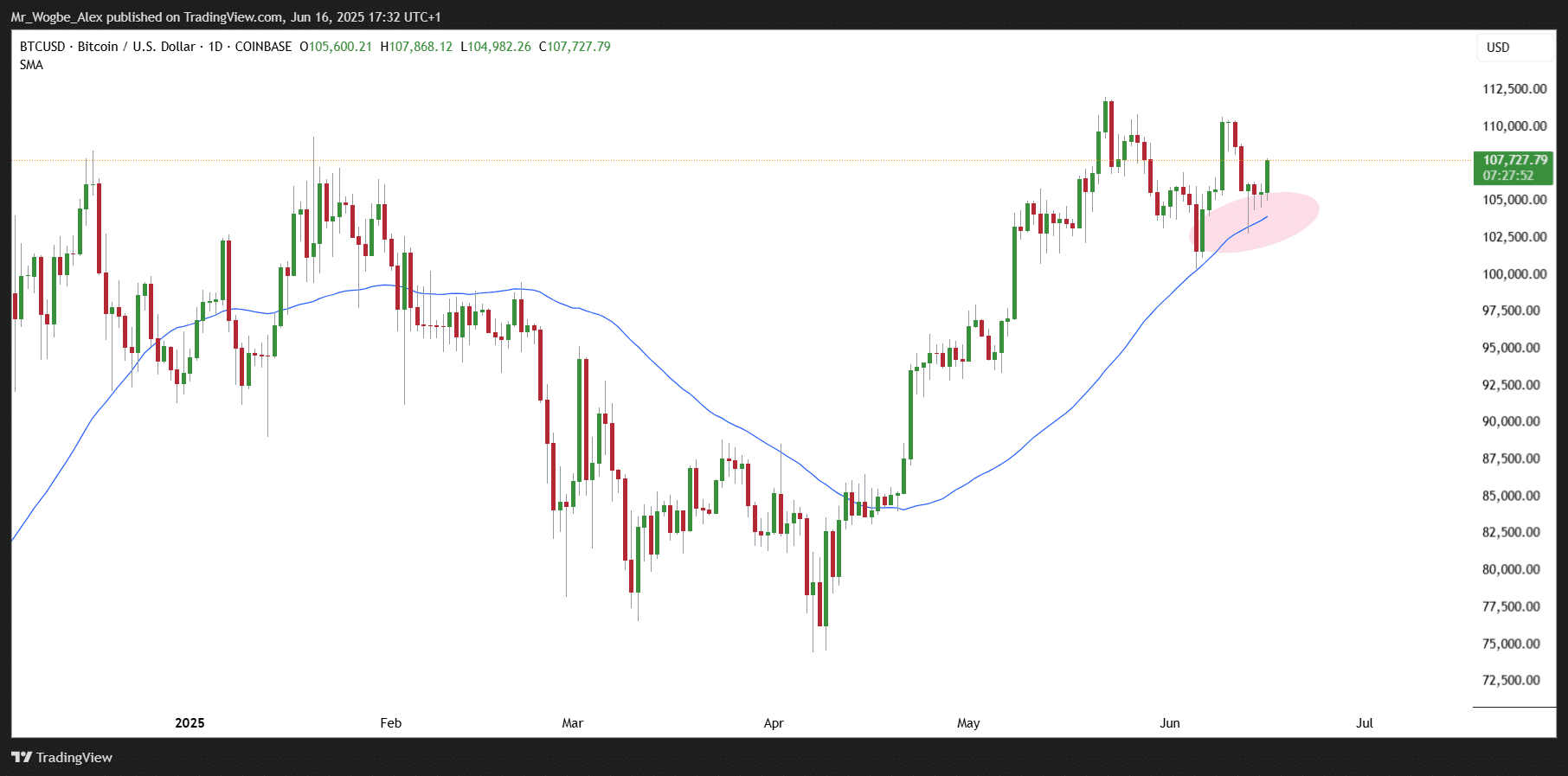

The key technical level to watch has been Bitcoin’s 50-day simple moving average, which has acted as reliable support during previous geopolitical shocks. When Bitcoin touched this level during the recent conflict, it bounced exactly as historical patterns would suggest.

The consistency of this response pattern indicates that while Bitcoin may react sharply to breaking news, its longer-term trajectory remains influenced by fundamental factors rather than temporary geopolitical events.

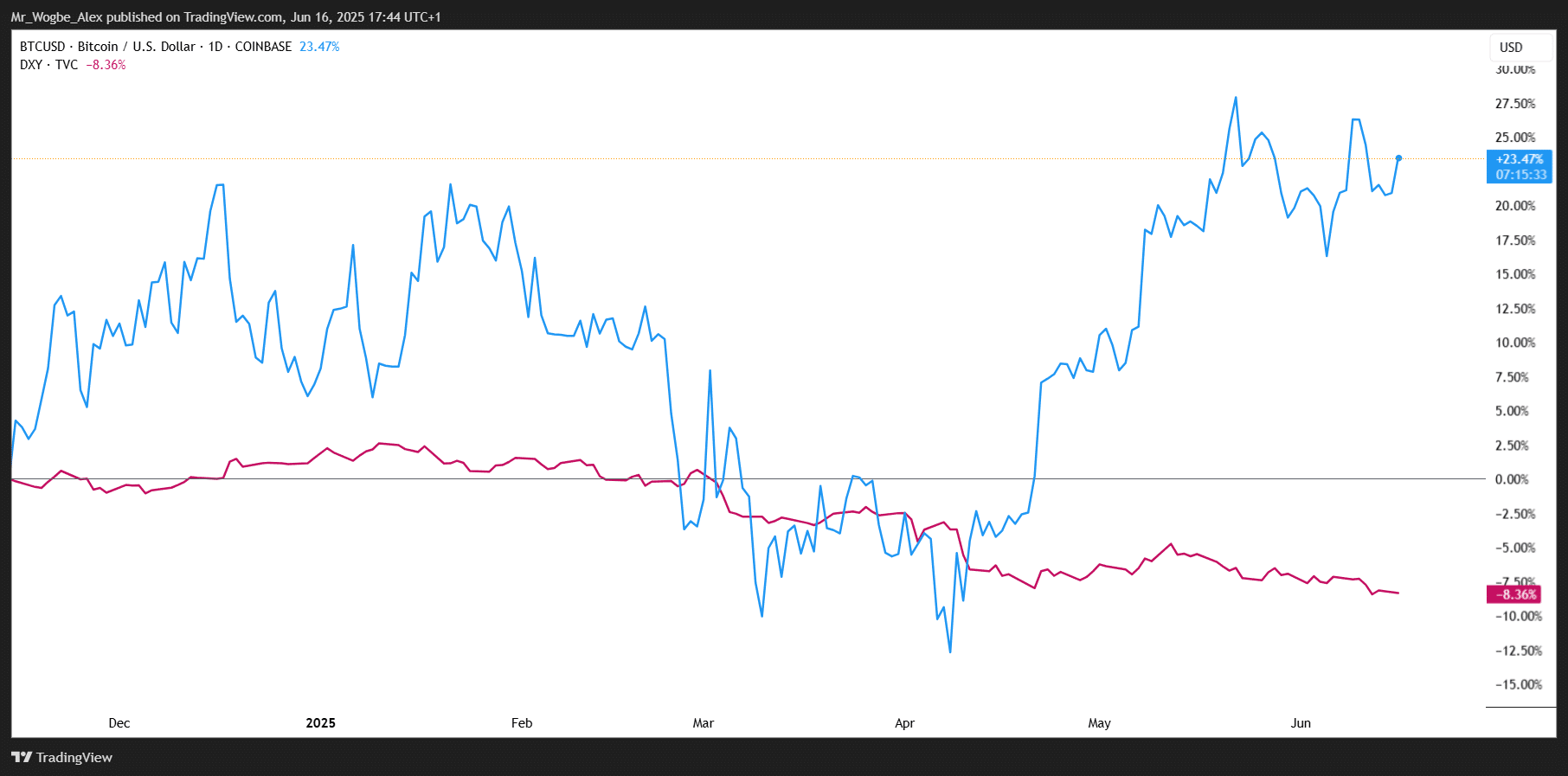

Smart money often uses these fear-driven selloffs as entry points, recognizing that panic rarely lasts long in liquid markets. And currently, this reaction puts Bitcoin as a better hedge compared to the dollar.

Corporate Adoption Signals Mainstream Acceptance

Beyond the immediate price action, subtle developments in corporate America suggest growing institutional comfort with Bitcoin integration.

Apple’s recent approval of SaruTobi, a Bitcoin-themed mobile game that allows users to buy and earn Bitcoin directly through the app, represents a significant policy shift for the typically conservative tech giant.

This approval might seem minor, but Apple’s approach to major strategic changes typically follows this exact pattern. The company often begins with small, seemingly insignificant moves before making larger commitments.

The App Store approval process is notoriously strict, and allowing Bitcoin transactions within apps signals a meaningful change in Apple’s stance toward cryptocurrency.

The implications extend far beyond gaming. If Apple continues down this path, we could see broader Bitcoin integration across iOS devices, potentially turning iPhones into hardware wallets or enabling native Bitcoin transactions through Apple Pay.

Such developments would expose Bitcoin to Apple’s massive user base and could accelerate mainstream adoption significantly.

Bitcoin’s Role in an Era of Expanding National Debt

The timing of these developments occurs against a backdrop of increasing concerns about global debt levels and monetary policy. The United States faces discussions about adding another $3 trillion to its national debt, highlighting the ongoing challenges of modern fiscal policy.

While this specific debt increase hasn’t been finalized, the trajectory of government spending continues upward regardless of political leadership.

This fiscal reality creates conditions that historically favor assets with fixed supply characteristics. Bitcoin’s programmed scarcity of 21 million coins stands in stark contrast to the unlimited printing capacity of fiat currencies.

As governments worldwide grapple with debt service costs and inflation pressures, this scarcity becomes increasingly relevant.

Economic historians and analysts like Ray Dalio have warned about potential debt spirals in developed economies.

These concerns aren’t limited to emerging markets anymore; they apply to countries that have enjoyed reserve currency status for decades. Bitcoin’s design specifically addresses these monetary concerns by removing human discretion from supply decisions.

The mathematical certainty of Bitcoin’s supply schedule offers a hedge against policy uncertainty. While traditional assets might fluctuate based on central bank decisions or government fiscal policies, Bitcoin operates according to predetermined rules that no authority can change without broad consensus.

Technical Analysis fro Bitcoin Points to Continued Volatility

From a technical perspective, Bitcoin’s recent behavior confirms its maturation as a tradable asset while highlighting ongoing volatility characteristics. The speed of the recent decline and recovery demonstrates both the efficiency of cryptocurrency markets and their sensitivity to external events.

The 50-day moving average continues to serve as a critical support level, suggesting that technical analysis remains relevant for Bitcoin price movements. This technical reliability provides traders and investors with concrete levels to monitor, even as fundamental factors drive longer-term trends.

Market structure analysis shows that leverage remains a significant factor in Bitcoin’s price volatility. When highly leveraged positions get liquidated during rapid price movements, the resulting cascade effects create opportunities for those with patient capital and strong risk management practices.

Understanding these dynamics helps explain why Bitcoin often experiences sharp initial reactions to news events, followed by more measured responses as markets digest the actual implications. The key lies in distinguishing between temporary technical disruptions and fundamental shifts in Bitcoin’s value proposition.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.