The US equities market took on a risk-off mood after California reinstated lockdown restrictions on businesses and public spaces considering the recent spike in Coronavirus infections in the state.

Furthermore, the prevailing diplomatic US-China tensions over China’s control of Hong Kong extended further support for the USD, which caused demand for the dollar-denominated commodity to stall.

Analysts expect gold to remain pressured in today’s session considering that the greenback will likely capitalize on the market-wide risk aversion.

Meanwhile, market participants will be looking at the US economic data docket, which features the US Consumer Price Index (CPI), for clues today. A worse-than-expected US inflation figure coupled with the worsening Covid-19 outlook could prevent gold from falling far from the $1,800 mark.

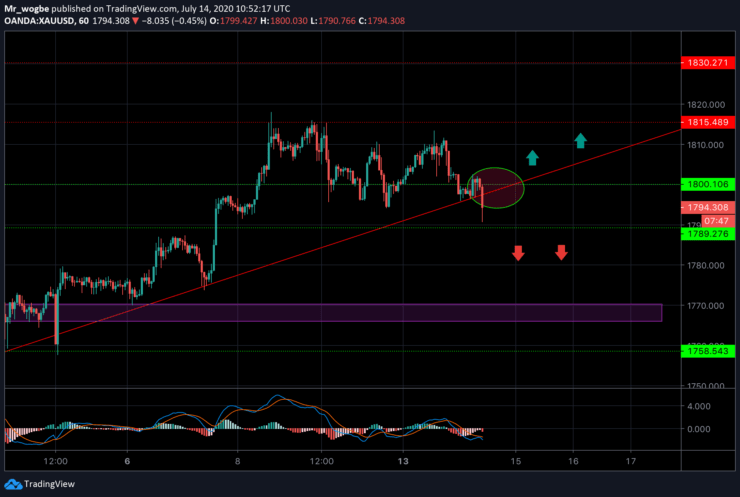

Gold (XAU) Value Forecast — July 14

XAU/USD Major Bias: Sideways

Supply Levels: $1,800, $1,810, and $1,815

Demand Levels: $1,790, $1,780, and $1,770

Gold has come under strong bearish pressure as the USD picks up. At press time, gold has broken through the $1,796 support, and investor focus has now been shifted to the $1,789 support level. A sustained dip below this level could open the yellow metal up for further declines to previous support levels.

On the flip side, gold will regain its bullish balance once it climbs above the $1,800 again. Also, a wedge has been formed in the near term making it very likely to see a surge (upwards/downwards).

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.