Market Analysis – February 20

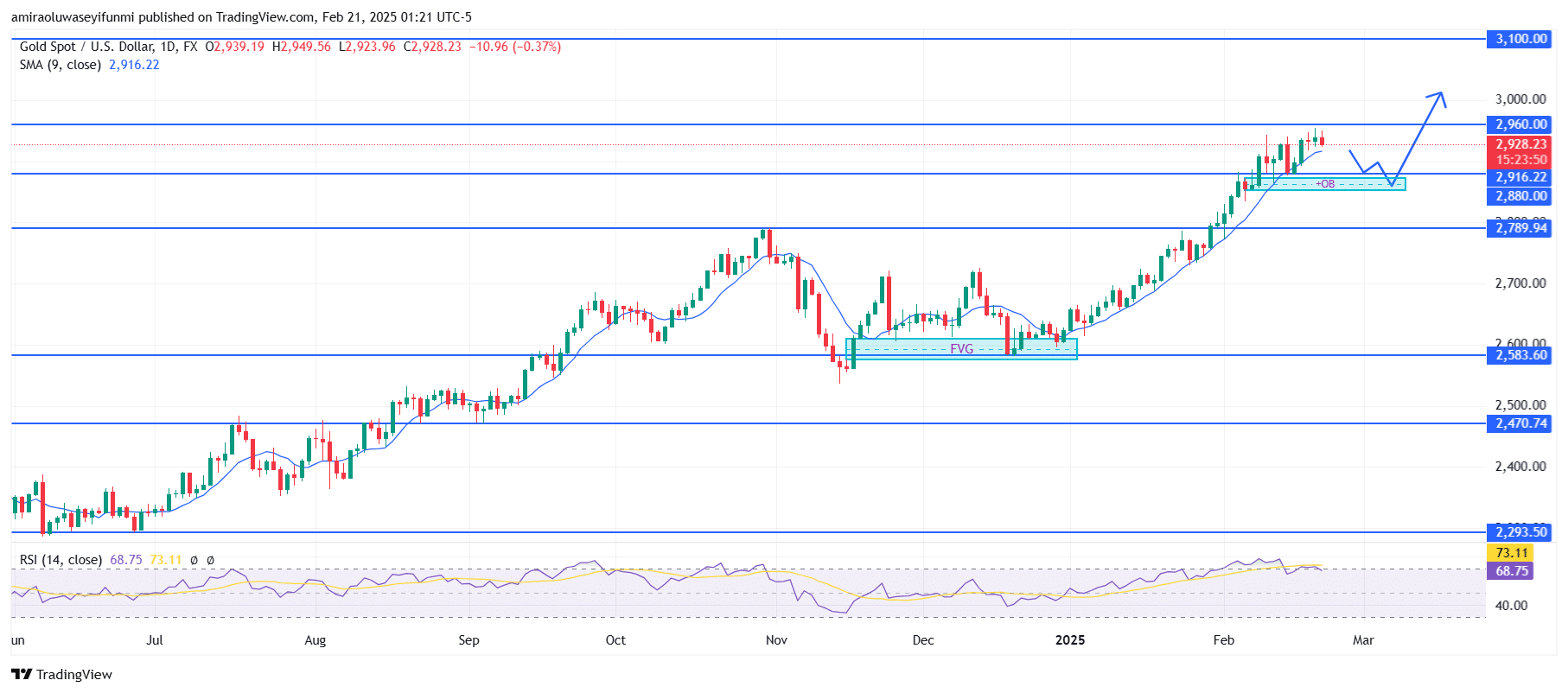

Gold (XAUUSD) remains bullish despite undergoing a short-term pullback. The market continues to trade above the 9-period Simple Moving Average (SMA) around $2,920, maintaining its upward trajectory. However, a minor correction could be imminent as the Relative Strength Index (RSI), currently at 68.68, approaches overbought territory. A slight decline in the RSI from recent highs indicates weakening buying pressure, increasing the likelihood of a pullback before further upward movement.

Gold Key Levels

Resistance Levels: $2,880, $2,960, $3,100

Support Levels: $2,790, $2,580, $2,470

Gold Long-Term Trend: Bullish

Recent price action shows that XAUUSD has broken above the $2,880 level and is now facing resistance at $2,960. After rebounding from a fair value gap (FVG) around $2,880, the price has moved significantly higher, reinforcing the bullish trend. A pullback into this FVG or the $2,880 – $2,920 range could provide a re-entry opportunity for buyers before another upward move.

Given the current market conditions, XAUUSD is likely to resume its climb toward $3,100 if it remains above $2,880. A confirmed breakout above $2,960 would further strengthen bullish momentum, setting $3,100 as the next target. However, if the price loses support above $2,880, a further decline toward $2,790 may occur before the bullish trend continues.

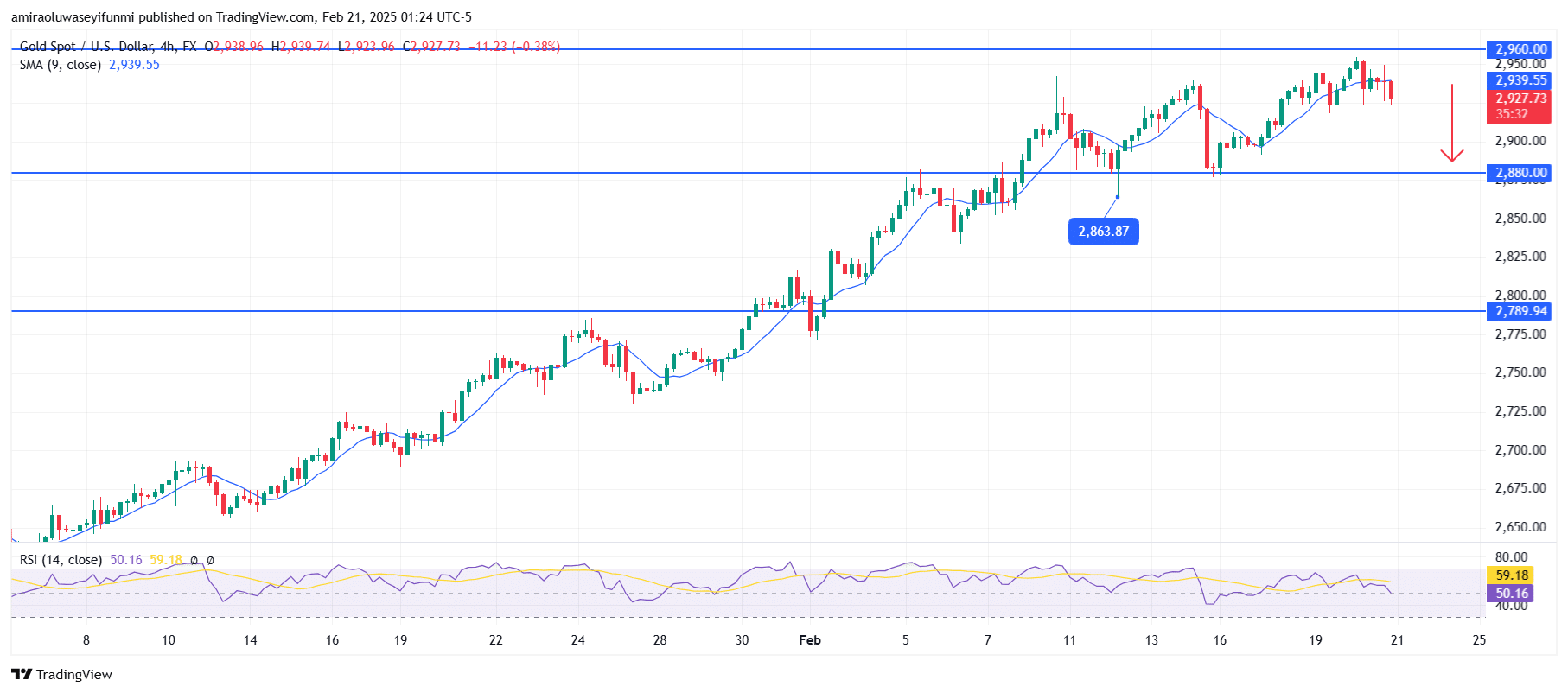

Gold Short-Term Trend: Bearish

Gold (XAUUSD) has entered a short-term bearish correction on the four-hour chart, with prices retreating from resistance at $2,960. The 9-period SMA at $2,940 now serves as dynamic resistance, adding to the downward pressure. RSI has dropped to 50.14, signaling weakening bullish momentum and a shift toward neutral-to-bearish sentiment. A break below the $2,880 support level could lead to further declines toward $2,790. Despite this short-term pullback, the broader bullish trend remains intact, and traders may watch for potential forex signals indicating a reversal or continuation of the trend.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.