Market Analysis – October 30

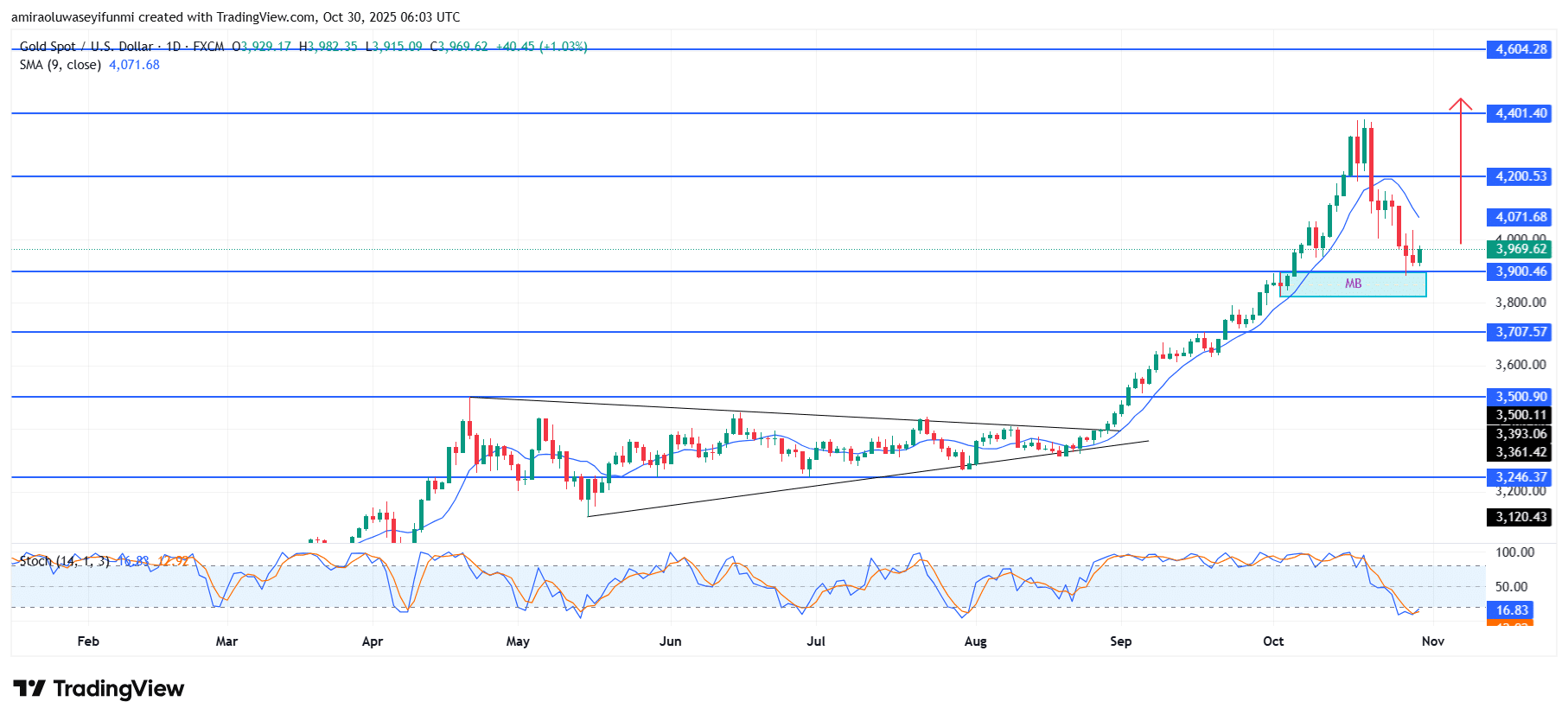

Gold (XAUUSD) extends its upside drive as buyers regain traction. Gold remains firmly positioned within a bullish framework, with price action maintaining upward alignment across both short- and medium-term metrics. The 9-day Simple Moving Average (SMA) around $4,070 continues to guide near-term movement, serving as a pivot level for renewed buying strength. Meanwhile, the stochastic indicator is rising from oversold territory near the 17 level, signaling early momentum recovery and renewed market optimism.

Gold Key Levels

Resistance Levels: $4,200, $4,400, $4,600

Support Levels: $3,900, $3,710, $3,500

Gold Long-Term Trend: Bullish

From a structural perspective, the metal has stabilized after rebounding from the $3,900 demand zone, following a corrective decline from the $4,400 high. This recovery phase suggests that gold may have completed a short-term pullback and is now forming a consolidation base above key support. The consistent defense of this region points to active accumulation, as buyers continue to counter supply pressure—reinforcing the strength of the prevailing uptrend.

Looking ahead, a daily close above the $4,070 pivot would likely confirm a continuation of the bullish cycle, paving the way for an advance toward $4,200 and potentially $4,400. Sustained movement beyond these levels could extend the rally toward the $4,600 resistance threshold, aligning with the upper boundary of the ongoing bullish trend. However, if prices fall below $3,900, a temporary retracement toward $3,700 could occur before buyers reassert control. Overall, market sentiment remains positive, suggesting further upward potential in the sessions ahead and providing useful insights for traders analyzing forex signals.

Gold Short-Term Trend: Bullish

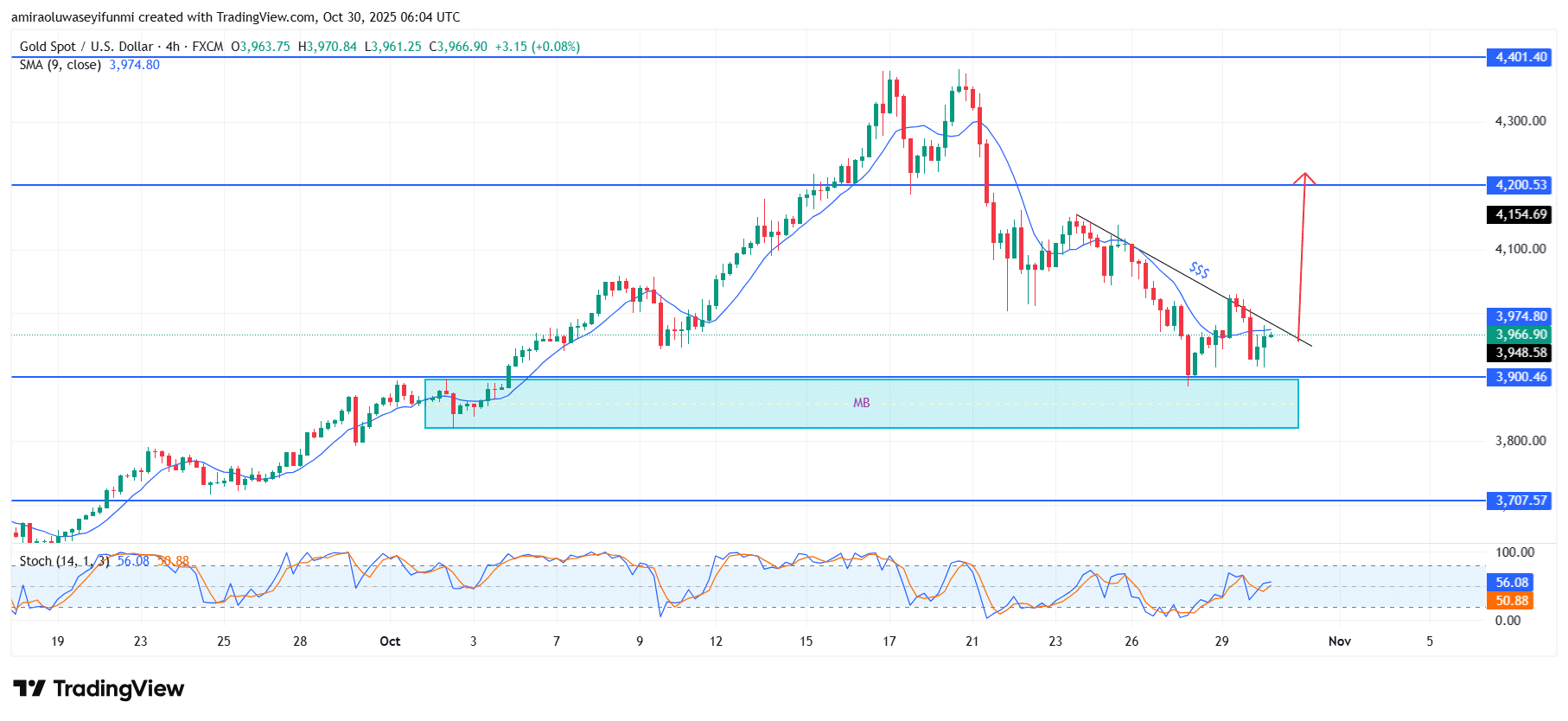

Gold (XAUUSD) is demonstrating renewed bullish intent on the four-hour chart after a strong rebound from the $3,900 mid-base support zone. The price is beginning to challenge the descending trendline, signaling a possible breakout above the short-term downtrend.

The 9-period SMA near $3,975 is flattening, indicating that selling pressure is easing as buyers regain dominance. A decisive move above $4,000 could accelerate momentum toward $4,200, confirming a continuation of the bullish outlook.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.