Worries over a second wave of the deadly Coronavirus disease continued to bolster the US dollar’s (DXY) demand as the global reserve currency. This, consequently, was one of the major factors that thwarted demand for the dollar-denominated commodity and has caused weakness for the third consecutive session.

Furthermore, the underlying risk tone surrounding the equity markets has marred the yellow metal’s safe-haven appeal. This is the commodity’s fourth consecutive red day in the last five sessions, which could be further intensified by the fresh selling below the $1900 level.

Meanwhile, market participants will be looking at the US economic docket today—which features the release of the US Manufacturing and Services PMI—for clues. This, coupled with the second day of the congressional testimony with Fed Chair Jerome Powell, will have a significant influence on the USD price action in the near-term.

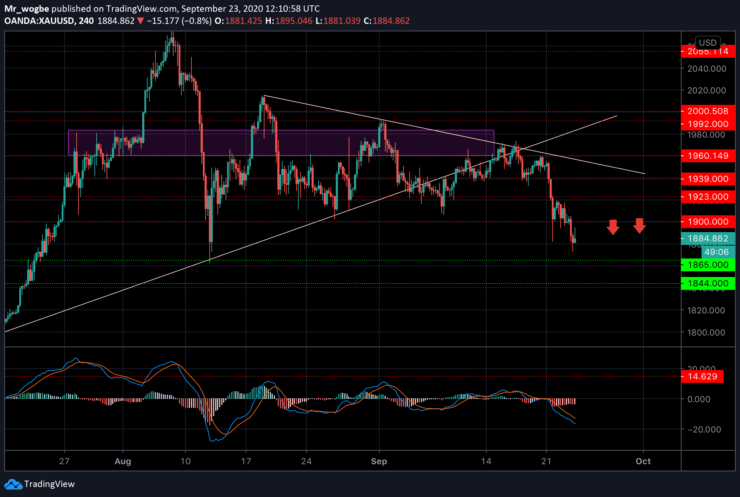

Gold (XAU) Value Forecast — September 23

XAU/USD Major Bias: Bearish

Supply Levels: $1900, $1909, and $1923

Demand Levels: $1875, $1864, and $1844

Gold has now succumbed to the lasting bearish pressure and has broken below the $1900 psychological line. The yellow metal is now on territory not seen in over six weeks.

Meanwhile, gold has strayed far away from the recent bearish trendline, further energizing bears. Also, the path of least resistance is to the downside giving bears the leeway to take the price lower in the near-term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.