The yellow metal appears to be regaining its bullish momentum as it etched closer to its two-week high yesterday. The growing weakness surrounding the US dollar (DXY) was seen as the major factor bolstering demand for the dollar-denominated commodity.

Additionally, expectations of a dovish outlook by the Federal Reserve in the upcoming FOMC meeting and a leg down in the US Treasury bond yields extended further support for the non-yielding metal. Nonetheless, the lasting risk appetite surrounding the global market could cap further price gains for gold.

The global risk appetite continues to be bolstered by the latest developments over a potential vaccine for the deadly Coronavirus disease. AstraZeneca resumed its phase-3 trials for its vaccine candidate and Pfizer has indicated that it could present the late-stage data for its vaccine by the end of October.

Meanwhile, bullish traders are advised to be cautious ahead of the FOMC monetary policy update set for later today, where the Fed is expected to announce its inflation projections. The bank will likely maintain an accommodative approach to inflation and keep interest rates lower.

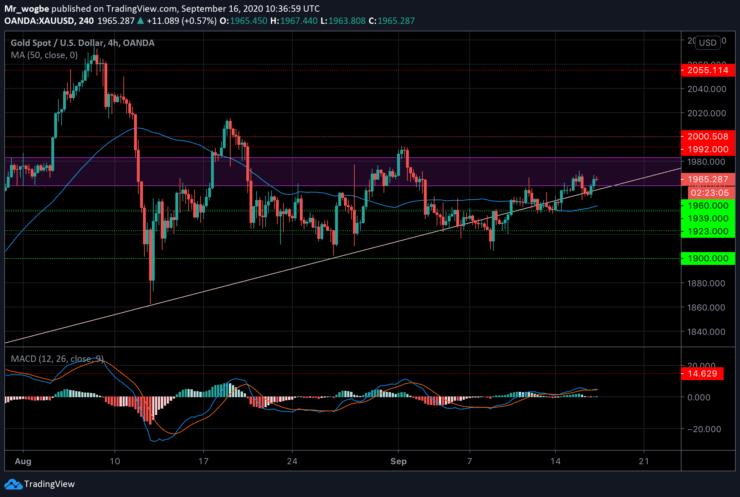

Gold (XAU) Value Forecast — September 16

XAU/USD Major Bias: Bullish

Supply Levels: $1983, $1992, and $2000

Demand Levels: $1950, $1940, and $1923

The XAU/USD has shown decent bullish inclinations in the past few sessions as we head into the FOMC meeting. The commodity has reclaimed its position in the $1983 – $1960 pivot area. We expect gold to reach the $1983 level soon, after which we could see a retest of the $1992 resistance.

Meanwhile, gold is now back above the prevailing ascending trendline, indicating that the bullish momentum will likely continue for now.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.