A dovish stance by FOMC officials in the two-day meeting will likely re-establish a bullish sentiment for the yellow metal. Comments of fresh implementation of average inflation targeting could also bolster demand for gold in the near-term.

However, if the Fed decides to emphasize the downside risks plaguing the economy and the growing separateness between Wall Street and Main Street, the yellow metal could come under renewed pressure. A pessimistic outlook by the Fed could force gold lower as it incentivizes demand for safe-haven currencies like the US dollar (DXY).

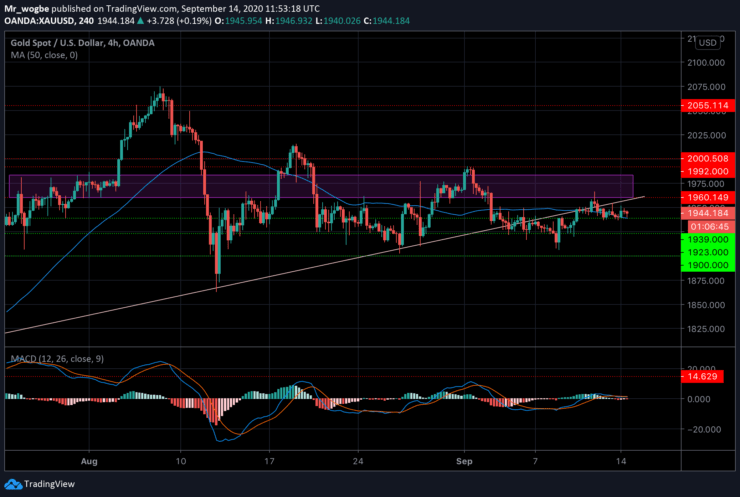

Gold (XAU) Value Forecast — September 14

XAU/USD Major Bias: Bullish

Supply Levels: $1960, $1983, and $2000

Demand Levels: $1939, $1923, and $1906

The path of least resistance for gold appears to be towards the upside. The confluence of support at the $1939 level (strong support line and 50 SMA) will likely keep prop-up the XAU/USD in the near-term.

The commodity attempted yet another breakout today but was strongly resisted by the $1960 resistance/pivot area. However, we could see gold retest that line and likely break it in the near-term as demand picks up. This will help the commodity take back its place above the ascending trendline and battle with the $1983-60 pivot zone.

Meanwhile, the MACD is indicating that an upwards momentum is just beginning and that we could likely see the $2000 again.

On the flip side, a break below the $1939 confluence could propel gold to the $1923 once again, where the commodity will likely find strong demand once again.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.