The lasting bearish tone surrounding the US dollar (DXY), sponsored by the uncertainty of a US fiscal stimulus measure, is one of the major factors underpinning demand for the dollar-denominated commodity. The chances of a massive stimulus are now at zero following the Democrats’ decision to block a Republican bill aimed at providing $300 billion in fresh Coronavirus aid.

Furthermore, the renewed Brexit tensions extended additional support to the yellow metal. However, hopes for a potential vaccine for the deadly Coronavirus disease provided some boost for the global risk sentiment. This has kept a strong lid over any potential gains for gold in the near-term.

Meanwhile, AstraZeneca announced that it would be resuming trials for its COVID-19 vaccine candidate, while Pfizer has also announced that its vaccine could be ready by late October.

Additionally, investors are likely going to remain on the sidelines ahead of the two-day FOMC meeting, scheduled to commence tomorrow. This will likely cause a scarcity of volatility across markets in the near-term.

That said, gold is likely to continue on a consolidation pattern amid the absence of any significant economic releases from the US.

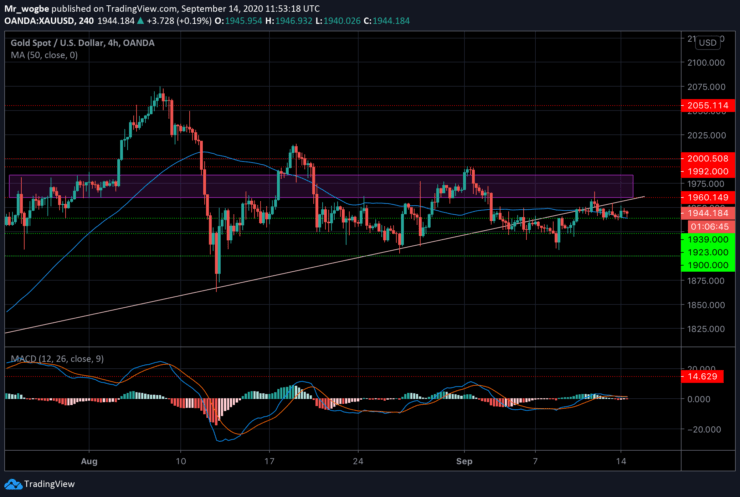

Gold (XAU) Value Forecast — September 14

XAU/USD Major Bias: Sideways

Supply Levels: $1950, $1960, and $1983

Demand Levels: $1939, $1923, and $1906

Gold has been trading within a consolidation range between $1937 and $1957 for its third consecutive session now, with a failed breakout to the $1966 on Thursday. The commodity remains under the strong ascending trendline, which now acts as a resistance for the commodity in the near-term.

Although bears will have a hard time taking gold below the $1939 line, giving the confluence of the $1939 support line and 50 SMA, a break above the $1950 seems unlikely considering the absence of volatility.

That said, we expect gold to continue trading within its consolidation range well into Tuesday or Wednesday.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.