The prevailing drawdown in the US Treasury bond yields kept the pressure on the US dollar (DXY), which extended support to the dollar-denominated commodity. The US bond yields retreated from a recent bull run overnight. Also, the Fed announced that its monetary policy will remain accommodative, which provided extra support to the non-yielding metal.

The recent Democratic win at the US Senate runoff in Georgia bolstered investors’ expectation over larger stimulus measures from the Biden administration, which triggered a selloff in the 10-year US government bond yield yesterday.

Nonetheless, these bolstering factors failed to provide meaningful gains for gold, considering the underlying risk mood across markets. The rollout of vaccines for the highly-contagious COVID-19 also helped bolster investors’ sentiment for a strong global economic recovery.

Moving on, market participants will be looking at the US economic docket today—which features the release of the latest consumer inflation figures—for clues. This data, coupled with the US bond yields, will influence the USD price dynamics today.

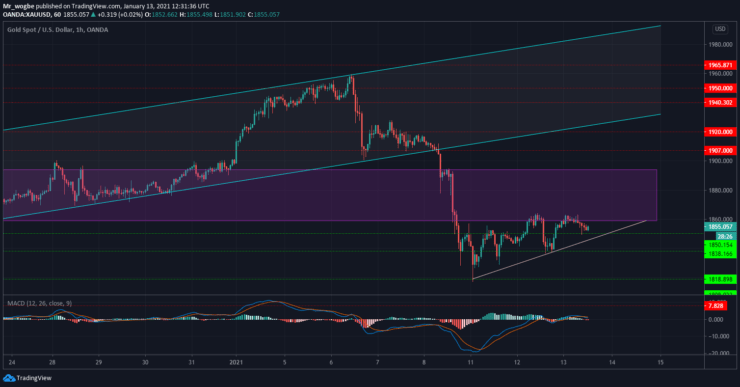

Gold (XAU) Value Forecast — January 13

XAU/USD Major Bias: Sideways

Supply Levels: $1860, $1880, and $1893

Demand Levels: $1850, $1838, and $1818

Gold bulls continue to put up a good fight against bears, who are relentlessly trying to take price lower. The commodity has been range-bound between the $1860 pivot point to the $1843 support.

Meanwhile, the commodity is steadily trading in an upward pattern as it aims to get back into the $1893 – $1860 pivot zone. In the meantime, the $1850 support will likely continue to bolster the commodity against any sustained decline.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.