The intraday rebound was triggered by the risk-averse mood sweeping across markets, which tends to bolster demand for the precious metal.

Growing concerns over the worsening state of Coronavirus numbers globally and the imposition of renewed lockdown measures across Europe and China dampened investors’ risk mood. This risk-off flight was evident in the equity markets.

Nonetheless, the bullish tone surrounding the US dollar (DXY) could cap any further gains for the dollar-denominated in the meantime. The greenback got adequate support from the prevailing rally in the US Treasury bond yields.

Meanwhile, investors have been slowly pricing-in the possibility of a more pronounced US fiscal spending in 2021, including direct stimulus payments and hefty infrastructure spending. The downbeat NFP reports on Friday further strengthened this speculation and boosted the US Treasury bond yields to a 10-month high.

That said, it is advisable to avoid taking aggressive bets at the moment and wait for a sustained directional move. The market will be dictated by the broader market risk sentiment and the USD price dynamics, considering the absence of any market-moving economic releases today.

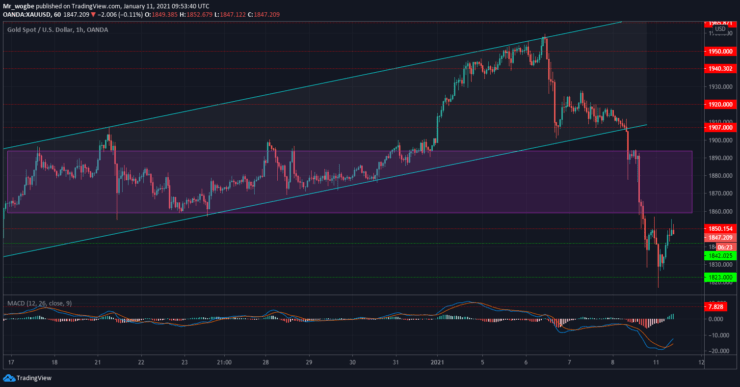

Gold (XAU) Value Forecast — January 11

XAU/USD Major Bias: Bullish

Supply Levels: $1859, $1880, and $1893

Demand Levels: $1842, $1823, and $1808

Following the devastating decline from last week, gold is now picking up the pieces and is making meaningful strides to get back into the $1859 – $1893 pivot zone and subsequently into the ascending channel.

That said, we expect the precious metal to stage a steady recovery near the $1880 in the coming hours and days.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.